Why Silver could be the precious metal of 2025

The gold bar is metallic yellow and slightly behind the silver bar, which is metallic white and positioned in front.

Gold may still be the headline act, but silver’s no longer content playing second fiddle. In 2025, silver isn’t just glittering - it’s surging forward as one of the most exciting metals on the market.

It’s no longer about coins and necklaces. Silver is now powering EVs, driving clean energy, and showing up in the guts of tomorrow’s tech. With rising demand, competitive pricing, and a key role in green and digital transitions, silver is worth a hard look.

Silver’s double act: Industrial muscle and investor appeal

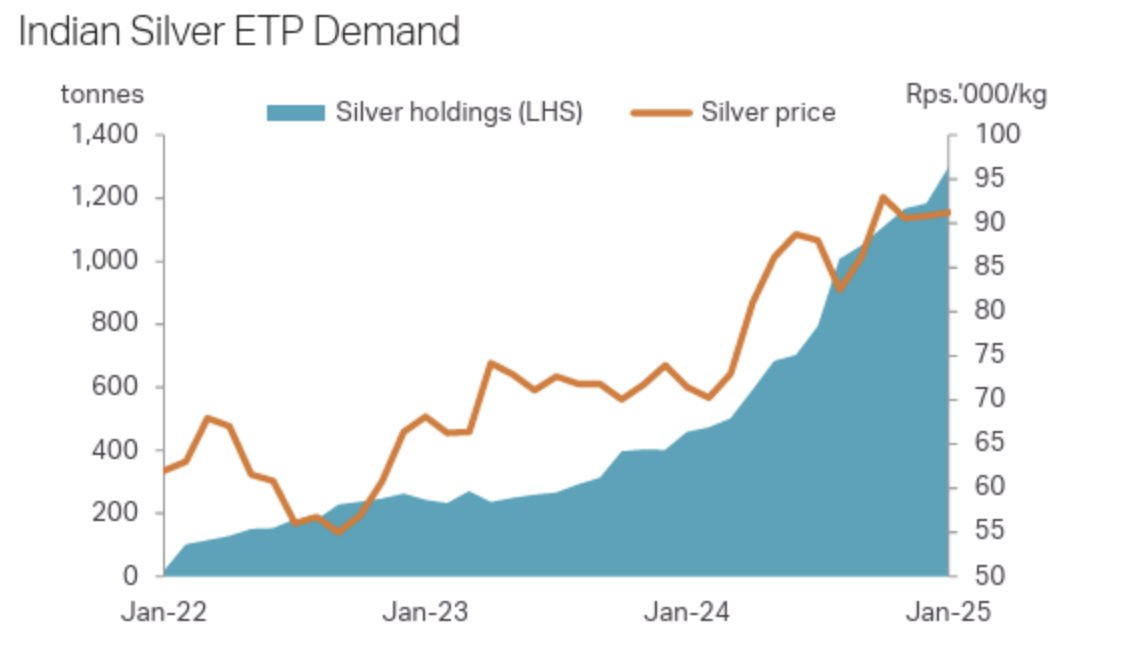

Silver is having a breakout moment - and it’s not just hype. The global demand is expected to top 1.2 billion ounces this year. India, a major market mover, has already tripled its silver imports in Q1 alone, spurred by expanding sectors like electric mobility, solar energy, and smart tech.

Source: Metals Focus

We’re simply using more silver than we can mine.

Why? Electric vehicles each require about 50 grams of silver for their electronic systems. Solar panels can’t function without it, thanks to silver’s unmatched conductivity that makes it vital to photovoltaic (PV) cells. AI hardware, 5G networks, even future data centres - they all need silver to stay fast and cool.

Once viewed as a background metal, silver is now critical to the technologies reshaping our world.

The macro tailwinds behind silver’s climb

Beyond tech, the macroeconomic mood is also giving silver a leg up.

