Bitcoin and Ethereum seek support

Market picture

The crypto market correction continues to deepen, although there have been some signs of stabilisation since the start of the day on Wednesday. The decline has continued for a whole week, reducing the market cap by almost 15%. The total cap was down to $2.28 trillion on Wednesday morning, rising to $2.35 trillion (-2.5% in 24 hours) by the start of active trading in Europe.

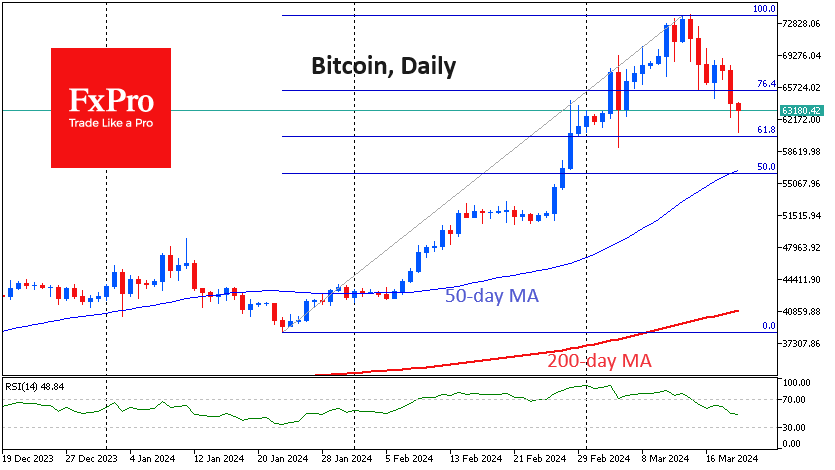

Bitcoin is down 13.6% in seven days, trading at $62.8K and dipping below $61.0K in the early session. Technically, it remains in a downtrend, with a series of lower lows and lower highs. We will pay attention to the first cryptocurrency's dynamics at the following support levels: $60.3K (correction to 61.8% of the last rally), $56K area (50-day average and 50% level) and $51.5K (consolidation area in February).

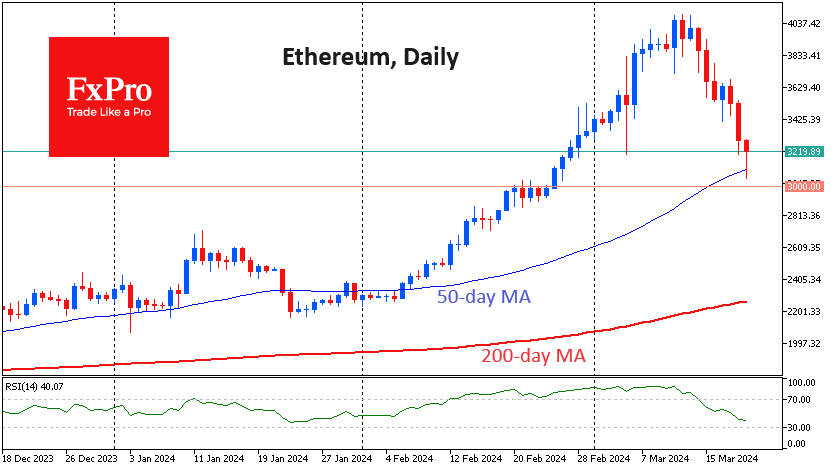

Ethereum approached $3050, but a temporary break below the 50-day moving average spurred buyers. Some traders are seeing the situation as an opportunity to join the global bull market after profit-taking. However, crypto traders should now keep a close eye on the appetite for risk in the financial markets. Today, it will be heavily influenced by the FOMC and other major central bank meetings later in the week.

News background

Against the backdrop of the first cryptocurrency to rally above $70K, holders have turned to sellers to lock in profits, according to Glassnode. Bitcoin's current correction offers an opportunity to "buy on the lows" ahead of the April halving, according to Bernstein.

Michael van de Poppe, founder of MN Trading, called the correction "sharp". "But remember, you don't want to buy altcoins when they're going up. You want to buy them when they're down 25-60 per cent. That's when the real profits come in," he added.

MicroStrategy bought 9,245 BTCs between 11 and 18 March at an average price of $67,382, according to founder Michael Saylor. MicroStrategy's total cryptocurrency reserves reached 214,246 BTC, which is more than 1% of the total digital gold issued.

CryptoQuant founder and CEO Ki Yoon Ju expressed concern about the boom in the meme-token segment. In his opinion, such projects only harm the crypto industry. Yoon Ju compared the situation to the ICO boom in 2018, which resulted in most investors simply losing their invested funds.

Fidelity Investments has amended its proposal to launch a spot Ethereum ETF to include staking in its provision.

Total client assets on Binance have surpassed $100 billion, according to the exchange. According to DeFi Llama, $109 billion is held on the platform, with Bitcoin (32%), USDT (21%) and BNB (15%) making up the majority of assets.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)