Trade optimism boosts Fed rate cut bets

US makes trade-related progress with China and Canada

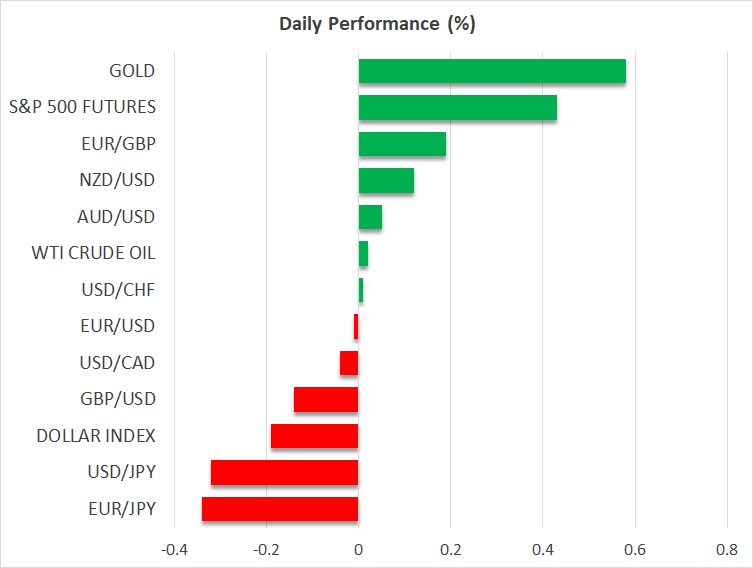

The US dollar traded mixed against the other major currencies on Friday, perhaps as the US data did not offer extra clarity as to how the Fed may need to proceed with monetary policy for the remainder of the year.

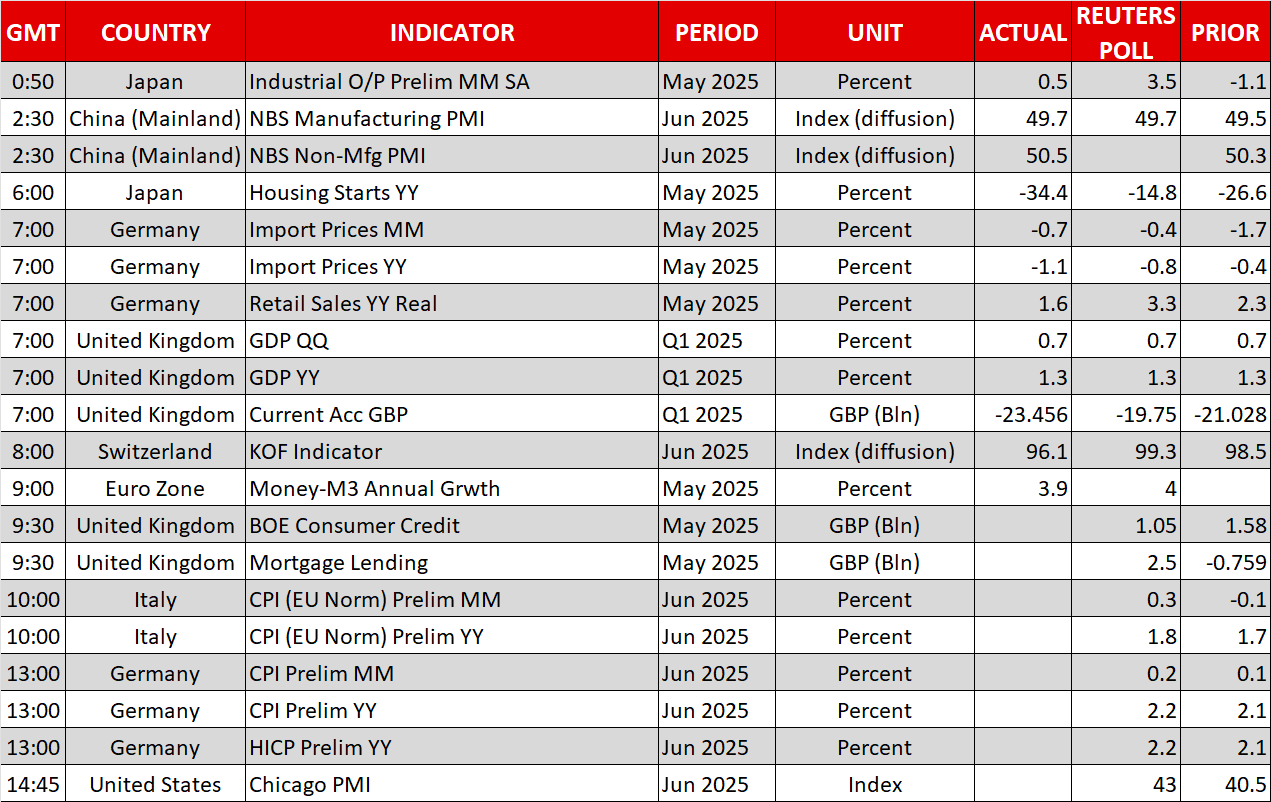

The core PCE index accelerated to 2.7% year-on-year in May, but consumer spending unexpectedly fell as the boost from preemptive buying ahead of tariffs faded. This allowed investors to continue penciling in around 65bps worth of Fed rate cuts by the end of the year, with renewed optimism about potential trade deals between the US and its main trading partners reinforcing such expectations today.

News reports said that the White House is getting closer to a more permanent deal with China, while Canada scrapped a digital service tax so it could resume stalled talks with the US. The loonie was among Friday’s losers as US President Trump said he will end talks with Canada in response to the digital service tax. Today, the loonie is in recovery mode.

As for China, the White House said on Thursday that they have signed a deal with China to speed up rare earth approvals, with Beijing confirming that they would process export licenses in accordance with the law. US Treasury Secretary Scott Bessent said on Friday that shipments from China would be expedited to all companies that have been receiving them on a regular basis.

Trump wants interest rates to be lowered to 1%

What may have also pushed the greenback lower are new attacks by US President Trump against Fed Chair Powell stating that he would “love” it for the Fed Chief to resign before his term ends. He added that he wants interest rates at 1% and repeated his intention to replace Powell with a more dovish policymaker.

One of the reasons why President Trump is so obsessed with lowering interest rates may be that his massive tax-cut and spending bill, which is now facing the Senate, is expected to add more than $3 trillion to the national debt over a decade, and high borrowing costs would make repaying the debt an extremely hard task.

Overall, the key takeaway is that the dollar’s dynamics, when it comes to tariffs, seem to have changed. Back in April and May, the dollar was weakening when tariff concerns were increasing, and it was gaining when there was relief. Now, with recession fears abating, it weakens when there is progress in the trade landscape as this lessens the likelihood of tariffs fueling inflation and forcing the Fed to keep interest rates higher for longer.

Wall Street climbs higher as Fed cut bets boost present values

On Wall Street, all three of the main indices closed well in positive territory, with the Dow Jones gaining 1% and the others, the S&P 500 and the Nasdaq, climbing to new all-time highs. Today, stock futures are in the green, suggesting new records in today’s session, as expectations of lower borrowing costs mean higher present values of future growth opportunities. And the resilience of the stock market despite high valuation metrics suggests that market participants remain willing to price in future growth opportunities, especially when it comes to Artificial Intelligence (AI).

Gold rebounded today due to the weaker dollar, but the bigger picture suggests that it remains in a bearish corrective mode, perhaps as investors’ increasing appetite is prompting them to liquidate some of their safe-haven holdings and divert those flows into stocks.

.jpg)