With central banks moving back towards rate cuts, precious metals are finding favour again. A weakening US dollar only adds to silver’s appeal for international investors.

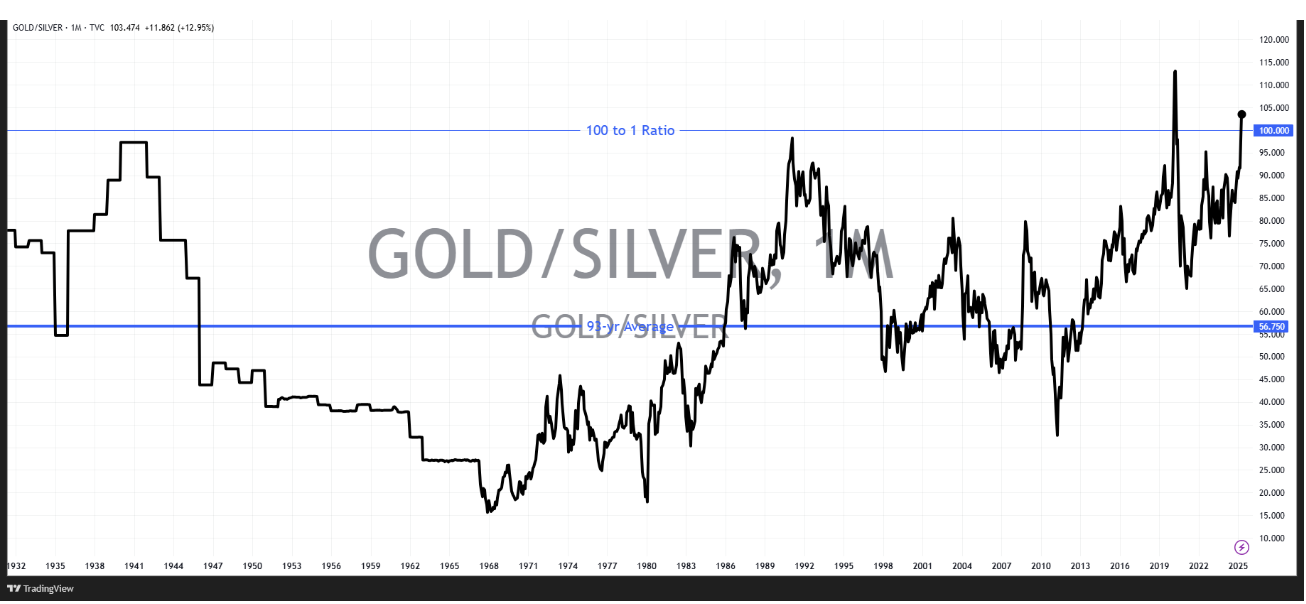

Then there’s the gold-to-silver ratio - currently sitting around 100:1. That’s a massive historical imbalance. Traditionally, when the ratio climbs that high, it suggests silver is deeply undervalued relative to gold.

