Risk appetite improves further ahead of PCE inflation data

Trade optimism fails to revive the dollar

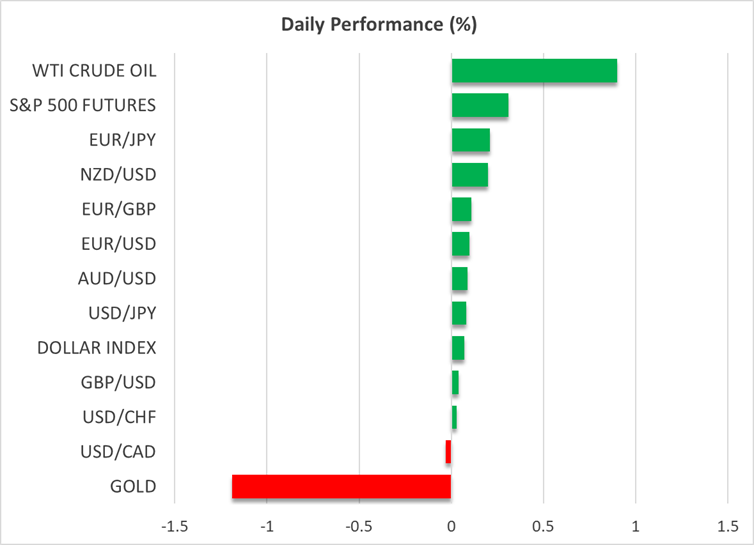

The US dollar hovered near three-year lows at the start of European trading on Friday, putting its index against a basket of currencies on course for weekly losses of 1.5%. The receding crisis in the Middle East that had rekindled the US currency’s safe-haven appeal, combined with growing expectations of more than two Fed rate cuts this year have scuppered the dollar’s recovery prospects.

Not even the headlines overnight about the White House finalizing the trade truce agreement with China and plans for 10 new deals have been able to inject much life into the flagging greenback. As things stand, the dollar, at best, is only able to halt the selloff, with a little help from some not-so-bad data.

