How markets will react to the US election results

Market picture

Polls and forecasts have yet to produce a clear frontrunner in the US presidential race. In recent days, there has been a widespread view that markets are pricing in a Trump victory, but for many investors it is too close to call, increasing the potential for movement when the results are announced.

Remember that in addition to the presidential election, there will also be votes for the Senate and the House of Representatives. The latest estimates suggest that the main candidates have an equal chance of winning. The Senate is expected to be controlled by the Republicans (69% chance), while the House of Representatives is expected to go to the Democrats (56% chance). The most significant impact on the markets would be the consolidation of power in the hands of one party, enabling it to implement its initiatives quickly. The expected outcome would force the president to compromise, which would take time, smoothing out the overall impact but not eliminating it.

If Harris wins

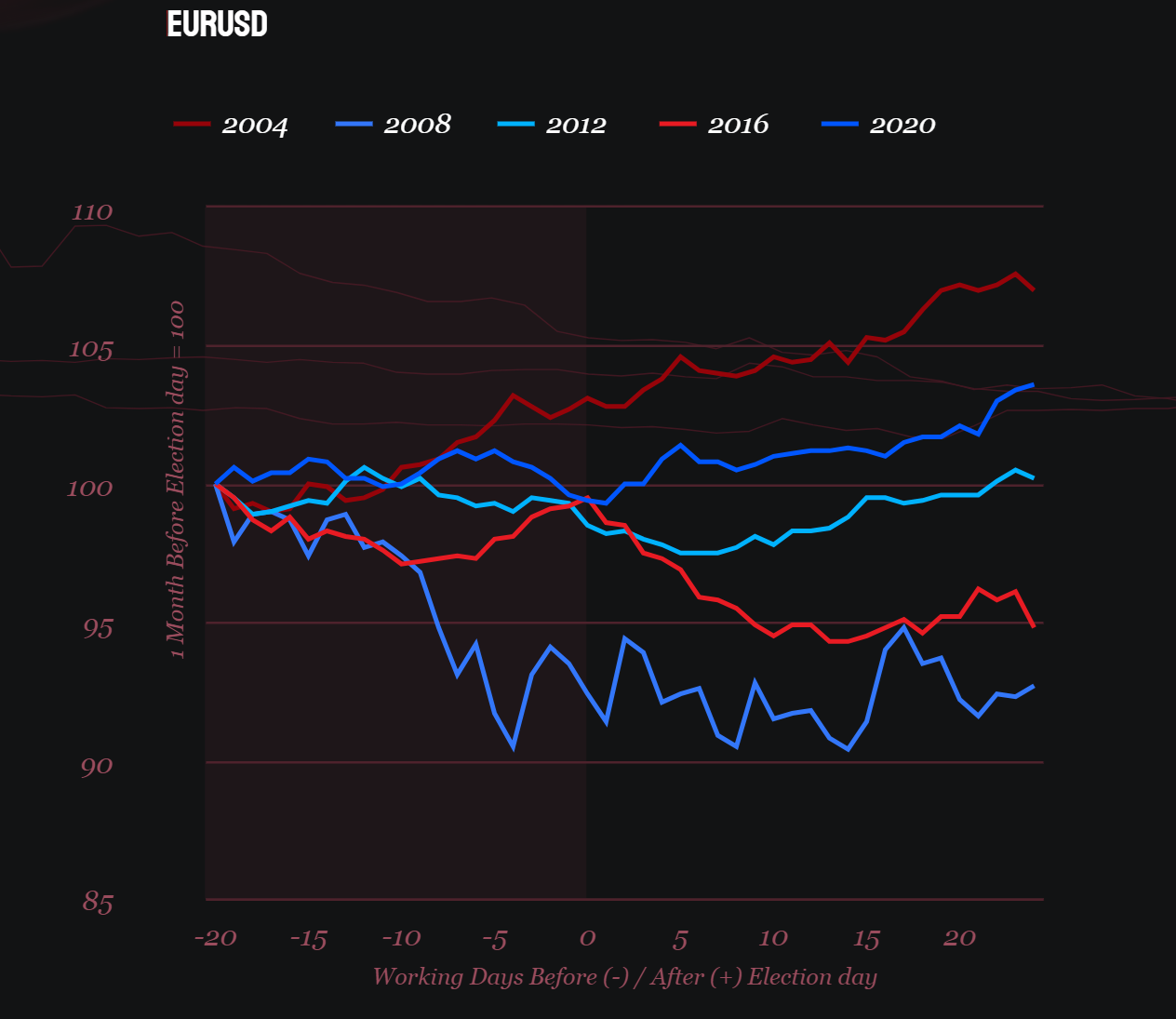

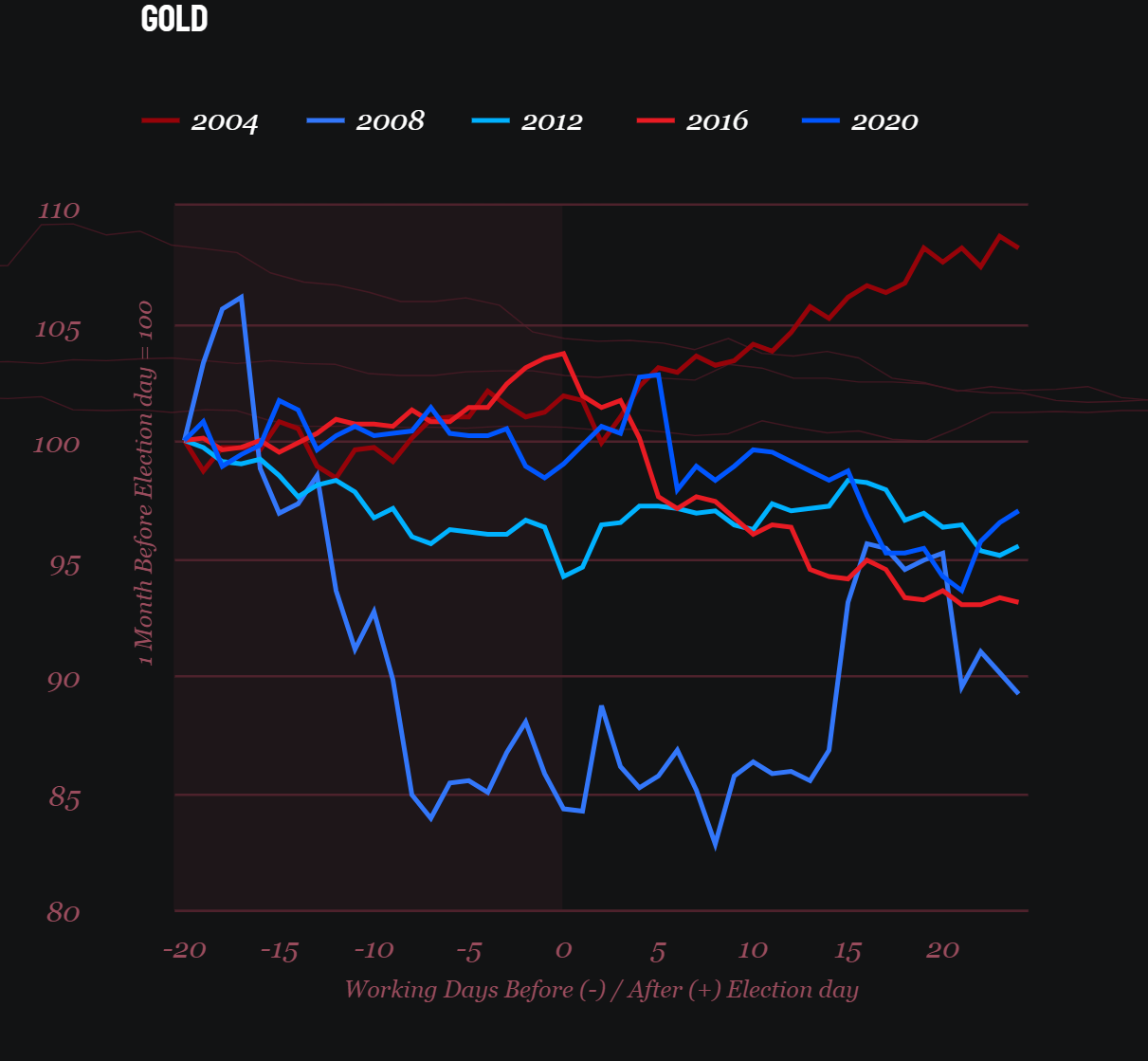

The arrival of Democrat Harris in the White House will maintain the status quo on key policies. This could be good news for alternative energy, as defences against Chinese competition are likely to increase. The arrival of the Democrats in 2020 has also been good for the Russell 2000 index, which has rushed to catch up with the rest of the market in anticipation of consumer stimulus. In the currency market, a rise in consumer spending could push the dollar lower. The Dollar Index would then move towards the 90-100 area from the current 104.3. Since 2008, the EURUSD has gained between 0.7% and 3.5% intraday on a Democratic victory. Gold has gained 2-5% intraday on a Democratic victory, but the dynamics have been mixed since then.

If Trump wins

Trump's return to the White House is potentially good news for big business, as it could lead to new tax cuts and trade barriers with a wide range of trading partners, from nearby Canada and Mexico to the EU and China. That was roughly the outcome after 2018. Rapid implementation of his reforms could bring capital inflows to the US, ensuring that stock indices outperform. We should also expect increased traction for hydrocarbon companies, given the industry's lobby among Republicans.

At the same time, this is potentially good news for the dollar, which added impressively in 2018-2020 as trade disputes have intensified. You can't do without them with a new ex-president. The US currency could also benefit from a rising risk premium, which goes hand in hand with Trump's heightened tone in meetings with colleagues and his frequent mood swings. The DXY could then return to its 2022 highs within a couple of years, 10% above current levels.

