Why Do So Many People Fail Prop Firm Challenges?

Hi Everyone,

I’ve been developing portfolios of automated trading algorithms for about 5 years. The focus has always been steady growth, low drawdown, and consistency. No martingale and no grid.

I decided to try prop firm trading after hearing that the pass rate is extremely low and very few traders actually reach payouts. So I went through the rules carefully and built my systems specifically to stay within them — avoiding daily drawdown violations, overall drawdown limits, news timing issues, etc.

For the challenge phase I used slightly higher risk to pass faster, and then switched to lower risk on the funded accounts to keep payouts stable. I also run multiple different systems on different accounts to smooth out the results over time.

So far I’ve reached $400k max allocation and around $27k in payouts, using the same systems I was already trading live — just adjusted a bit to fit the prop firm environment.

I’m interested to hear your thoughts:What do you think makes prop firm challenges so difficult for most traders?

Not bad! Now time for Live account. First live account ?

RandoPajuste posted:

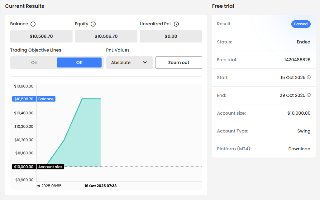

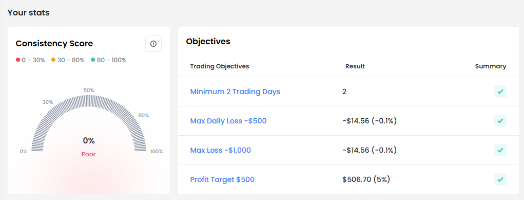

Can you beat this with 1:30 swing account? Drawdown: -0.1% (-14.56) vs Profit: +5% (506.70)

As long as you are not trading ICT you have a chance to make some live profits haha

I figured out about FTMO, you can do it 2 ways, long hard way that is safe and takes 3-4 months or fast risky way (max 2-5 days).Those 2 trades with XAUUSD were made in the same morning with no news.Possibly there is also a bit luck involved, but result is really nice! Usually -0.5% up to -2% drawdown is ok with this risky strategy.Idea were if there is no trading room (1:30), how fast I can pass the challenge with lowest drawdown (passed with 2 hours: +506). Is this strategy repeatable: possibly not and better stick with long and safe trading with FTMO.

RandoPajuste posted:I figured out about FTMO, you can do it 2 ways, long hard way that is safe and takes 3-4 months or fast risky way (max 2-5 days).Those 2 trades with XAUUSD were made in the same morning with no news.Possibly there is also a bit luck involved, but result is really nice! Usually -0.5% up to -2% drawdown is ok with this risky strategy.Idea were if there is no trading room (1:30), how fast I can pass the challenge with lowest drawdown (passed with 2 hours: +506). Is this strategy repeatable: possibly not and better stick with long and safe trading with FTMO.

How I do it is that I developed a Daily Drawdown protector. So I can use many of my different trading systems in a portfolio and still not break the 5% max daily drawdown rule. I just set DD protector to 4% and if there would be a very bad day it won't breach that rule. And yeah I just try to pass the challenge decently fast. I normally pass them in 3-6 weeks with a 80% pass rate.

RandoPajuste posted:I figured out about FTMO, you can do it 2 ways, long hard way that is safe and takes 3-4 months or fast risky way (max 2-5 days).Those 2 trades with XAUUSD were made in the same morning with no news.Possibly there is also a bit luck involved, but result is really nice! Usually -0.5% up to -2% drawdown is ok with this risky strategy.Idea were if there is no trading room (1:30), how fast I can pass the challenge with lowest drawdown (passed with 2 hours: +506). Is this strategy repeatable: possibly not and better stick with long and safe trading with FTMO.

But I am all about long term performance. If you dont have +1 year of profitability you have no proof you can trade.

I am not telling anything about your trading. Possibly you trade really good. I also have my own DD protector set to 4.5%. You didn't get my overall point. This lucky FTMO passing were basically World Record performance, consider laverage (1:30), time (2h), drawdown (-0.1%) and Profit (+5%). Possibly in future someone will make it with 1 trade, less time and even better drawdown performance (maybe commision only). Answer for your thread question: Possibly the reason why most fail in prop firms, they use fast risky way to get the account and also no DD protection - patience and safe trading is the key.

yeah maybe that is a record. You must have had some very very lucky trades that went only in your direction. Strong momentum moves with no pullbacks. extremely lucky. Good for you :)

short answer - that's prop trading firm model of the business. they earn money when people lose their deposits.

DanGreenX posted:short answer - that's prop trading firm model of the business. they earn money when people lose their deposits.

yeah 100%. They make money when people watch YouTube and trade like YouTube gurus haha! And they loose money when people learn how to trade with good algorithms. I am worried they will find a reason to ban me soon after taking out profits every month for like 6 months now. They work like a casino, if some1 is to good they can just ban you if they want

You are right. But such firms earn when you register and pays fees. They don't care you earn or not. Most of the profits - fees

DSikora posted:You are right. But such firms earn when you register and pays fees. They don't care you earn or not. Most of the profits - fees

Yeah ofc. All trading accounts are demo. No real trying involved. And yeah all their profit comes from challenge fees