Gold Too Hot

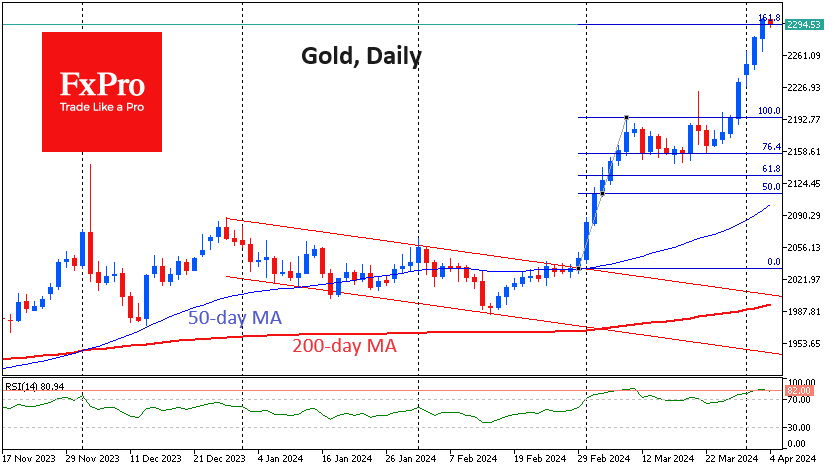

Overnight, the gold price briefly exceeded $2300, recording another round level, not counting an update of the all-time high. This is an occasion to assess gold's prospects, which are becoming a little less unambiguous.

Touching the level of $2300 marked the achievement of the 161.8% Fibonacci retracement of the growth impulse from 29 February to 8 March. Then gold proved bullish as it continued to gain strength above the 50-day moving average. The subsequent long consolidation with a shallow correction confirmed the strong bullish sentiment of the metal. Gold has added every trading session since 25 March but has so far been subdued since the start of the day on Thursday morning. The next step in this pattern is profit-taking, allowing the price to cool somewhat.

On the daily timeframes, the RSI on Wednesday was close to the early March peaks, after which the past consolidation began. The bears took control in March 2022 at similar overbought levels. However, in July 2020, the price continued to grow after reaching similar RSI parameters. In similar conditions in 2019 and 2020, there was a growth stop but not a reversal. The balance of power is in favour of the bears.

Friday's NFPs have repeatedly served as a turning point for gold, and they could be again this time. The March release halted gold's rally: the November, December and February releases triggered a sell-off, and the October release was the final point of a five-month downtrend.

Now is the time for bulls to be wary of the importance of labour market data for gold. They have a lot to lose as the price flew into space, partly ignoring the latest economic data coming out on the dollar's side, from strong manufacturing PMIs to the acceleration in wage growth that ADP talked about on Wednesday.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)