Markets in cautious mode as cryptos tumble

Weak start for risk assets

December has begun on the back foot for risk assets following the Thanksgiving holiday, which for certain investors marks the start of the famous Santa rally. US equity futures are in the red, with the cryptocurrency market once again generating negative headlines. Both bitcoin and ether tumbled during the Asian morning session, declining from the November-end levels of $91,780 and $3,022 respectively.

A number of reasons have been singled out for this move. While some analysts point to the S&P Global rating agency downgrading USDT's dollar-peg rating to “weak”, raising concerns about the firm’s ability to maintain the peg, particularly amidst turbulent times, this announcement came last Wednesday. Therefore, today’s move appears to be a reaction to BitMEX co-founder Arthur Hayes warning about Tether’s reserves, and to news about Yearn finance, one the biggest DeFi platforms, suffering a hack with around $9m in losses.

While the latter confirms that the crypto industry has yet to address hacking issues, failing to protect its reputation, Hayes’ comments about Tether being less secure than widely considered are critical. By ‘stress testing’ Tether’s reserves, he concluded that a significant correction in both gold and bitcoin would make USDT worthless.

Mixed moves posted in November

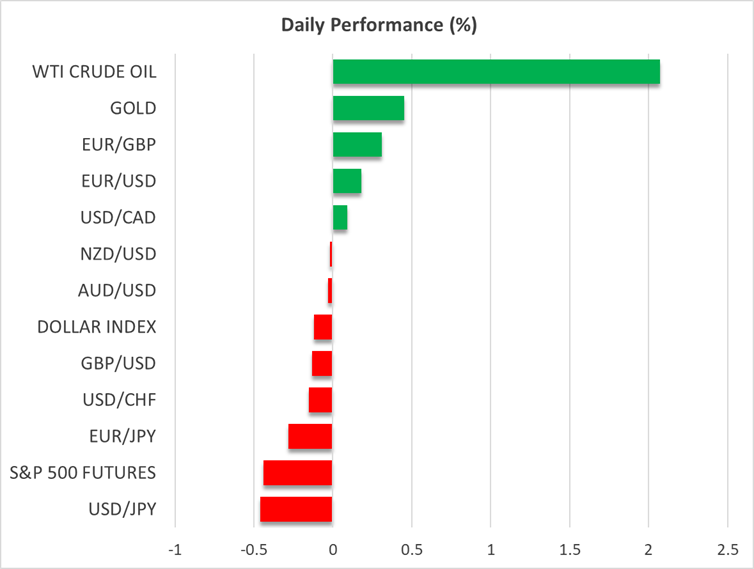

Today’s moves confirm the ongoing crypto weakness, with bitcoin shedding 17% of its value in November, clearly underperforming other key market assets. Gold continued its positive run, erasing a decent chunk of its late October correction, while oil dropped another 4% in anticipation of a Ukraine-Russia truce. It was a quieter month for FX, with yen crosses recording the most significant moves. Euro/dollar finished the month around 0.5% higher.

Busy calendar week, Fed blackout period now in effect

The countdown for the December 10 Fed meeting has commenced, with the markets currently pricing in a 92% probability of a rate cut. This looks exaggerated considering last week’s light data calendar and even lighter Fedspeak. With the official blackout period in place, and despite the lack of the nonfarm payroll report on Friday, the week is crammed with key data, mostly for November.

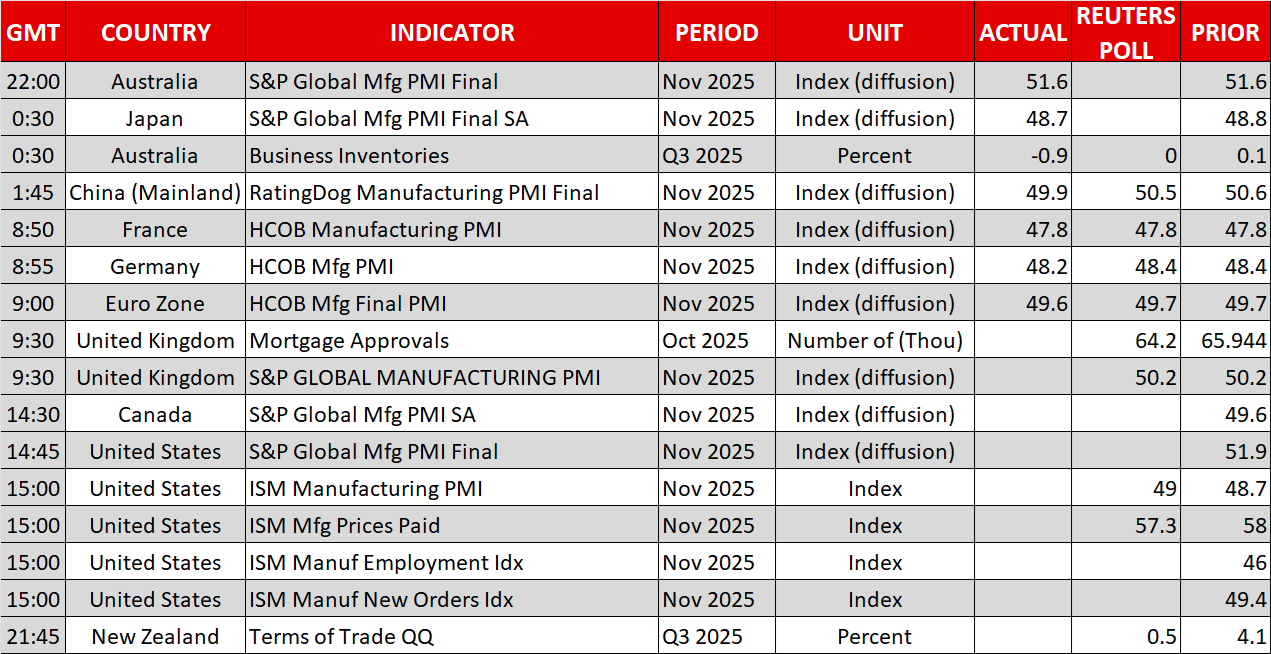

The focus today will be the November ISM Manufacturing PMI surveys, expected to show a marginal improvement to 49 from 48.7. Notably, both the official and private Manufacturing PMIs from China printed at sub-50 territory earlier today, with the private survey clearly highlighting domestic demand as the culprit for the weak prints.

The current risk-off has failed to boost the greenback, with euro/dollar climbing to 1.1615 at the time of writing, meeting strong resistance at the 50-day simple moving average. On the flip side, gold has returned to its habit of rallying under every market scenario, posting a higher high today, above the mid-November peak of $4,245.

Oil and yen on the move today as well

Oil is also edging higher today, partly following the OPEC+ agreement to maintain production quotas for 2026, with the usual eight producers rubberstamping their earlier announcement to stop output hikes until the end of Q1. More importantly, negotiations between the US and Ukraine in Florida, USA, continue, focusing on the stickier points of the US proposal, while Russian President Putin is playing hardball. Chances for an agreement are not high, with the original optimism gradually fizzling out and opening the door to a small oil price increase.

Meanwhile, after hovering around the ¥156.74 level, dollar/yen is sliding today. Some point to BoJ Governor Ueda’s comments earlier today, where he stated that “If the BoJ’s projections for economic activity and inflation continue to materialise, the bank will continue to raise the policy interest rate”. This is in line with his previous remarks though, but investors have reacted positively. That said, market expectations for a December rate hike are still stuck at 33%.