Source: Trading View

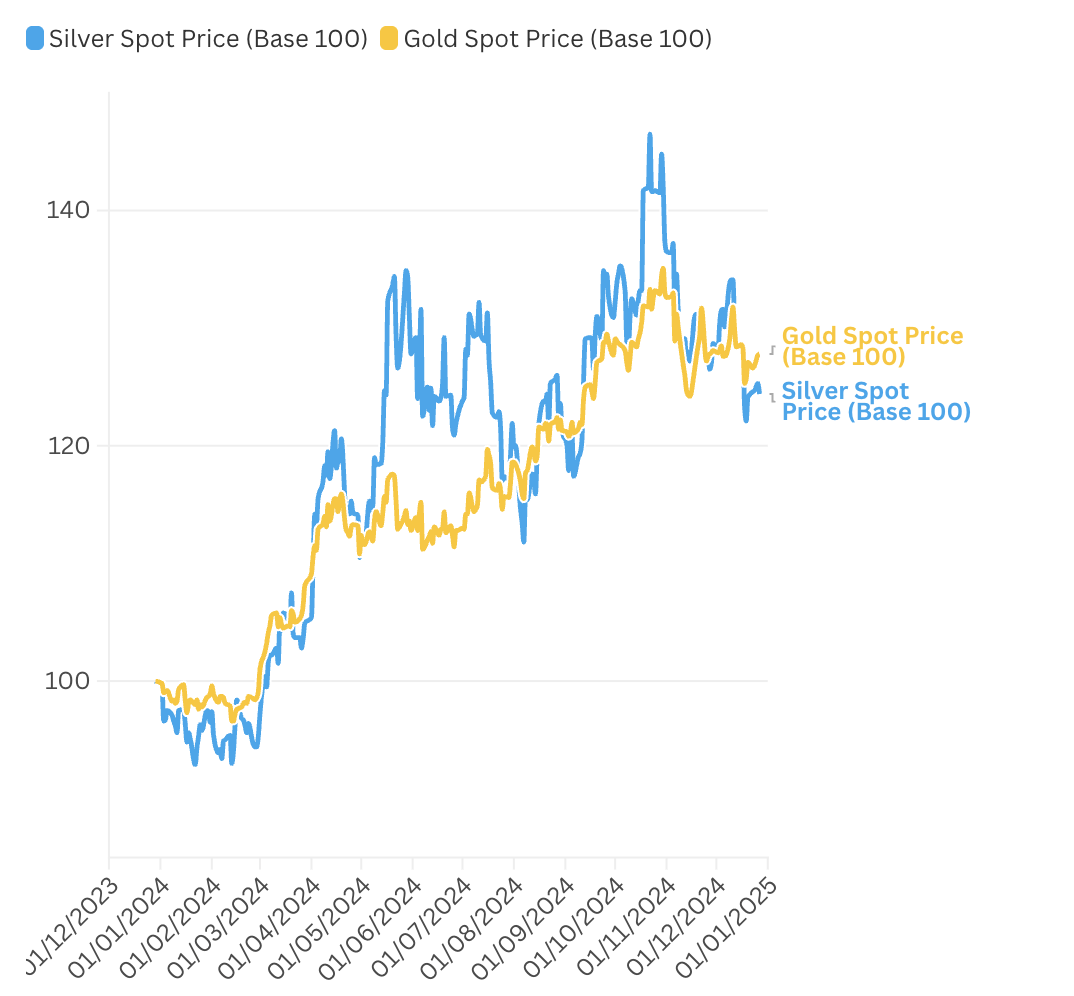

And silver’s no stranger to outperformance. Just look at the bull runs of 2020 and 2024, where silver didn’t just tag along with gold - it sprinted ahead.

Source: Trackinsight

What makes silver shine in 2025?

Investors are starting to take notice - and reposition. Silver is evolving from a defensive hedge into a credible growth asset. And with prices far lower than gold, it’s much more accessible for new entrants or diversified portfolios.

In fact, bullion insiders report that silver now makes up 20–30% of precious metals holdings, up sharply from previous years.

While gold may always carry a cultural and emotional cachet, silver is emerging as the pragmatic choice for a fast-changing world. It’s useful, affordable, and riding high on some of the decade’s most powerful trends.

