EURUSD on the edge as US tariffs decision nears

EURUSD held a muted tone, struggling to break past the 1.0800 mark as traders braced for the upcoming US reciprocal tariffs set to be unveiled on Wednesday night. Uncertainty lingers over whether the US president will adopt a conciliatory approach or escalate tensions with a hardline trade stance, potentially igniting fresh concerns in an already fragile geopolitical landscape.

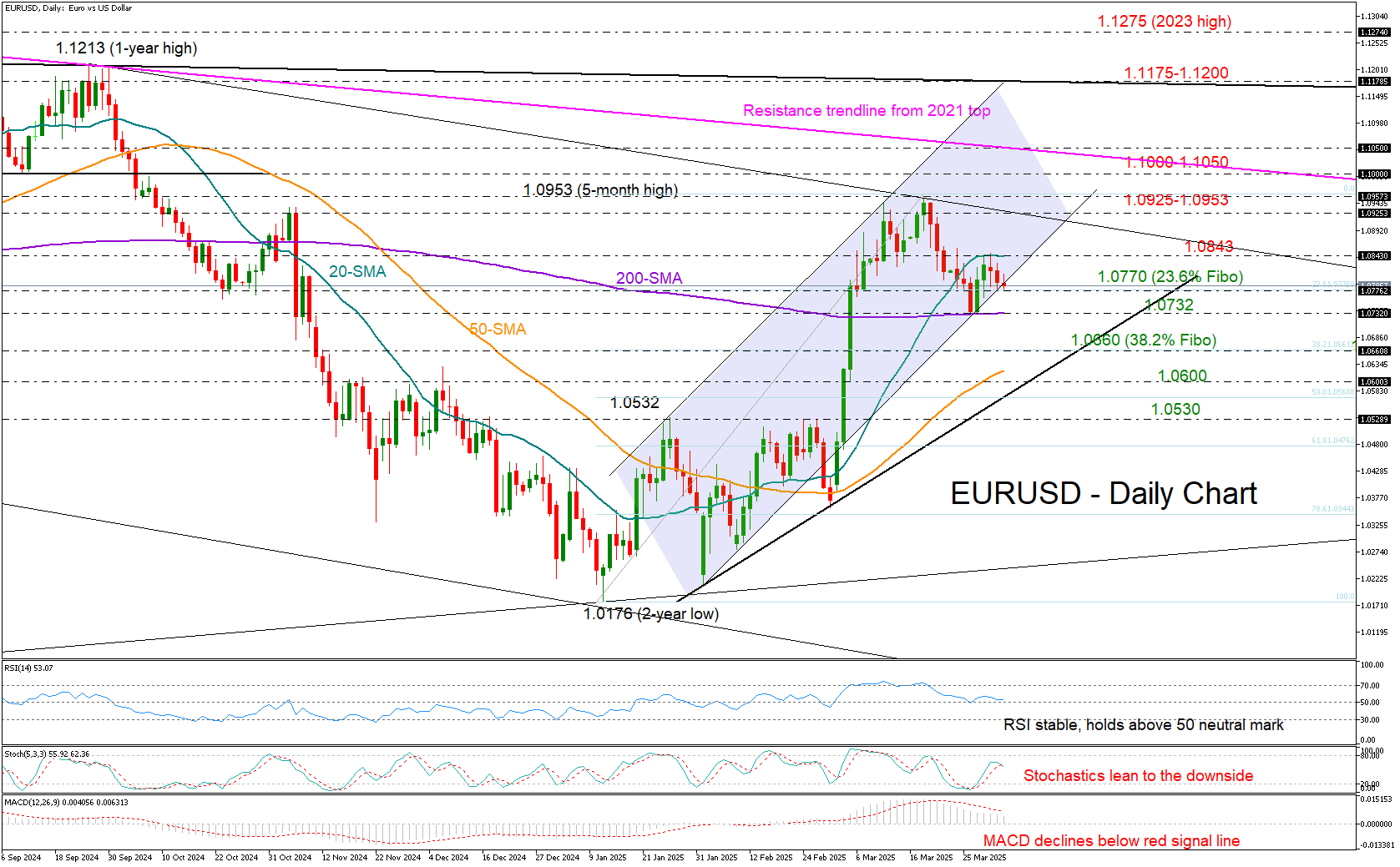

From a technical standpoint, the pair could face renewed downside pressure if support around 1.0770 – where the lower boundary of a bullish channel and the 23.6% Fibonacci retracement level of the latest upward move reside – fails to hold. A sharper bearish signal could emerge if the price dips below the 200-day SMA, which acted as a floor last week at 1.0732. A decisive close beneath this level could activate fresh selling orders, pushing the pair toward the 38.2% Fibonacci retracement at 1.0660 or down to the tentative support trendline near 1.0600. If selling momentum intensifies, the next key destination could be the 1.0530 region.

While the downward tilt in technical indicators sends a cautionary signal, the RSI has yet to cross below its neutral 50 mark, leaving room for a potential rebound. If the price manages to break through resistance at the 20-day SMA around 1.0840, bullish momentum could return, shifting focus toward the 1.0925-1.0950 range. A further advance past this zone would bring the 1.1000-1.1050 resistance area into play, and a breakout here could accelerate gains toward the 2024 highs near 1.1175-1.1200.

In summary, EURUSD remains trapped in a neutral zone, and unless it firmly establishes support above 1.0732, the risk could tilt back to the downside.