USDJPY: no relief in sight yet

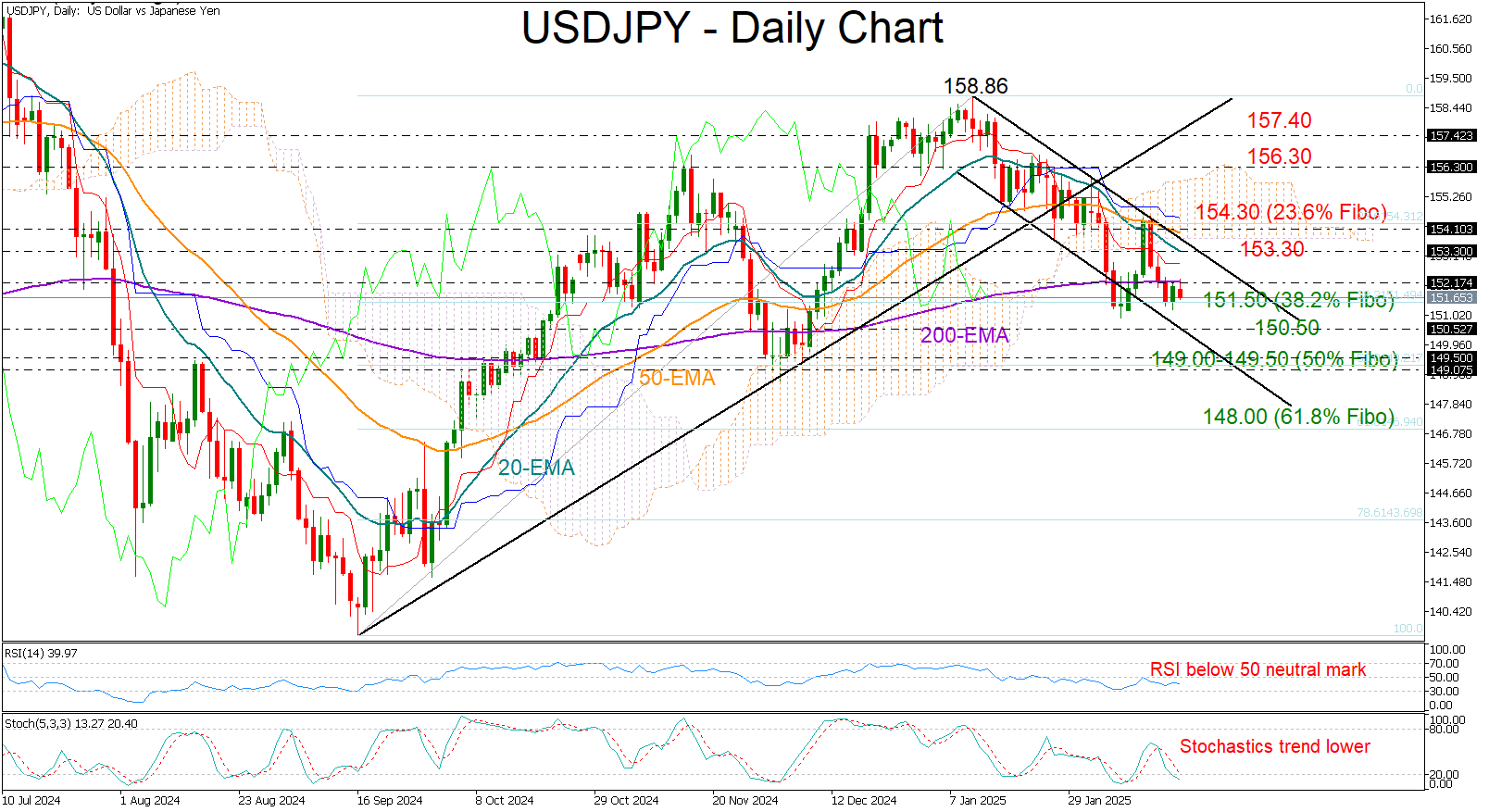

USDJPY has been treading water in a tight range this week, holding between the 200-day exponential moving average (EMA) near 152.20 and the 151.50 support level after a sharp drop from the 154.30 resistance zone. The outlook remains fragile, with technical indicators signaling further downside risks.

At the moment, there’s little to get excited about from a technical perspective. The price has dipped below the Ichimoku cloud, and the 20- and 50-day EMAs are locked in a bearish crossover, endorsing the negative trajectory in the market. Additionally, the RSI remains clearly below its 50 neutral mark, while the stochastic oscillator is edging into oversold territory - both indicating that selling pressures could persist in the near term.

If the 151.50 level gives way – aligned with the 38.2% Fibonacci retracement of the September-January rally - the pair could quickly test the next line of defense around 150.50. Should that also fail to hold, the 149.00-149.50 area, where the pair staged a strong rebound in December, could become the next battleground. A break below this zone would open the door to a steeper drop towards the 61.8% Fibonacci retracement at 148.00.

On the flip side, a successful break above the 200-day EMA could re-challenge the resistance area of 153.30-154.30. This area is packed with obstacles, including the 20- and 50-day EMAs, the Ichimoku cloud’s lower band, the 23.6% Fibonacci level, and a downward-sloping trendline from January’s peak. Hence, a decisive close above this zone could reignite buying interest, propelling the pair to the next barrier near 156.40. Any further upside would face a tougher battle around the broken support trendline near 157.40.

In summary, USDJPY continues to have a bearish lean in the short term. If resistance around 152.20 holds firm, a resumption of the downtrend is likely. A move below 145.00 would signal a deeper, more sustained bearish reversal in the medium-term outlook.