Is the GBPUSD Bull Run About to Snap?

Ultima Markets offers an in-depth look at the GBPUSD for December 19, 2025, with key insights you won’t want to miss.

GBPUSD Set for Major Breakout?

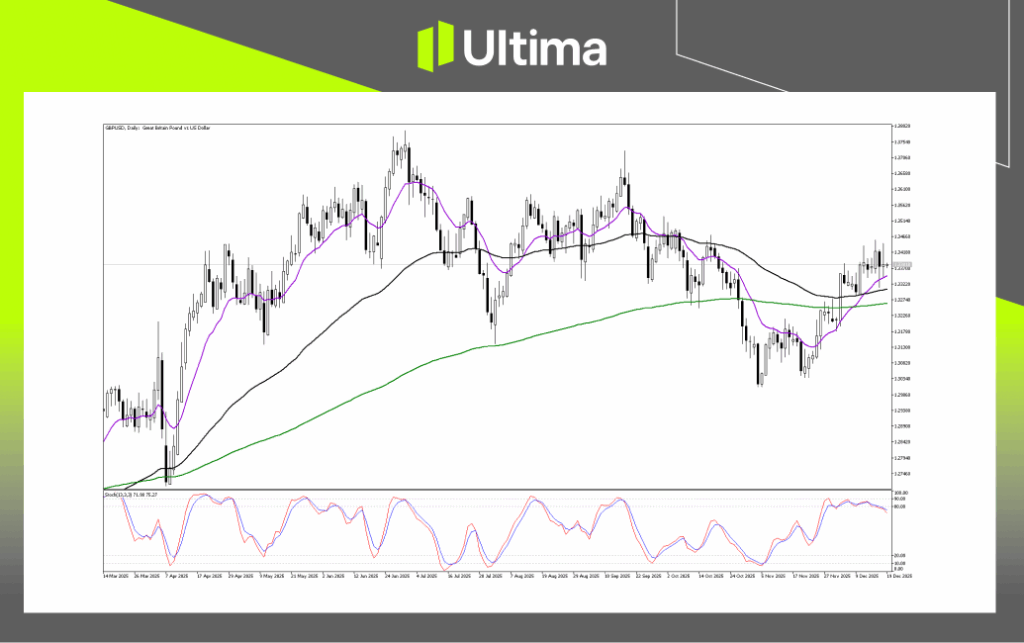

The daily chart reveals a consistent pattern of higher highs and higher lows since the November dip, with recent movements indicating a shift from correction to a resumption of the primary uptrend. The Stochastic oscillator is in the overbought zone, hovering between 70-80 and showing a slight downward tilt, though no sharp death cross has emerged.

This suggests the bullish trend is intact, but the pair might undergo some sideways movement or a brief support retest before continuing its rise.

Key Levels

The upward trajectory remains intact as long as the 1.3250-1.3300 support zone holds. A break above 1.3470 would confirm the next significant upward move.

GBPUSD on the Brink of a Major Move

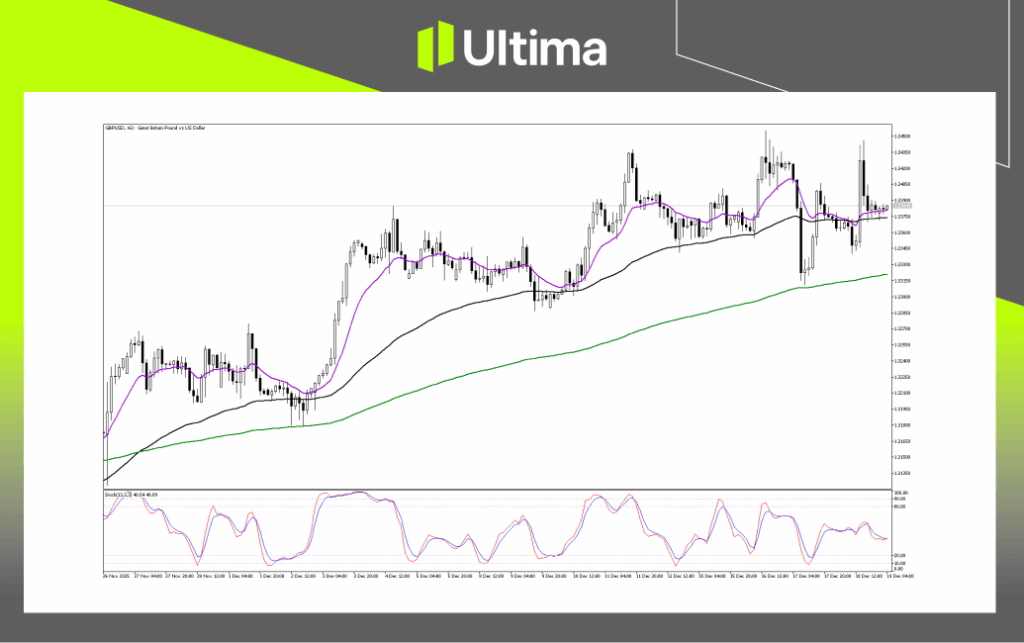

GBPUSD is showing a neutral-to-bullish outlook, with the broader trend still leaning upward while the price moves within a flag pattern. The most reliable strategy is to wait for a clear break, either above 1.3450 or below 1.3360 to pinpoint the next high-probability direction for trades.