Gold rose 5% intraday on Trump's election, only to erase the gains before the end of the day and lose 14% by the end of the year. In general, however, gold is more tied to monetary policy cycles than to individual presidents. Assuming higher inflation in the US under Trump, we should expect higher Fed rates and more pressure on the price of the ounce.

Whoever wins

Investors are increasingly focusing on the dynamics of the budget deficit. A couple of years ago, markets chastised the UK for announcing 'unfunded' tax cuts. The same could be happening in the US. We do not rule out the possibility that the persistent fall in bond prices (rising yields) and the pull on the dollar and gold since September are a manifestation of concern about this issue. The candidates are avoiding this uncomfortable topic but will surely return to it immediately after the victory speech. There is potential for volatility in the first few days after the election, as well as a commitment to the original campaign promises.

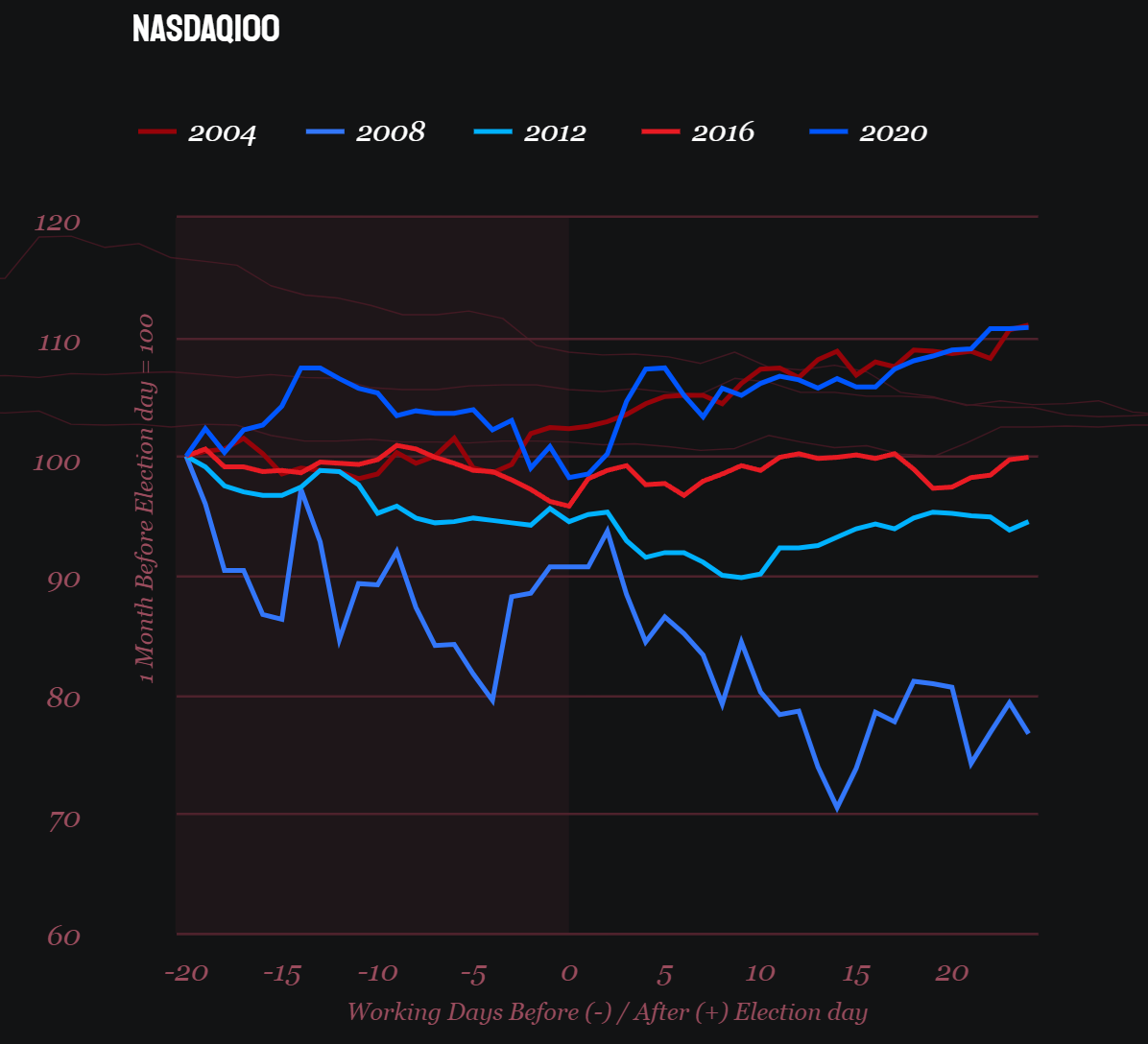

Stock indices tend to rally soon after an election, after a period of sluggishness in the weeks leading up to it. But it's worth noting that in previous elections, equity indices have corrected more deeply and accelerated higher than we've seen now. A repeat of all-time highs is likely, but it's hardly reasonable to expect 10% or 15% gains for the rest of the year after election day, as we saw in 2016 and 2020, or even 7%, as was the case in 2012.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)