Lower global trade uncertainty supports risk appetite

Lower global trade uncertainty supports risk appetite

US dollar

The US has signed agreements with Japan, Indonesia and the Philippines. Tariffs range from 15% to 19%. Tokyo has secured a reduction in import duties on cars from Washington from 25% to 15%. Looking at this deal, the European Union also wants to get 15% tariffs. Brussels does not intend to activate the anti-coercion mechanism and respond with reciprocal duties of €100 billion.

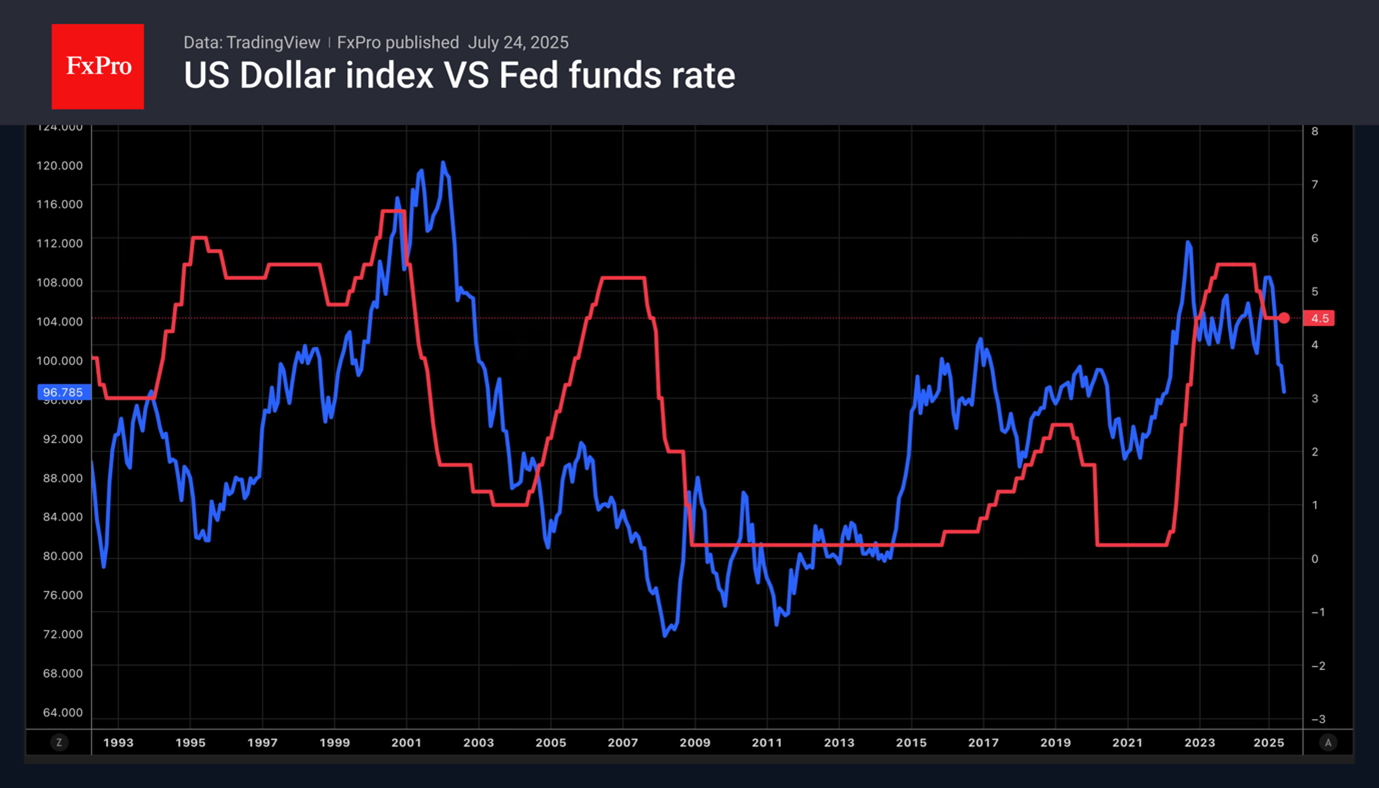

The reduced risk of a large-scale trade war between the US and the EU is increasing global risk appetite and putting pressure on the US dollar as a safe-haven asset. At the same time, the reduction in trade uncertainty is giving the Fed a free hand to ease monetary policy. A sharp cut in the federal funds rate may happen sooner than expected, contributing to the dollar's decline.

The futures market expects an acceleration of easing in 2026 due to Jerome Powell's departure from the Fed chair. Donald Trump should choose the nominee, and obviously, it will be a very dovish person who aligns with the president’s opinion. Recently, he demanded that the Fed cut rates by 300 basis points.

