- Accueil

- Communauté

- Général

- Why Do So Many People Fail Prop Firm Challenges?

Why Do So Many People Fail Prop Firm Challenges?

Hi Everyone,

I’ve been developing portfolios of automated trading algorithms for about 5 years. The focus has always been steady growth, low drawdown, and consistency. No martingale and no grid.

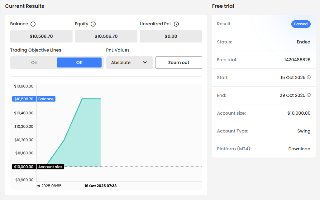

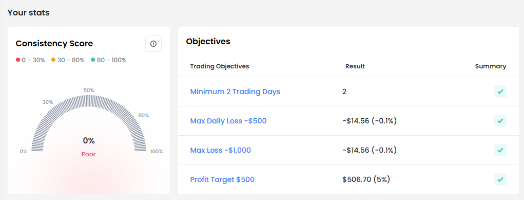

I decided to try prop firm trading after hearing that the pass rate is extremely low and very few traders actually reach payouts. So I went through the rules carefully and built my systems specifically to stay within them — avoiding daily drawdown violations, overall drawdown limits, news timing issues, etc.

For the challenge phase I used slightly higher risk to pass faster, and then switched to lower risk on the funded accounts to keep payouts stable. I also run multiple different systems on different accounts to smooth out the results over time.

So far I’ve reached $400k max allocation and around $27k in payouts, using the same systems I was already trading live — just adjusted a bit to fit the prop firm environment.

I’m interested to hear your thoughts:What do you think makes prop firm challenges so difficult for most traders?