Oil market prices caught between sanctions and surpluses

The oil market is walking a fine line. One minute it’s buoyed by the threat of sweeping sanctions, the next it’s weighed down by oversupply and faltering demand. The result? A price rally that feels more like a balancing act than a breakout.

With Trump issuing ultimatums, OPEC+ looming in the wings, and inventories on the rise, traders are split: is oil being held up by political theatre or genuine scarcity?

Sanction hype lifts prices - for now

Former U.S. President Donald Trump has thrown a fresh match into the geopolitical fire. His message? Russia has 10 days to show real progress on Ukraine - or face new penalties. But this time, it’s not just Moscow on the hook. Trump floated 100% tariffs on countries still buying Russian oil - a move that could reshape global flows overnight.

And markets didn’t wait to see if he was bluffing.

Prices jumped nearly 4% in a single day, with Brent climbing past $72 and WTI testing $69 - the highest levels seen in over a month.

Source: Trading View

Source: Trading View

Traders are pricing in the real possibility that 2 million barrels per day of Russian oil could be squeezed off the market if importers like India bow to pressure (while China’s likely to dig in).

Stockpiles rise as demand cools

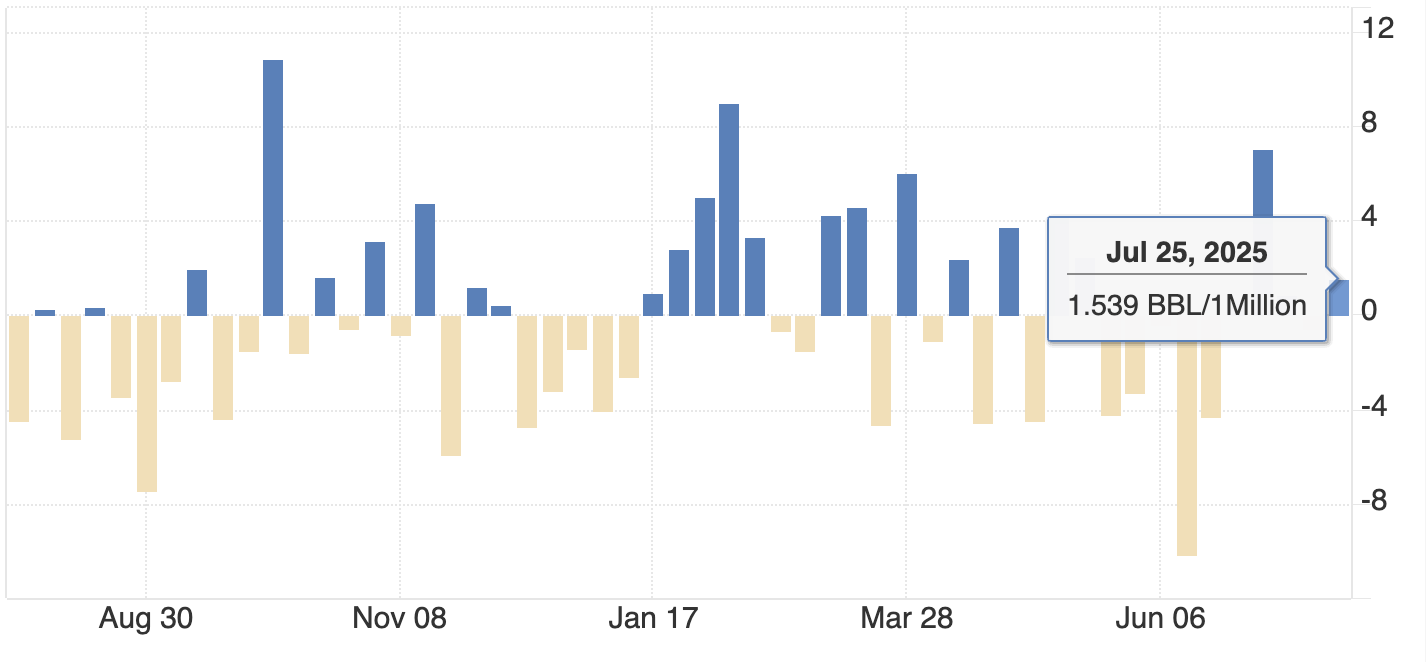

But the fundamentals aren’t exactly backing the rally. According to the American Petroleum Institute, U.S. crude inventories climbed by 1.539 million barrels last week - a bearish surprise in a market supposedly tight on supply.

Source: API, Trading Economics

Source: API, Trading Economics

Meanwhile, the IEA has cut its 2025 demand growth outlook to just 700,000 barrels per day - the weakest in over a decade.

And the supply side? Still ticking higher. OPEC+ hasn’t hit the brakes, the U.S. is poised to boost production, and Venezuela is itching to get back in the game if sanctions are eased.

In short, there’s no real shortage - at least not yet.

Rally or red herring?

Beyond the headlines, this surge has also kicked off some technical fireworks. WTI punched through its 200-day moving average, triggering momentum buying. Bullish options are now leading the charge, and commodity trading advisers have flipped long after weeks on the defensive.

But it’s all looking a bit speculative.

If Trump’s threat doesn’t materialise, or if countries call his bluff, the support could crumble. As one analyst put it, “This rally is running on adrenaline - not barrels.”

What to watch next

Plenty could still sway the market in the days ahead:

- U.S. Federal Reserve decision – Will they keep rates steady or open the door to cuts?

- EIA inventory data – Will it confirm the build?

- 1 August trade deadline – Can the U.S. land a deal with key partners?

- OPEC+ meeting – Will production guidance for September tighten or stay the course?

Also in the mix: China’s PMI figures, U.S. jobs data, and Bank of Japan’s rate decision - all with the power to move global demand expectations.

Right now, oil prices are balancing risk against reality. The geopolitical premium is propping up the market, but if tensions ease or sanctions stall, focus will shift back to the fundamentals, which are far from bullish.

So, will oil stay up or take a dip?

It all depends on whether traders stick with hard data or keep chasing political headlines. Either way, this market is on edge.

At the time of writing, prices are in price discovery mode after a huge move down weeks ago. The bullish narrative is supported by the volume bars showing dominant buy pressure over the past 3 days. If the rally continues, we could see prices breach the $70 mark. Conversely, if prices succumb to fundamentals, we could see a price reversal. A significant plunge could see prices held at the $64.73 and $60.23 support levels.

Source: Deriv X

Disclaimer

The information contained within this article is for educational purposes only and is not intended as financial or investment advice. We recommend you do your own research before making any trading decisions.

This information is considered accurate and correct at the date of publication. Changes in circumstances after the time of publication may impact the accuracy of the information.

The performance figures quoted are not a guarantee of future performance.