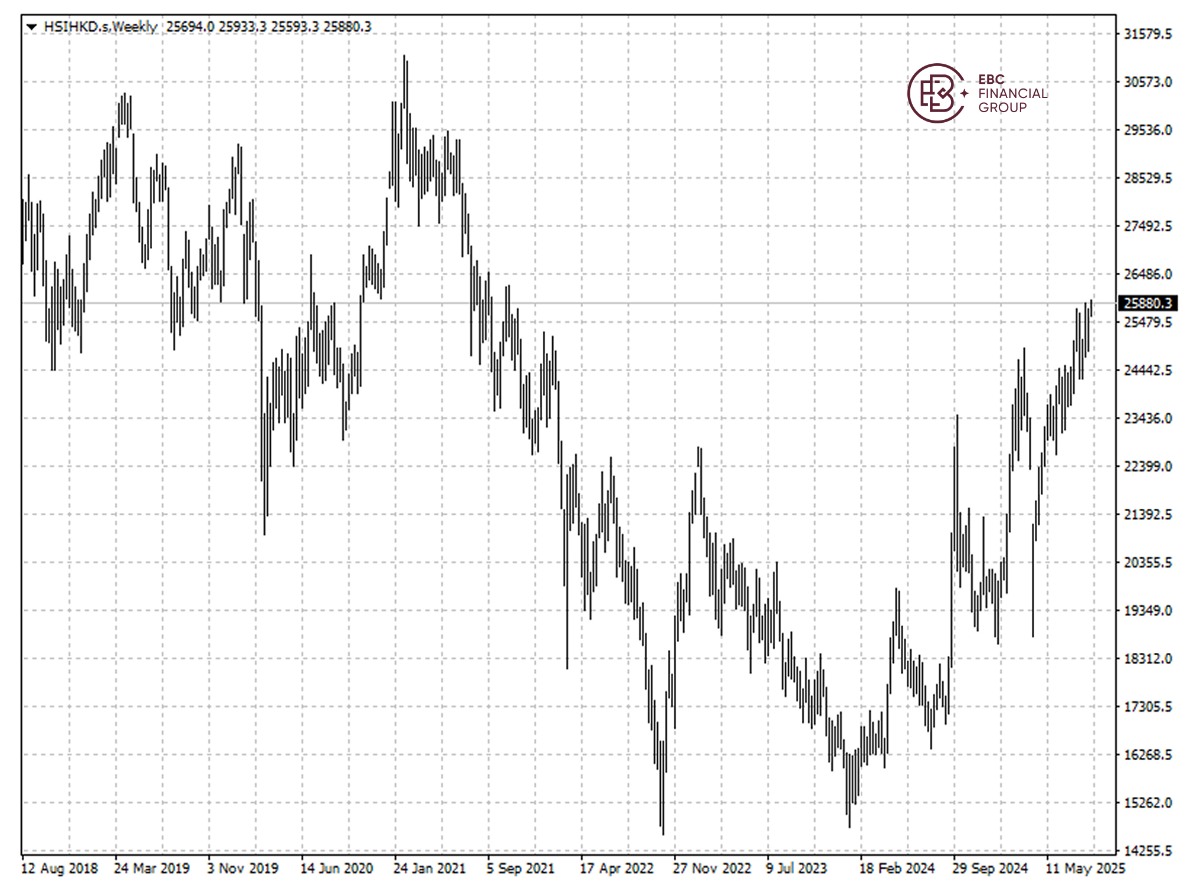

EBC Markets Briefing | Hang Seng eyes 4-year high

The Hang Seng index soared around 2% on Monday after Fed Chair Powell signalled interest rate cuts over the weekend. Lower borrowing costs in the US will likely benefit tech companies worldwide.

Hong Kong's stock market has boomed this year and the bourse is upbeat that the return of international investors will help sustain momentum amid a boom in listings and trading.

Average daily turnover of equity products almost doubled in the period from a year earlier to HK$220 billion, according to the bourse. Southbound turnover soared 154% while flows the other way rose 19%.

During the first half, 44 new listings debuted on HKEX, raising a total of HK$109.4 billion. There were 207 active IPO applications at the end of June, more than double from the same period last year.

Money managers are scaling back their bearish stance on China, adding technology and consumer stocks to their portfolios amid a four-month-long rally, according to an HSBC Holdings survey.

Respondents boosted their allocations to shares of Alibaba Group, Xiaomi and BYD. Alibaba is among the biggest contributors for gains in a benchmark emerging-market index this year.

The Hang Seng has breached its high of 25885.5 hit weeks ago – a sign of confidence in bullishness. The next hurdle appears to be 26,200 dating back to October 2021.

EBC Financial Group Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Global Financial Collaboration or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.