EBC Markets Briefing | Wall St wallows; Berkshire endorses Alphabet

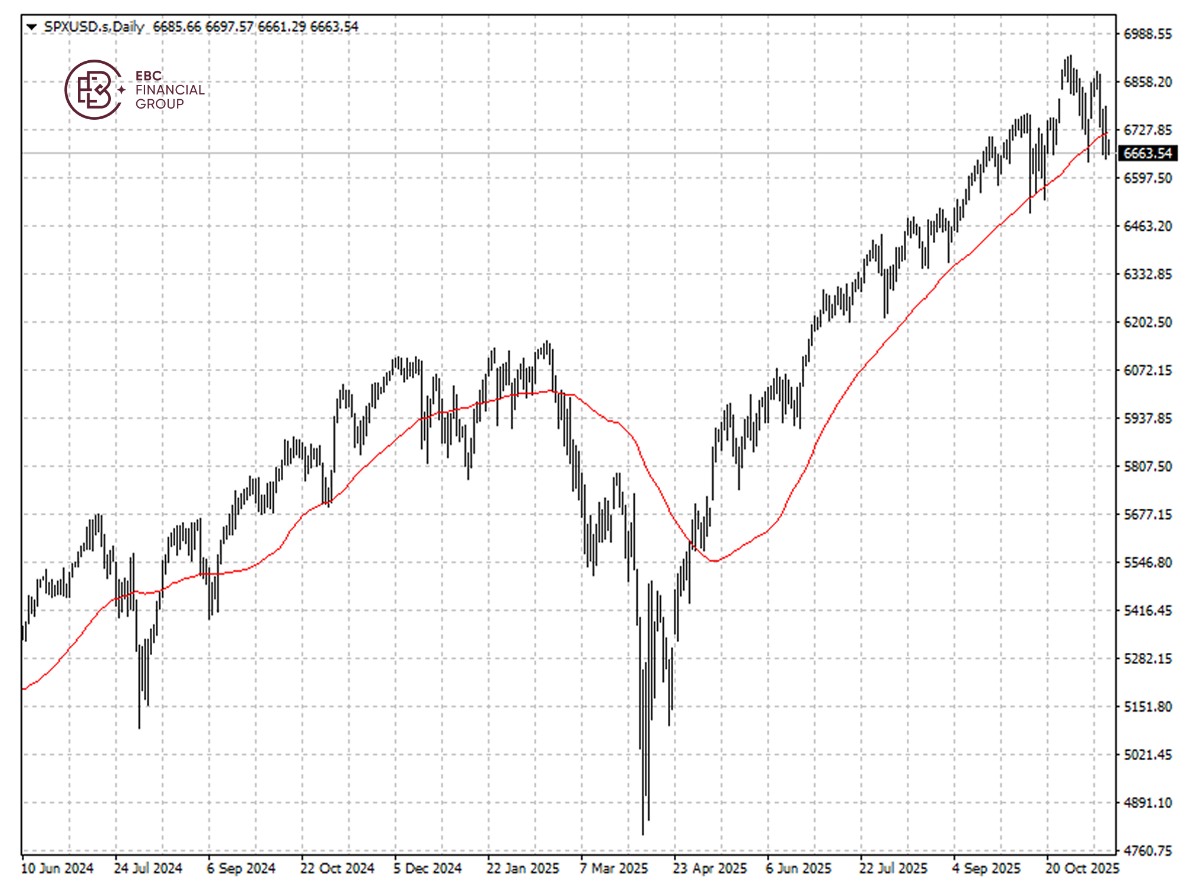

US stocks ended down sharply on Monday, with the S&P 500 closing below a key technical indicator for the first time since April, as optimism following the end of government shutdown faded.

Trade Representative Jamieson Greer said on Friday that Trump was ready to follow through with pledges to grant tariff exemptions on some food and other products that are not produced in the US.

Corporate America' earnings are growing at the fastest pace in four years, according to Morgan Stanley. That came despite warnings earlier this year from executives that Trump's sweeping tariffs would push up costs.

However, warnings from some consumer-facing companies suggest many Americans may be struggling. The University of Michigan's index of consumer sentiment fell to a three-year low in November.

The probability of another 25-bp cut, implied by market prices, has fallen to 40 per cent over the past week after several members of the FOMC made plain their lack of support for action at the next meeting.

While September's rise in the consumer prices was weaker than anticipated at 3% year on year, the reading remains in excess of the 2% target. That gives the Fed little leeway to cut rates.

