Inflation in Focus as Traders Eye BoE’s Next Move | 22nd October 2025

Inflation Watch Begins

Markets opened cautiously on Wednesday as investors awaited key inflation data from the UK, expected to influence the Bank of England’s next rate decision. The broader market mood stayed balanced, with easing US–China trade tensions offering some relief while traders continued assessing the global inflation outlook. Commodity currencies steadied after recent volatility, and crude prices extended gains on signs of improving demand.

UK CPI & GBP/USD Forecast

Current Price and Context

The Pound trades cautiously around 1.3340 as traders brace for the UK CPI release, which is expected to show a mild uptick in inflation for September. The data comes just ahead of the Bank of England’s rate decision, keeping volatility elevated in GBP pairs.

Key Drivers

Geopolitical Risks: Broader geopolitical calm allows inflation data to take center stage in shaping BoE expectations.

US Economic Data: Softer US housing figures have weighed slightly on the dollar, offering limited GBP support.

FOMC Outcome: The Fed’s dovish tone continues to restrain dollar upside, aiding GBP stabilization.

Trade Policy: Ongoing discussions between the UK and EU over post-Brexit trade standards add mild uncertainty.

Monetary Policy: Markets anticipate a more hawkish BoE if inflation exceeds forecasts, with rate cut odds reduced.

Technical Outlook

Trend: Slightly bullish ahead of CPI data.

Resistance: 1.3380

Support: 1.3280

Forecast: GBP/USD may test 1.3400 if CPI beats estimates but risks retreating toward 1.3250 on a soft print.

Sentiment and Catalysts

Market Sentiment: Cautiously optimistic with traders pricing limited upside for GBP.

Catalysts: UK CPI data, BoE commentary, and dollar index movement.

WTI Crude Oil Forecast

Current Price and Context

WTI trades near $57.70, extending modest gains as optimism around US–China trade progress improves the demand outlook. Falling US stockpiles and a weaker greenback also lend near-term support.

Key Drivers

Geopolitical Risks: Easing tensions in the Middle East and stable OPEC supply expectations cap volatility.

US Economic Data: Inventory drawdowns and energy demand data will guide price momentum.

FOMC Outcome: The Fed’s dovish tone supports commodities priced in USD.

Trade Policy: Signs of improved trade cooperation between the US and China lift sentiment for oil demand.

Monetary Policy: Global easing expectations sustain risk appetite and commodity resilience.

Technical Outlook

Trend: Consolidation within a recovery phase.

Resistance: $58.30

Support: $56.70

Forecast: A break above $58.50 could target $59.20, while downside risks persist toward $56.00 if sentiment cools.

Sentiment and Catalysts

Market Sentiment: Neutral-to-bullish as traders watch inventory data.

Catalysts: API/EIA inventory reports, OPEC comments, and US-China headlines.

AUD/USD Forecast

Current Price and Context

AUD/USD holds near 0.6480, pressured by signs of foreign capital outflows and cautious risk tone despite a broadly weaker US dollar. Markets remain sensitive to both Chinese economic data and global trade headlines.

Key Drivers

Geopolitical Risks: Stabilizing trade ties between the US and China offer some relief to the Aussie.

US Economic Data: Lower-than-expected retail sales capped USD gains, providing limited AUD support.

FOMC Outcome: Fed’s dovish outlook underpins risk assets but fails to lift AUD decisively.

Trade Policy: Improved regional export prospects help balance domestic weakness.

Monetary Policy: The RBA remains patient on rate adjustments, keeping the pair range-bound.

Technical Outlook

Trend: Sideways-to-weak.

Resistance: 0.6510

Support: 0.6430

Forecast: Consolidation likely, with a potential dip toward 0.6420 if US yields rebound.

Sentiment and Catalysts

Market Sentiment: Mixed, as traders weigh weak domestic indicators against improved global sentiment.

Catalysts: Australian trade data, Chinese PMI updates, and commodity price trends.

USD/CAD Forecast

Current Price and Context

USD/CAD hovers around 1.4000, easing slightly as crude oil prices rebound on falling stockpiles. The Loonie remains supported by the recovery in oil, Canada’s top export, while the dollar struggles to regain footing.

Key Drivers

Geopolitical Risks: Stable global outlook keeps USD/CAD primarily driven by commodity dynamics.

US Economic Data: Upcoming US jobless claims may add short-term volatility.

FOMC Outcome: The Fed’s softer tone limits USD strength, keeping CAD favored.

