EBC Markets Briefing | Turkish lira had another nightmare year

The Turkish lira extended its losing streak with a slump of nearly 20% in 2024. Global central banks scrambled to defend currencies on Thursday after the Fed signalled a slower pace of rate cuts going forward.

But Turkey’s central bank lowered interest rates for the first time in almost two years last week, pointing to slower consumer demand and the currency’s strength for a larger-than-expected cut of 250 bps.

More than a third of the labour force earns the minimum wage and this year’s 49% increase caused an uptick in inflation, making it difficult for the monetary authority to contain price pressures.

The government has decided to raise the minimum wage by just 30% next year might have also encouraged the central bank’s move of loosening aggressively, analysts said.

The country has slipped into stagflation with GDP contracting by 0.2% in Q2 and Q3 respectively. If policymakers prioritised price stability, further rate hikes could wreak a havoc on the economy.

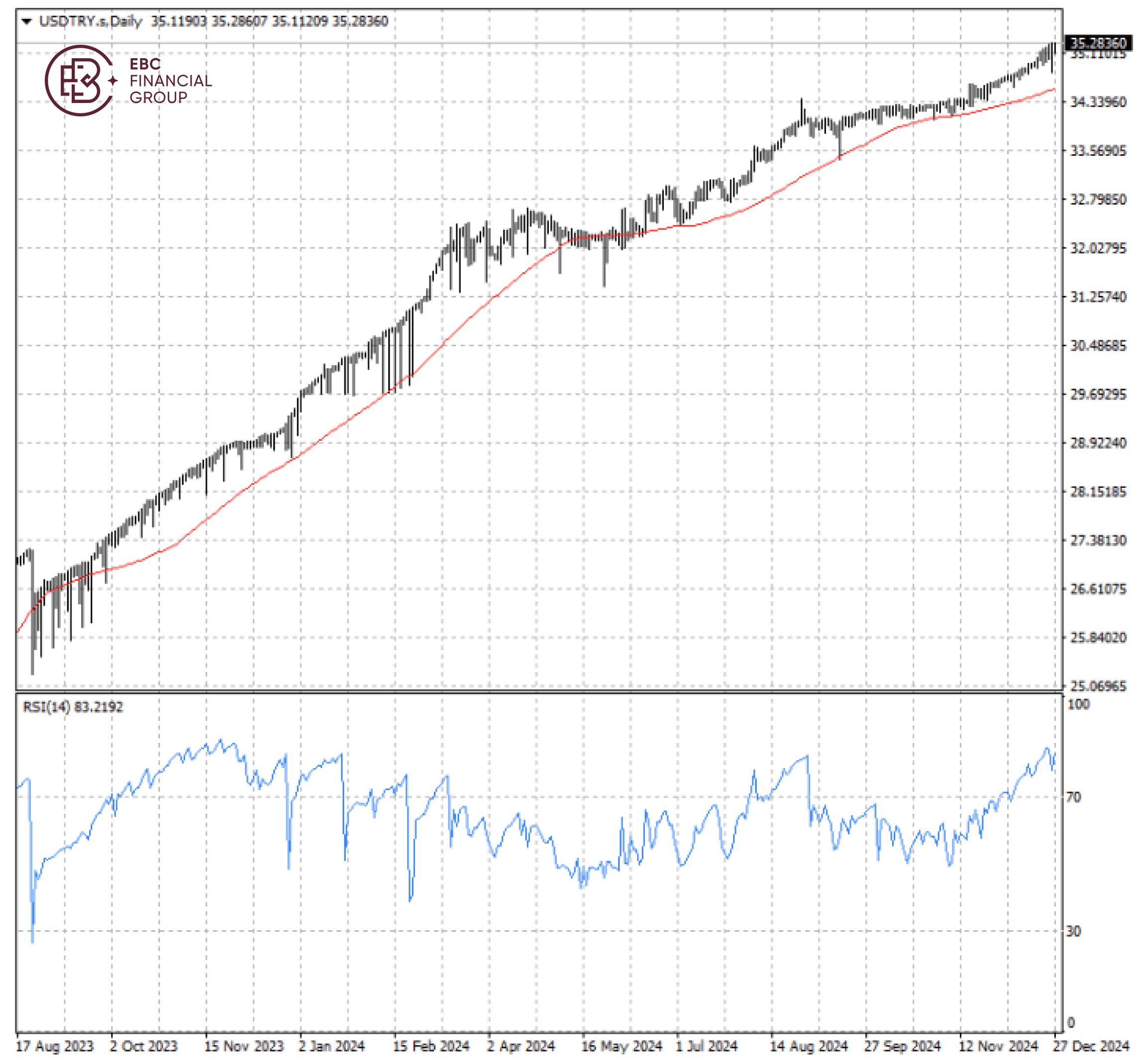

It is even more tricky to predict the turning point in the currency after a prolonged period of freefall. It was worth more than a quarter of one dollar in early 2018 compared with 35.2 per dollar for now.

The lira was trading below 50 SMA persistently with RSI indicative of an oversold condition. Hence it could see a short-lived rally in the near term before resuming downtrend around 50 SMA.

EBC Financial Risk Management Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Financial News or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.