Why Do So Many People Fail Prop Firm Challenges?

Hi Everyone,

I’ve been developing portfolios of automated trading algorithms for about 5 years. The focus has always been steady growth, low drawdown, and consistency. No martingale and no grid.

I decided to try prop firm trading after hearing that the pass rate is extremely low and very few traders actually reach payouts. So I went through the rules carefully and built my systems specifically to stay within them — avoiding daily drawdown violations, overall drawdown limits, news timing issues, etc.

For the challenge phase I used slightly higher risk to pass faster, and then switched to lower risk on the funded accounts to keep payouts stable. I also run multiple different systems on different accounts to smooth out the results over time.

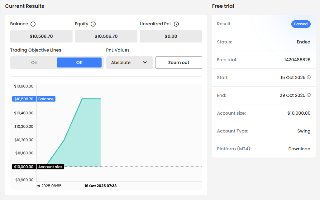

So far I’ve reached $400k max allocation and around $27k in payouts, using the same systems I was already trading live — just adjusted a bit to fit the prop firm environment.

I’m interested to hear your thoughts:What do you think makes prop firm challenges so difficult for most traders?

Not bad! Now time for Live account. First live account ?

RandoPajuste posted:

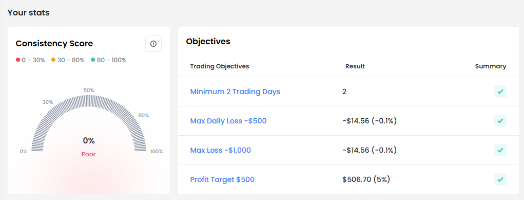

Can you beat this with 1:30 swing account? Drawdown: -0.1% (-14.56) vs Profit: +5% (506.70)

As long as you are not trading ICT you have a chance to make some live profits haha

I figured out about FTMO, you can do it 2 ways, long hard way that is safe and takes 3-4 months or fast risky way (max 2-5 days).Those 2 trades with XAUUSD were made in the same morning with no news.Possibly there is also a bit luck involved, but result is really nice! Usually -0.5% up to -2% drawdown is ok with this risky strategy.Idea were if there is no trading room (1:30), how fast I can pass the challenge with lowest drawdown (passed with 2 hours: +506). Is this strategy repeatable: possibly not and better stick with long and safe trading with FTMO.