USD/JPY slides to 151.00 as Powell signals stir market uncertainty

USD/JPY erased Monday’s opening gap, retreating toward the key 151.00 psychological level following remarks from Federal Reserve Chair Jerome Powell. Powell acknowledged the resilience of economic activity but flagged emerging risks in the labor market and tightening financial conditions. His comments hinted at a potential end to the Fed’s balance-sheet runoff, amplifying policy uncertainty and weighing on the dollar.

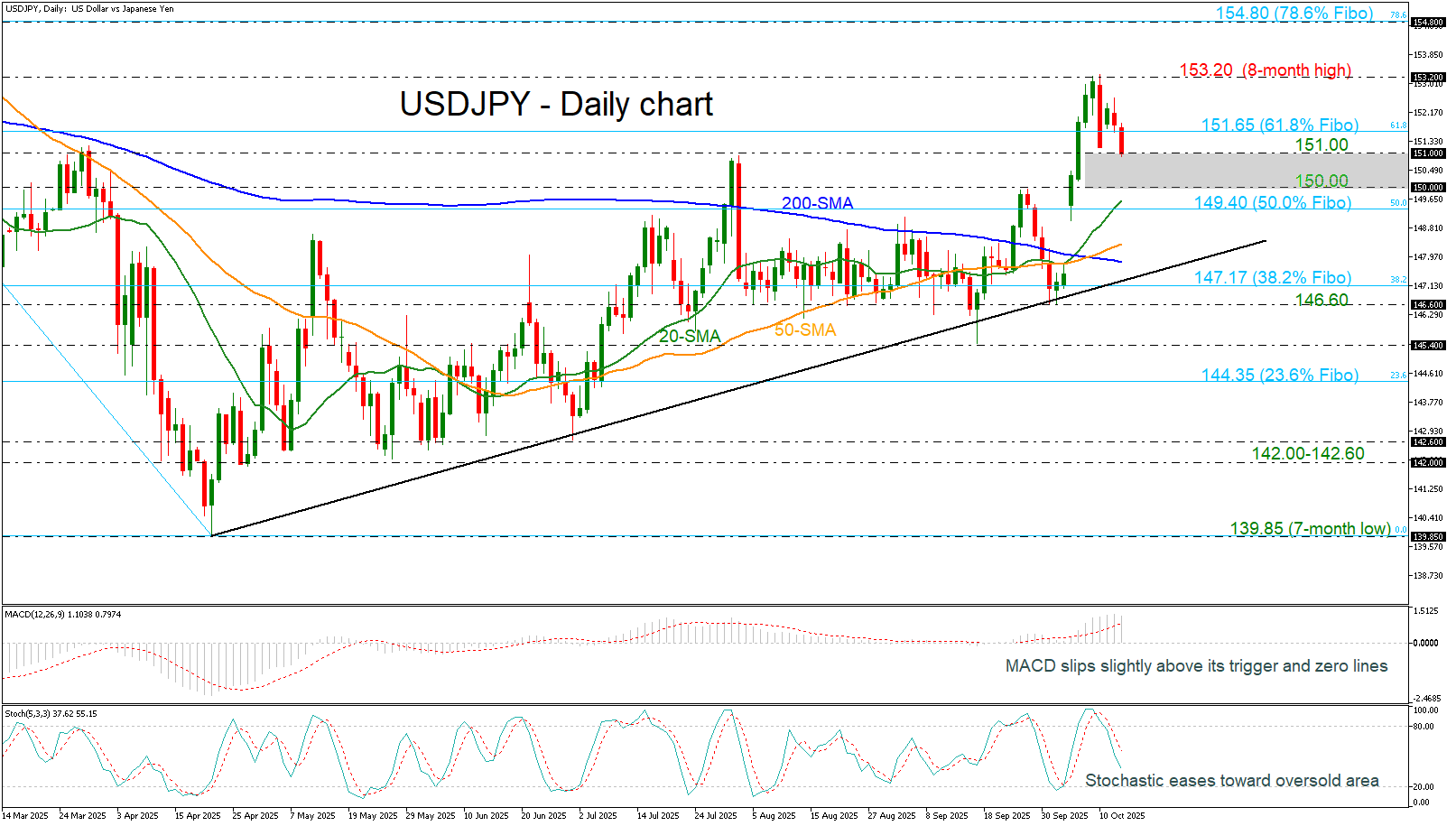

Technically, further downside pressure could expose the 150.00 psychological threshold, with the 50.0% Fibonacci retracement of the 158.86–139.85 decline located at 149.40. A break below this zone may accelerate bearish momentum toward the 50-day and 200-day simple moving averages (SMAs) at 148.35 and 147.80, respectively. The medium-term ascending trendline near 147.50 could act as a final buffer against deeper losses.

On the other hand, a rebound from 151.00 may open the door for a retest of the 61.8% Fibonacci level at 151.65, followed by the eight-month high at 153.20.

Momentum indicators offer mixed signals. The MACD is softening above its trigger and zero lines, while the stochastic oscillator is nearing oversold territory, suggesting potential for a short-term bounce.

While Powell’s cautious tone has introduced downside risks for USD/JPY, the pair remains technically supported above key levels. A decisive move below 150.00 could trigger a deeper correction.