Dollar trades quietly but headed for worst week since July

Dollar stays calm amid Thanksgiving Holiday

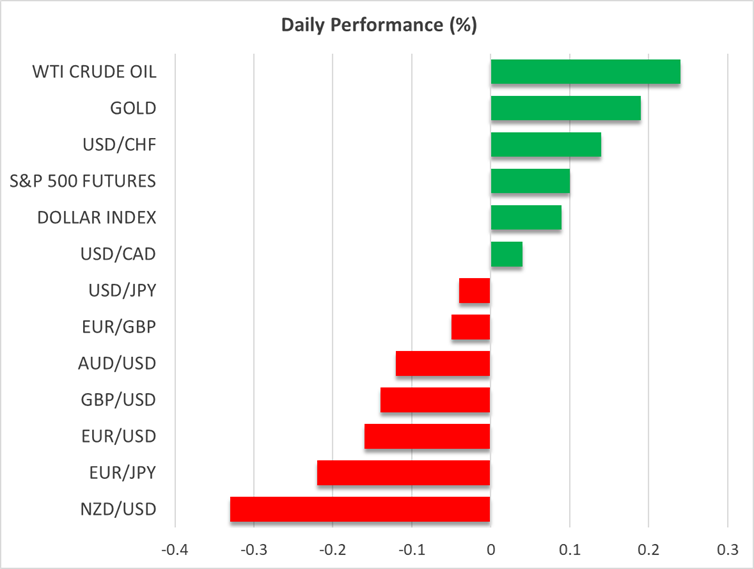

The US dollar traded quietly on Thanksgiving Day staying in narrow ranges or staying virtually unchanged against most of its major counterparts. It continued losing ground against the kiwi, which rebounded strongly this week following the RBNZ’s hawkish rate cut.

Today, the greenback is slightly higher against all its peers, but it is headed for its worst weekly performance since late July as market participants continued to add to their Fed rate cut bets.

The softness revealed by the shutdown-delayed US data and dovish remarks by key Fed officials, including the influential New York Fed President John Williams, have prompted investors to assign a strong 80% chance of a 25bps reduction at the upcoming meeting, and to pencil in another three same-sized reductions for 2026.

Today it is Black Friday, and many US traders are likely to stay away from their desks, especially as the New York Stock Exchange (NYSE) is scheduled to close early today. This means the greenback may continue trading quietly today, and that the next catalysts may be next week’s ISM manufacturing and non-manufacturing PMI figures.

To intervene or not to intervene?

