The euro holds on by a thread

The US dollar remained resilient despite a shutdown and was not deterred by disappointing statistics. The government shutdown is set to become the longest in history. The Polymarket and Kalshi prediction markets give a 52% chance that the executive branch will remain out of action until mid-November. Jerome Powell argued that the shutdown is forcing the Fed to be cautious. The longer it lasts, the lower the chances of a December rate cut, which works in favour of the dollar.

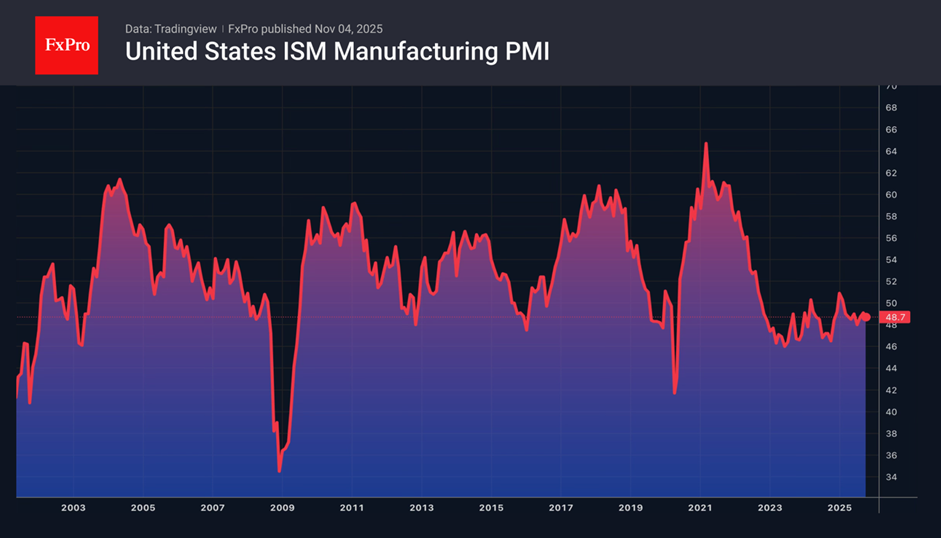

The ISM PMI slowed from 49.1 to 48.7 in October. The indicator has been below 50 for eight months, signalling a decline in the sector. The prices slowed compared to September, while employment has been in a contractionary territory since January. The dynamics of the indicators point to a cooling economy and support the idea of a loosening of the Fed's monetary policy at the end of the year. As a result, EURUSD has found its footing.

The euro was supported by the intention of the Socialists in France to give the government more time to draw up an acceptable budget. Previously, the party had intended to dismiss the prime minister.

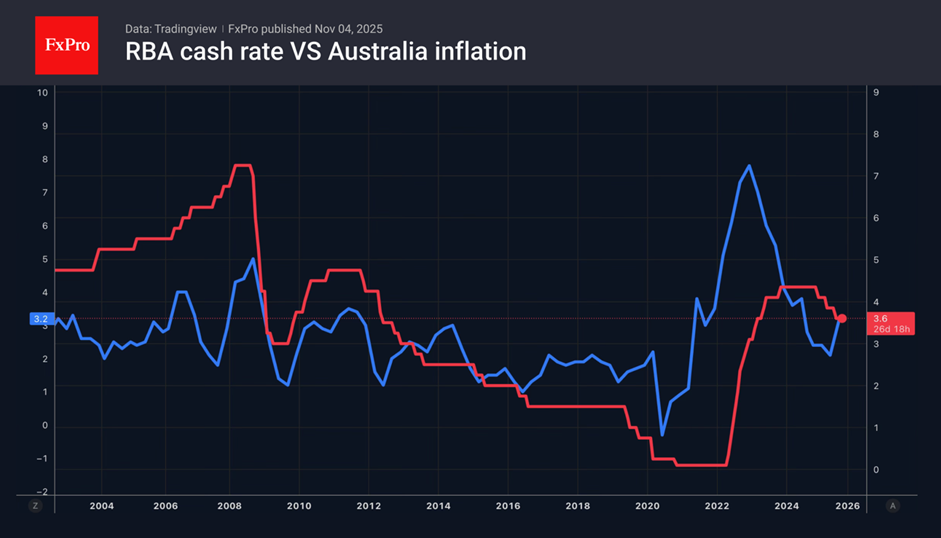

The Reserve Bank of Australia’s decision to leave the key rate at 3.6% did not help the AUD. It was taken unanimously by nine members of the Council, citing the continuing risks of accelerating inflation. At the same time, the phrase about still tight monetary policy sent AUDUSD into shock. Before the RBA's October meeting, several major banks, including Goldman Sachs and the Commonwealth Bank of Australia, claimed that the cycle of policy easing was over. The futures market expected a cut by May next year. If the central bank does so earlier, the Aussie risks continuing its descent.

As USDJPY approaches the 155 level, investors' nerves are frayed. They are taking profits on fears of currency intervention. Greed is giving way to fear, causing the pair to retreat. Traders are not encouraged even by statements from Goldman Sachs and Bank of America that the 155 mark is not a red line.

The slowdown in consumer prices in Switzerland to 0.1% has revived rumours of the SNB returning to negative rates and put downward pressure on the franc.

The FxPro Analyst Team

-11122024742.png)

-11122024742.png)