Ethereum Accelerates as Bitcoin Consolidates

Ethereum Accelerates as Bitcoin Consolidates

Market Picture

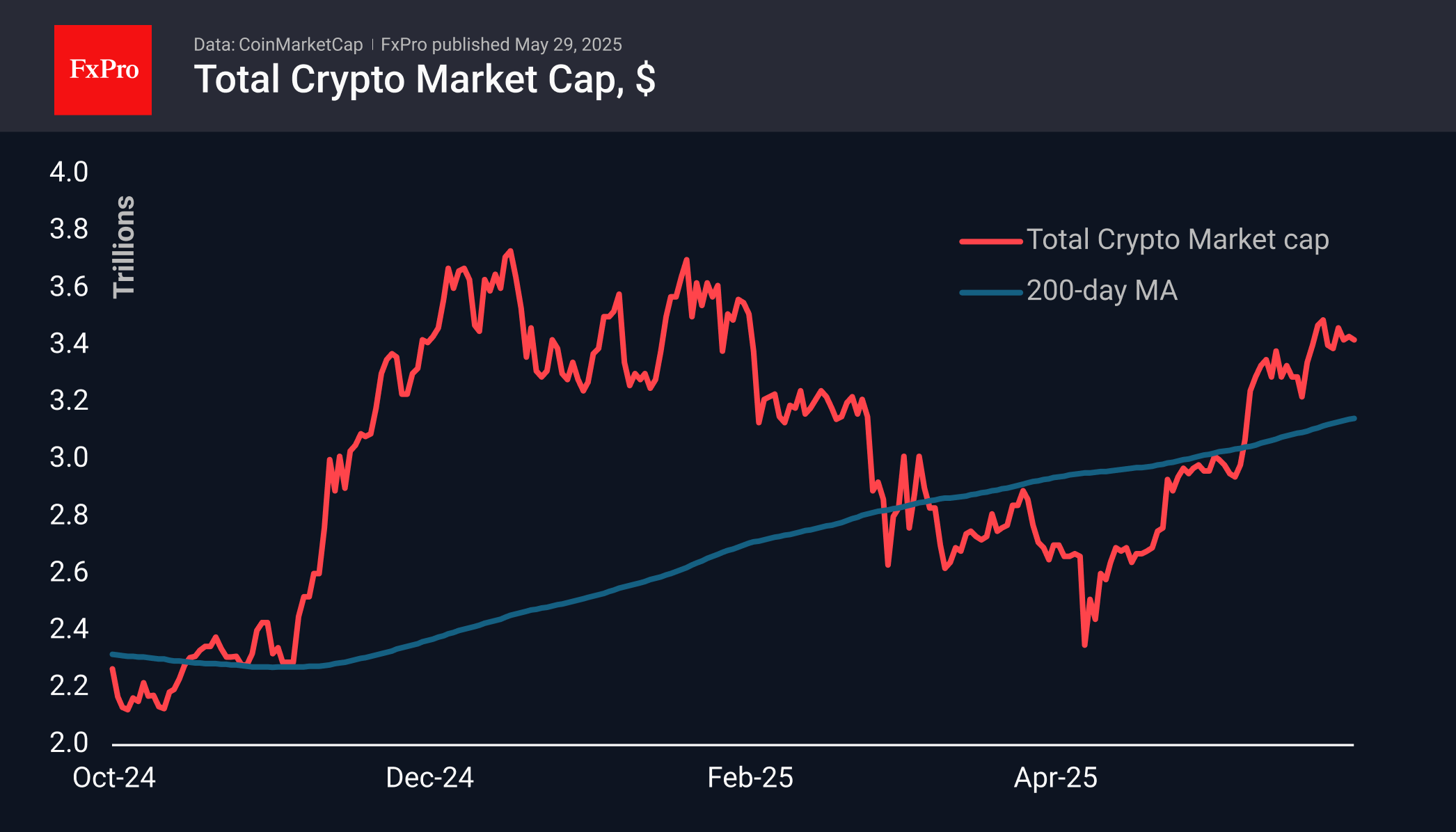

Market capitalisation has changed little over the last day, hovering around the $3.42 trillion mark. Cryptocurrencies prefer not to notice positive stock market movements as they are related to tariffs and company reports, not money supply. In addition, the dollar's exchange rate is rising for the third day.

The day before, Bitcoin retreated from the trading range's upper boundary at 110k to its lower boundary at 107k. This rest at previous highs effectively removes the local overheating of the market. As the institutional presence in Bitcoin expands, its dynamics are becoming more similar to the behaviour of stock and commodity market instruments, with less pronounced FOMO periods.

Ethereum was briefly above $2780 on Thursday morning, hitting new highs from February and the 200-day moving average. A consolidation above $2700 has the potential to attract the attention of broader traders, kick-starting momentum to $3300 or even $4000.

News Background

The positive trend in US spot bitcoin-ETFs has continued for 9 consecutive trading sessions and 24 trading days out of the last 27.

Strategy additionally bought an additional 4,020 BTC ($427.1 million) last week at an average price of $106,237 per coin. The company now owns 580,250 BTC with an average price of $69,979 and is in profit by almost $22 billion at current prices. Strategy continues to buy BTC, but the pace of acquisitions has slowed from its November peak.

According to mining company Marathon Digital Holdings (mara), the U.S. government can increase the bitcoin reserve if it finds a way to do so without new taxes and increased government debt. The US government can replenish the bitcoin reserve in many ways, including mining the first cryptocurrency.

The futures and options markets point to growing interest from large investors in Ethereum over Bitcoin. Coindesk analyst Omkar Godbole said this signals a possible shift in focus in the crypto market.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)