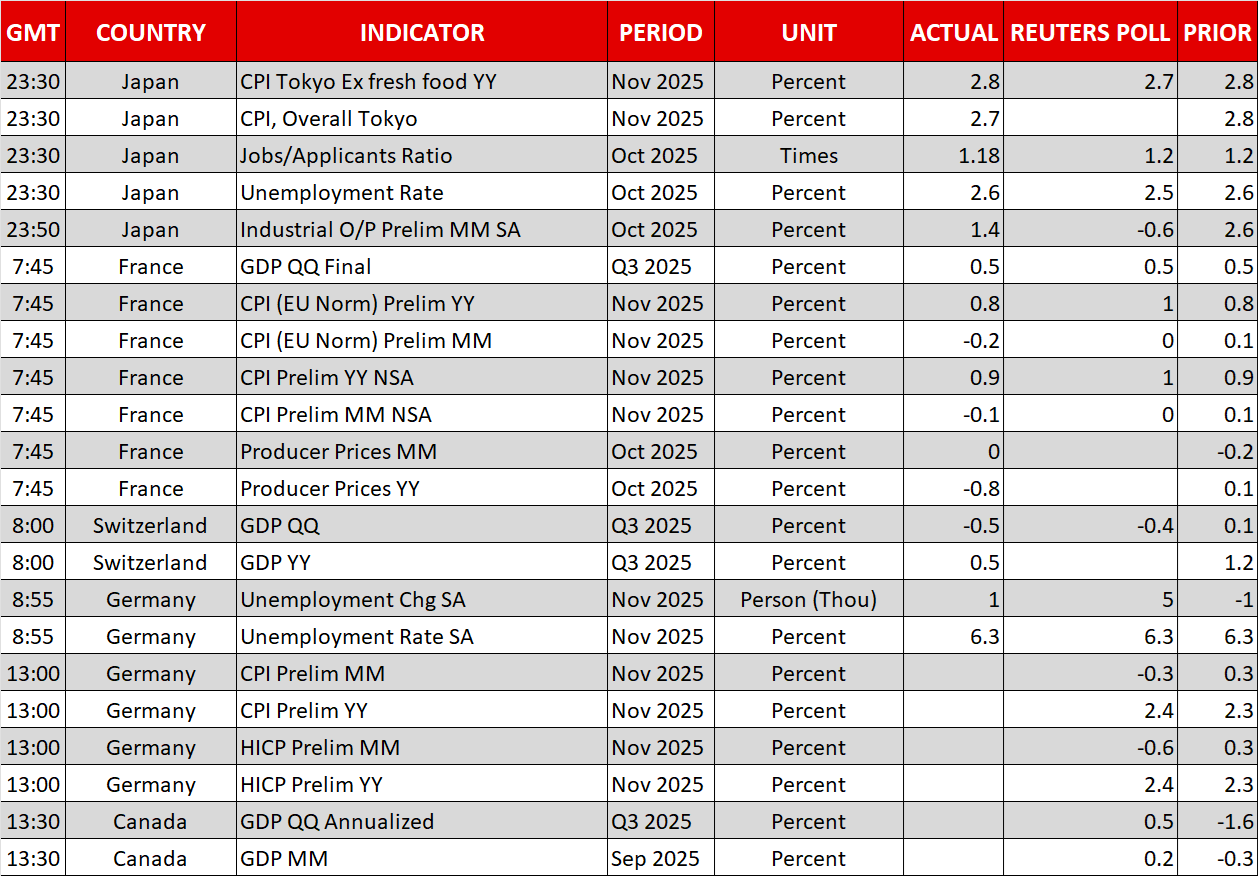

The Japanese yen gained some ground against the dollar yesterday, but it is on the slide again today, even after Japanese data revealed that industrial production and retail sales grew by more than expected in October. Combined with the stickiness in Tokyo CPI inflation for November and the 2.6% unemployment rate for October, the data reinforced the case for higher rates in the world’s fourth largest economy. According to Japan’s Overnight Index Swaps (OIS) market, the probability of a 25bps rate increase at the December 19 BoJ gathering now stands at 35%.

However, with the yen remaining wounded and dollar/yen above the 155.00 zone, concerns about intervention by Japanese authorities remain elevated, especially during thin-liquidity periods as any action will have a greater impact on the exchange rate. If there is no action even today, this could mean that officials could tolerate a higher rate next week and perhaps reconsider their strategy upon a breach of the 160.00 psychological territory in dollar/yen.

Pound pulls back as December BoE cut is nearly a done deal

The pound traded virtually unchanged yesterday and it is pulling back today, despite gaining ground on Wednesday after UK Chancellor Rachel Reeves announced plans to raise taxes by 26bn pounds.

With the Office for Budget Responsibility (OBR) downgrading significantly its GDP estimate for 2026, perhaps traders are selling the pound today on the narrative that tighter fiscal policy and expectations of slower growth next year could give permission to the BoE to proceed with more rate cuts moving forward. For now, a 25bps reduction at the December 18 meeting is nearly fully priced in and another 40bps worth of rate cuts baked into the cake for next year.

Stock futures and gold gain, oil up on Ukraine peace uncertainty

As for the stock market, US stock futures are slightly in the green today suggesting a higher open to today’s holiday-shortened trading session. Expectations of a series of rate cuts by the Fed and an upbeat earnings season have put concerns about stretched valuations on the back burner for now.

Gold is extending its recovery today, also helped by dovish Fed rate cut expectations, while oil prices saw solid gains on Tuesday and Wednesday, despite headlines that Ukraine accepted a modified deal offered by the US for ending the war with Russia. Perhaps the reason why oil participants did not maintain their short positions was the uncertainty on whether Russia will accept the accord.

Ukrainian President Zelenskiy said yesterday that Ukrainian and US officials are scheduled to meet to continue discussions, while Russian President Putin noted that the outlines of the draft deal discussed by the US and Ukraine could become the basis of future agreements but if that is not the case, then Russia would continue fighting.