Trade Policy: Improved US–China relations bolster Canada’s export outlook.

Monetary Policy: The BoC remains neutral, with inflation data likely to steer next direction.

Technical Outlook

Trend: Bearish bias below 1.4050.

Resistance: 1.4050

Support: 1.3960

Forecast: Further declines toward 1.3920 likely if oil maintains upward traction.

Sentiment and Catalysts

Market Sentiment: Favoring CAD as energy markets stabilize.

Catalysts: Crude oil inventory data, BoC remarks, and US macro numbers.

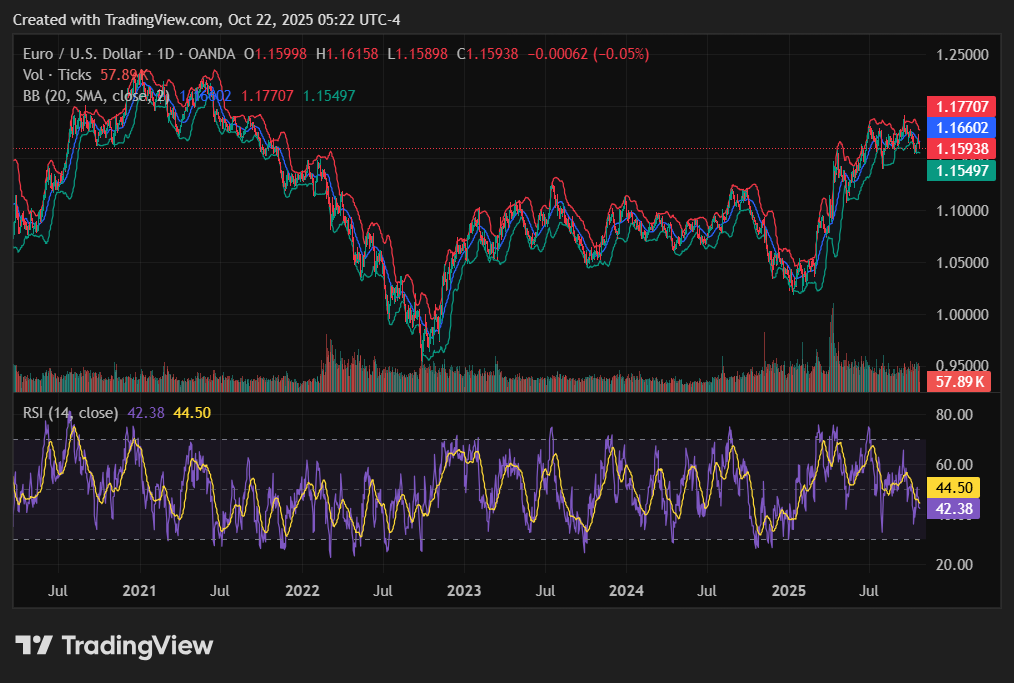

EUR/USD Forecast

Current Price and Context

EUR/USD trades near 1.1590, stabilizing after a brief rebound as traders assess the impact of Fed commentary and Europe’s mixed economic outlook. The euro remains range-bound amid a cautious global mood.

Key Drivers

Geopolitical Risks: Reduced trade tensions lift sentiment across European markets.

US Economic Data: Light US calendar allows EUR/USD to react to broader risk sentiment.

FOMC Outcome: Dovish expectations continue to limit USD advances.

Trade Policy: Stability in global trade supports euro resilience.

Monetary Policy: ECB officials maintain a balanced stance, limiting volatility.

Technical Outlook

Trend: Consolidative with mild upward bias.

Resistance: 1.1630

Support: 1.1550

Forecast: EUR/USD may test 1.1620 if dollar softness persists, but failure to break higher could trigger pullbacks.

Sentiment and Catalysts

Market Sentiment: Neutral, with slight bullish bias toward the euro.

Catalysts: ECB commentary, US data, and cross-asset risk flows.

Wrap-up

Overall, today’s market tone centers on inflation and central bank cues. The UK CPI print could set the tone for BoE expectations and ripple through the broader FX market. Meanwhile, traders will keep an eye on energy prices, trade developments, and upcoming US data for fresh directional momentum as markets look to end the week on a steadier footing.

Ready to trade global markets with confidence? Join Moneta Markets today and unlock 1000+ instruments, ultra-fast execution, ECN spreads from 0.0 pips, and more! Start now with Moneta Markets!