Breakout Scenarios

A bullish breakout would be confirmed by a sustained move above 1.3450, aiming for 1.3500 and potentially 1.3550, especially if the Stochastic oscillator crosses upward and enters the overbought zone above 80.On the other hand, a bearish move would be triggered by a break and close below 1.3360, with a target near the green moving average around 1.3320. This wouldn't necessarily mark the trend's end, but rather indicate a market pullback to attract more buyers at lower levels.

Key Levels to Watch for GBPUSD

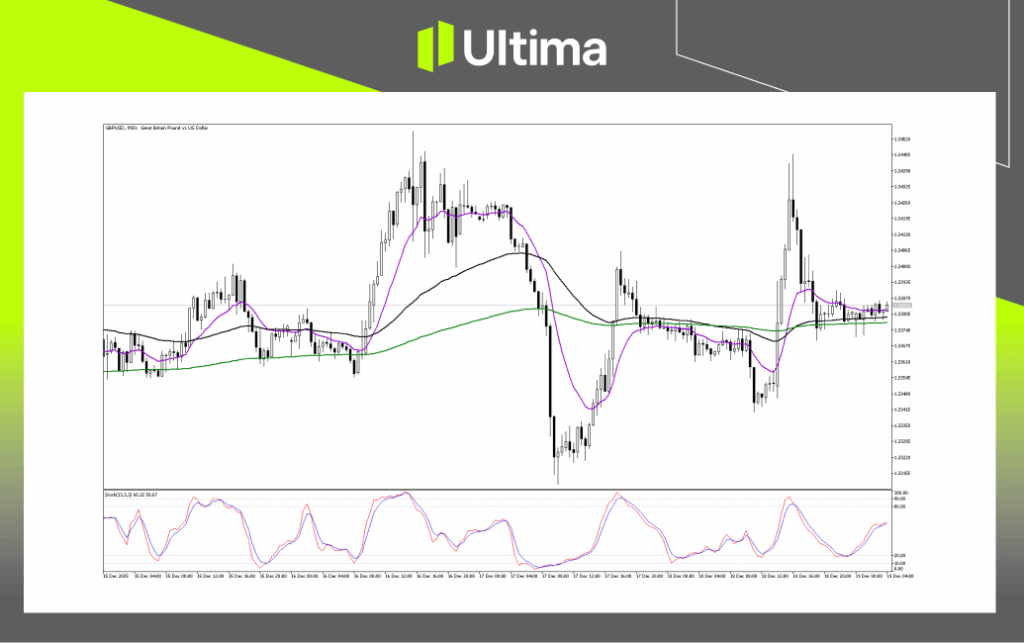

After the wild fluctuations on December 17th and 18th, price action is now tightening with reduced volatility. This narrowing range often signals a potential explosive move, much like a spring ready to release.

Bullish Breakout

A bullish move would be confirmed by a decisive close above 1.3413 on a 30-minute candle, with a likely retest of resistance at 1.3445. If momentum picks up, the next target could be the 1.3500 level.

Bearish Breakdown

A bearish move would be triggered by a drop below the moving average cluster and a close beneath 1.3360, indicating that the squeeze has resolved downward. This could lead to targets around 1.3340, with major support at 1.3320.

Navigating the Forex Market with Ultima Markets

Success in trading requires staying ahead of the curve and making well-informed, data-driven decisions. Ultima Markets is committed to offering you the insights and support needed to navigate the ever-changing landscape of forex, indices, commodities, and shares. Our platform empowers you with the tools, education, and market analysis to excel in your trading journey.

Join Ultima Markets today and gain access to a robust trading ecosystem, enhanced by the UM Academy, designed to help you master the markets. Reach out for personalised support and stay connected with our expert team for ongoing updates and analysis.

—–

Legal Documents

Trading leveraged derivative products carries a high level of risk and may not be suitable for all investors. Leverage can magnify both gains and losses, potentially resulting in rapid and substantial capital loss. Before trading, carefully assess your investment objectives, level of experience, and risk tolerance. If you are uncertain, seek advice from a licensed financial adviser. Leveraged products are not intended for inexperienced investors who do not fully understand the risks or who are unable to bear the possibility of significant losses.

Copyright © 2025 Ultima Markets Ltd. All rights reserved.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.