Stock indices

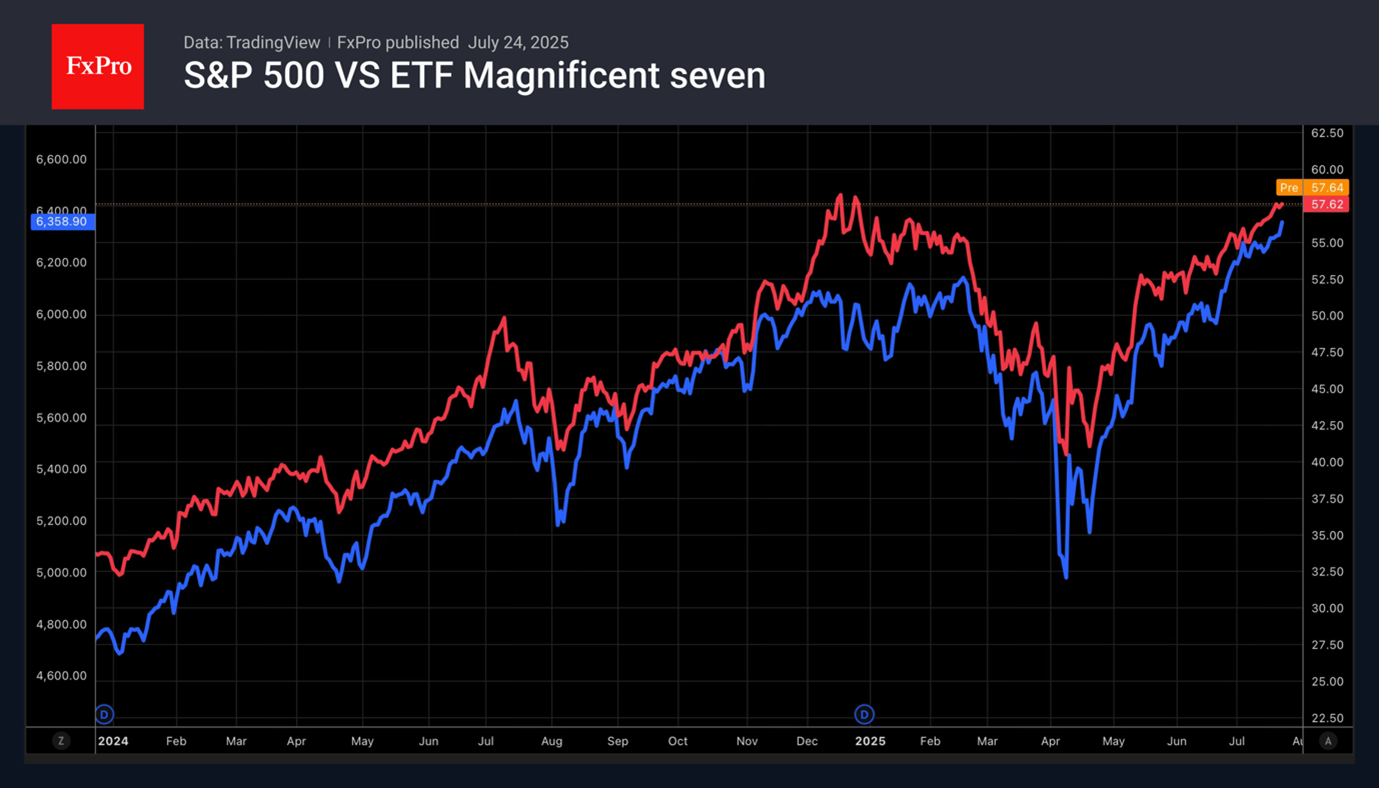

The US economy is not falling off a cliff since trade deals are reducing uncertainty. The Fed is moving towards easing monetary policy, and corporate earnings are positive. What else do stock indices need for a rally? The S&P 500 continues to break historical highs and eagerly awaits data from the so-called Magnificent Seven. Analysts expect those companies to report 14% profit growth compared to just 3% growth for the other 493 companies in the broad stock index.

So far, actual data for the second quarter has been better for 83% of reporting issuers. The average for the last 5 and 10 years is 78% and 75%, respectively. A weak dollar supports the S&P 500. Due to the enormous size of the US domestic market, only 13% of corporate profits come from abroad. Companies included in the broad stock index are more international. For Goldman Sachs, for example, the figure is 28%.

How long will the euphoria last? If tariffs push the US economy toward stagflation, corporate earnings will fall, and the S&P 500 will slide.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)