USD/JPY runs out of fuel near July’s high

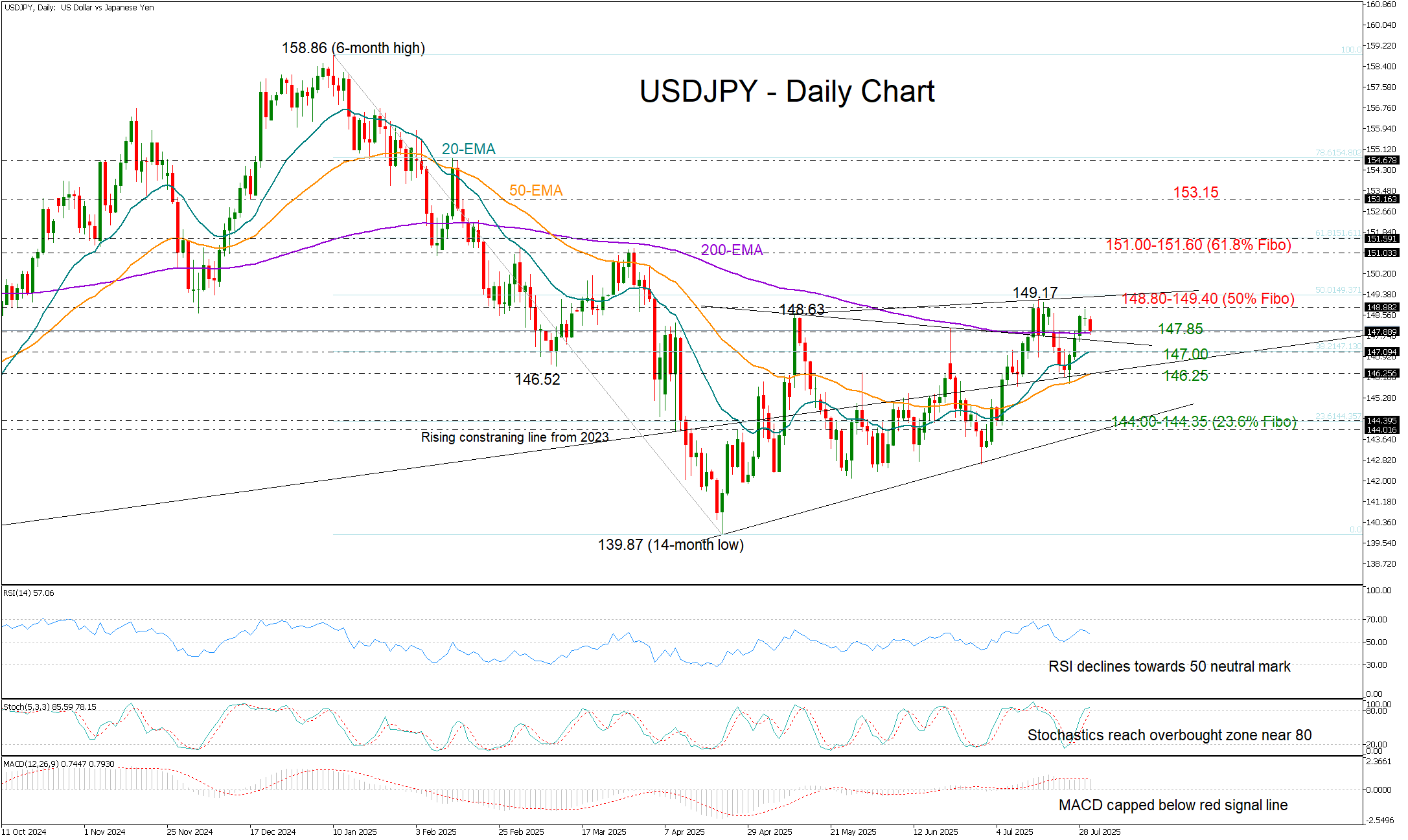

USD/JPY surrendered to the bears early on Wednesday after its three-day bullish streak ran out of steam just below the 148.80–149.40 ceiling, which capped July’s gains.

While market stability is typical ahead of FOMC policy meetings, upcoming US GDP growth figures – and particularly the price component – could inject early volatility before the central bank's rate decision. Investors are anticipating a swift 2.4% rebound following the -0.5% contraction in Q1, the first such decline in over two years.

Technically, Tuesday’s doji candlestick has already raised concerns that the pair could remain trapped within the three-month-old sideways pattern. The momentum indicators are offering little optimism: the stochastic oscillator is about to peak in overbought territory, and the RSI is trending downward toward the neutral 50 mark.

As such, traders may wait for a confirmed negative move below the 200-day exponential moving average (EMA) at 147.80 or even a slide beneath the 20-day EMA at 147.00 to target the 50-day EMA at 146.25. A failure to rebound there could open the door for a deeper decline toward the 144.00–144.35 area, where a tentative support line from April and the 23.6% Fibonacci retracement of the January–April downleg are sitting.

To the upside, a sustained break above the 148.80–149.40 resistance zone is a prerequisite for a rally toward the 151.00 round level and the 61.8% Fibonacci mark at 151.60. Beyond that, the pair could aim for a further advance toward 153.15.

Summing up, USD/J/PY remains in a wait-and-see mode, with downside risks increasing after a second rejection at the key resistance zone of 148.80-149.40. A decisive move below the 200-day EMA could signal the start of the next bearish cycle.

.jpg)