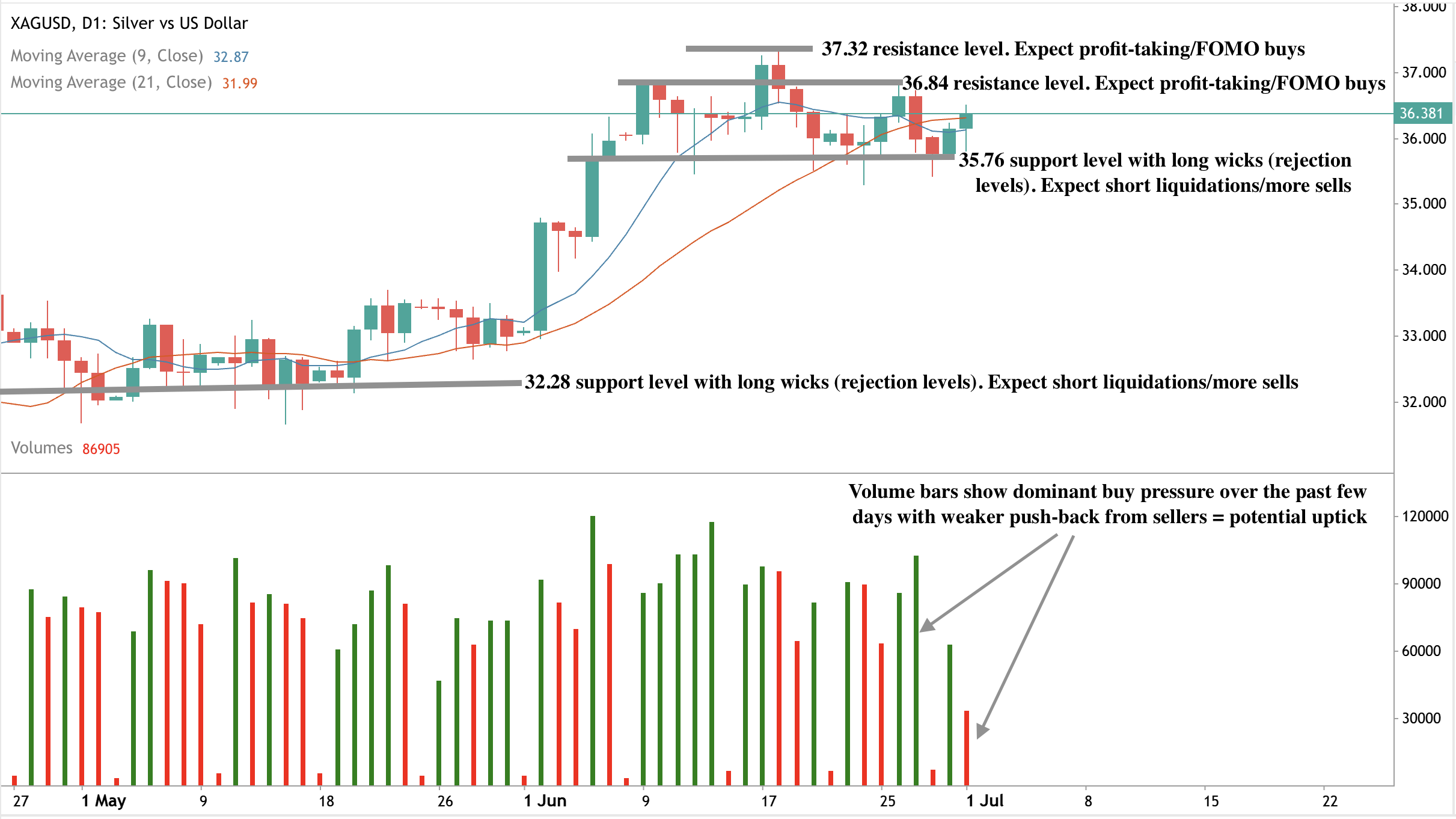

Silver price forecast

Silver has been underestimated for too long. But 2025 is shaping up to be its breakout year - the perfect blend of safe-haven and future-facing asset. Whether you’re an everyday saver, a sustainability-minded investor, or simply looking for smart diversification, silver is ticking all the right boxes. It may not have gold’s legacy. But in 2025, silver has something better: momentum.

Source: Deriv MT5

Disclaimer-

The information contained within this article is for educational purposes only and is not intended as financial or investment advice. We recommend you do your own research before making any trading decisions.

This information is considered accurate and correct at the date of publication. Changes in circumstances after the time of publication may impact the accuracy of the information.

The performance figures quoted are not a guarantee of future performance.