The dollar delivered a dovish surprise

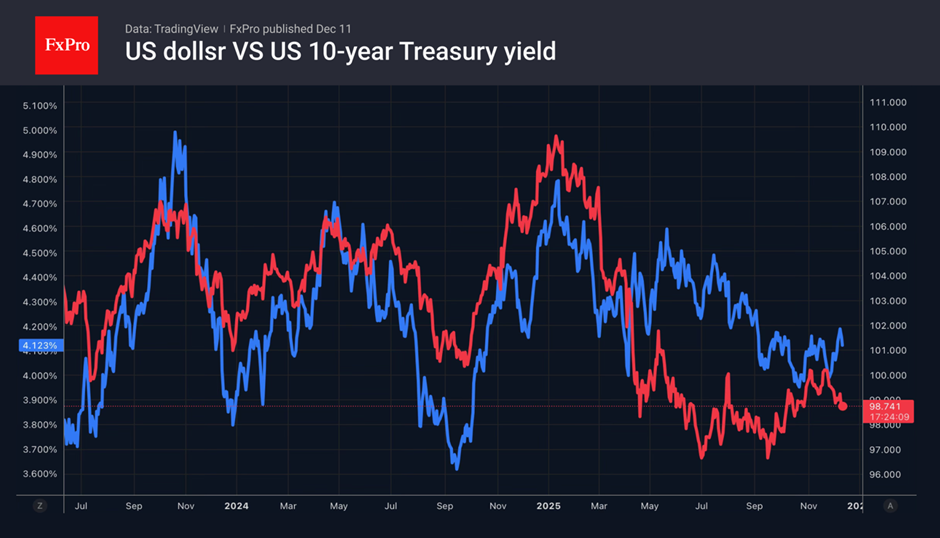

The US dollar experienced its worst day in nearly three months after the Fed cut its key rate and announced a $40 billion asset purchase programme for the upcoming month. The Fed chairman noted that the labour market is cooling and that official employment figures are overstated by about 60k. Coupled with the Fed's restart of Treasury bond purchases, this lowered yields and triggered a sell-off of the dollar in the market.

At the same time, the Fed's hawkish stance did materialise. The median FOMC forecast predicts only one rate cut in 2026, and Jerome Powell stated that the rate is in a neutral range, where it neither heats up nor cools down the economy. The Fed feels comfortable in a ‘wait and see’ mode.

The likelihood of a key rate cut in January has decreased from 25% to 20%, and the futures market does not anticipate a cut until April. Consequently, the decline in the dollar appears excessive. Another factor influencing this is the robustness of key competitors. Officials at the ECB and the Reserve Bank of Australia have not ruled out tightening policy as early as 2026, while former Bank of Japan chief economist Hideo Hayakawa mentions the possibility of four rate hikes by the end of 2027.

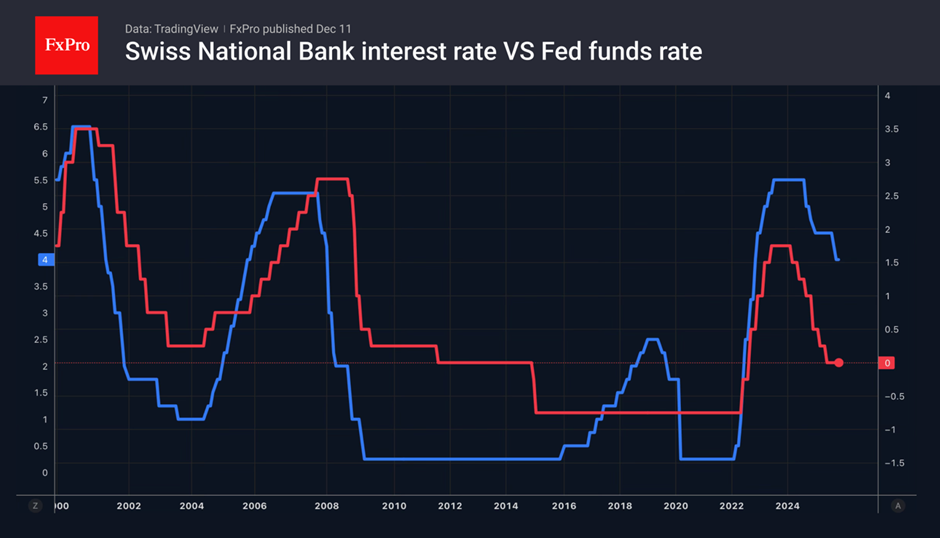

The main beneficiaries of the dollar's decline have been the Swiss franc and the British pound. Switzerland announced a retroactive cut in import duties from the US, reducing them from 39% to 15%. This change will take effect from 14 November and is expected to boost exports and the economy. Additionally, signals from the Federal Reserve about pausing rate cuts, along with reversals by other central banks, are dampening concerns of the SNB returning to negative interest rates. This supports bearish sentiment on the USDCHF pair.

The futures market continues to price in a rate cut by the Bank of England on 18 December. However, expectations that the BoE will follow the Fed and tighten policy are generating bullish rumours for the GBPUSD pair. The central bank anticipates that measures outlined by Rachel Reeves in the draft budget will reduce inflation by 0.4-0.5 percentage points annually, starting in the second quarter of 2026.

The FxPro Analyst Team

-11122024742.png)

-11122024742.png)