Breaking below the 50 SMA, the S&P 500 index is heading towards the low around 6,640 which could rein in more losses. If the level does not hold, another leg lower would be in the cards.

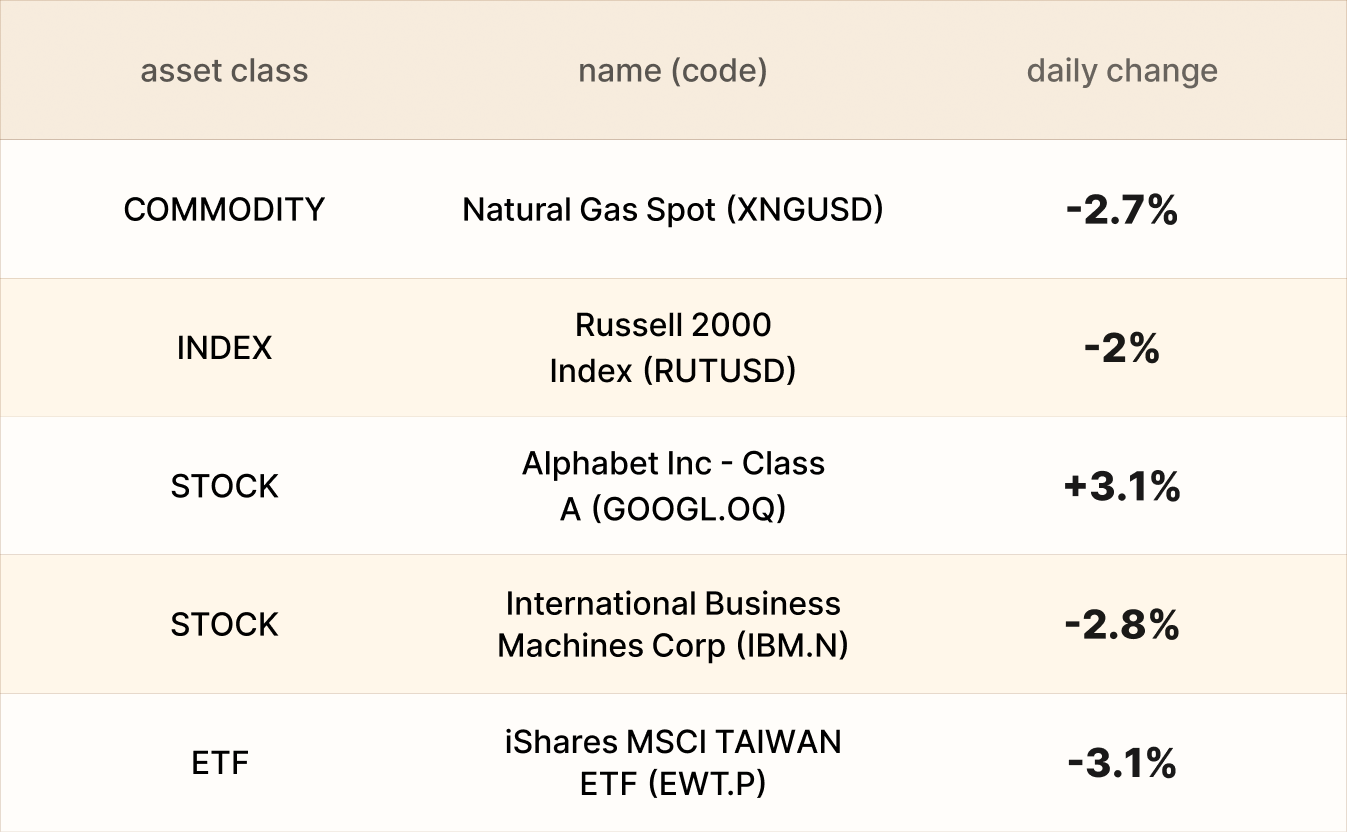

Asset recap

As of market close on 17 November, among EBC products, Alphabet shares led gains. Berkshire Hathaway revealed that it bought a $4.3 billion stake in Google parent Alphabet in Q3.

AI could be increasing worker productivity so much that companies slow hiring, top Trump administration economic advisor Kevin Hassett said Monday ahead of September jobs report.

A number of research analysts have recently issued reports on IBM shares. The company saw a pullback after notching a yearly gain of around 40% that is driven by quantum computing.

EBC Financial Group Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Global Financial Collaboration or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.