All eyes on core PCE amid very mixed data

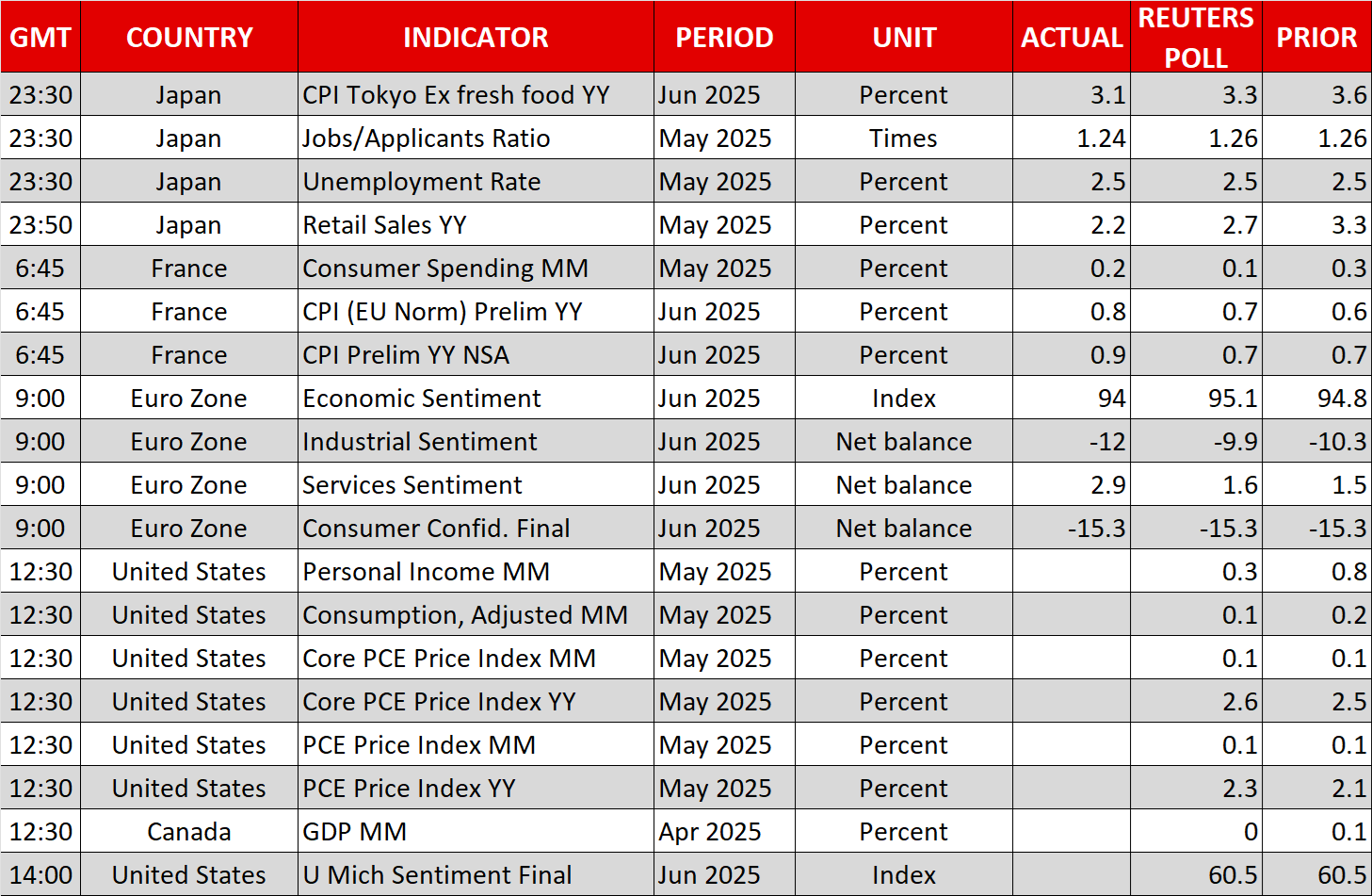

A flurry of US indicators on Thursday cast doubt on the urgency for an imminent Fed rate cut, while the additional Fedspeak, including Chair Powell’s testimony, following Waller’s and Bowman’s dovish remarks does not suggest there is a consensus for a July move.

Durable goods orders surged by 16.4% m/m in May, with non-defence capital goods orders rising by 1.7% m/m. Weekly jobless claims, meanwhile, fell from the previous week, although continued claims hit the highest since the pandemic.

On the worrying side, GDP growth for the first quarter was revised lower to an even bigger contraction, mainly due to weaker-than-originally estimated consumer spending.

The focus is now on today’s PCE inflation numbers for better clarity. The core PCE price index – the Fed’s preferred inflation gauge – likely rose by just 0.1% m/m in May but inched slightly higher to 2.6% on a yearly basis. The latest personal consumption print will also be important.

Any downside surprises could see expectations for a third 25-bps cut this year shoot up again, further pressuring the dollar.

Another record high for the Nasdaq 100

In equity markets, the mood has definitely brightened from the start of the week, with several major indices, including the Nasdaq 100 and the MSCI All Country World Index, notching up fresh record closes.

Renewed optimism about AI is driving the tech rally on Wall Street, with Nvidia hitting a new all-time high.

Investors are also feeling more upbeat about the prospect of the Trump administration reaching trade agreements with America’s major trading partners before the July 9 deadline when the pause in the reciprocal tariffs is set to expire.

Hopes rise for trade deal announcements

Speaking in a Bloomberg interview overnight, US Commerce Secretary Howard Lutnick said that the US and China have finalized the ‘trade understanding’ that was agreed in London earlier this month and hinted that a deal with 10 more countries could be imminent.

However, Lutnick warned that those countries that fail to reach a deal before the deadline will be sent letters by the President, setting out the terms for future trade. But few believe that the US will risk reimposing the higher reciprocal tariff rates, at least not for the important trading partners, even if a deal hasn’t been struck yet, and that further extensions are the most likely outcome.

In a further relief for the markets, Treasury Secretary Scott Bessent announced that the ‘revenge tax’ that was included in the House’s budget bill will be scrapped after the White House reached a deal with the G7 for the US to be exempt from some taxes imposed by other nations.

Not a great week for oil, gold and yen; budget bill vote eyed

All this is positive for risk sentiment and is what’s driving risk assets higher but safe havens lower. However, there’s no confirmation yet of any new trade deals making it over the finish line and there’s still the budget bill that needs to be passed by Congress.

Senate Republicans are pushing for a vote on the bill by Saturday so that it can be signed by President Trump before the July 4 Independence Day holiday.

But with oil prices plummeting more than 10% this week and in the process, sharply reducing the risks to higher inflation, it’s easy to see why markets are in jubilant form and not too concerned about the outstanding issues.

The euro was last testing $1.17, while the yen was struggling to hold onto the 144 level against the dollar. Softer than expected CPI figures for the Tokyo region are adding to the yen’s pain today.

Gold is also struggling, breaching the $3,300 mark to fall to four-week lows, as the ceasefire between Israel and Iran seems to be holding and the Trump administration appears keen not to re-escalate trade tensions.

.jpg)