Crypto stays under pressure

Market picture

The pressure on the crypto has been more sustained than on the stocks. Over the past 24 hours, the total crypto cap has fallen by 2.6%, with most of the downward momentum starting in the US session. The stock market, on the other hand, was supported by Powell's comments and closed at all-time highs, supporting risk appetite in Asia. Bitcoin, Ethereum, and BNB returned to their lows in the last seven days. At the same time, there is still interest in buying smaller coins: Solana, XRP, and Toncoin.

Bitcoin retreated to $60.5K at the lows of the Asian session, partially recovering to $61K at the time of writing. The cryptocurrency is under pressure but remains in a technical correction after the upward momentum. Only a drop below $58K will disrupt the bullish picture, breaking the concentrated support area in the form of the 61.8% level ($60.3K), the 200-day moving average ($58.3K) and the previous low ($58.2K). In this case, be prepared for a drop to $51.0K with alarming consequences for the entire cryptocurrency market.

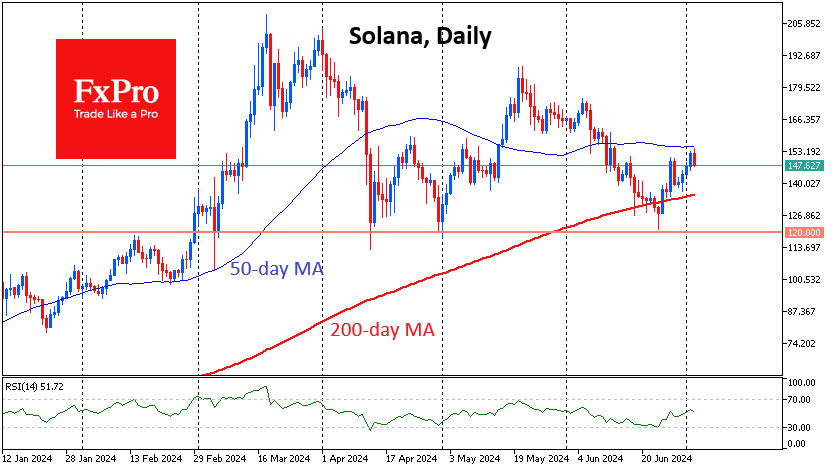

Solana has been up over the last 24 hours but is down 3% since the start of the day on Wednesday, having found technical resistance in the form of its 50-day moving average. The fundamental picture is one of a worrying sell-off in the major cryptocurrencies despite the overall positivity in equities.

News background

Bitfinex notes that long-term Bitcoin holders, who stopped taking profits in early May, have resumed selling assets. This trend could put significant short-term pressure on BTC.

Bitcoin may face selling pressure in July due to the upcoming start of payments to Mt. Gox creditors. Crypto assets worth $9.4 billion are to be distributed to around 127,000 users of the exchange, which went bankrupt in 2014.

Another negative factor is the potential selling pressure following the recent BTC transfers to exchanges by the DFI authorities. Over the past month, ~$193 million worth of coins have been transferred from the wallets of the FRG authorities to CEX.

Swiss state-owned bank PostFinance launched trading services for its customers in five cryptocurrencies: Ripple (XRP), Solana (SOL), Avalanche (AVAX), Cardano (ADA) and Polkadot (DOT), in addition to Bitcoin and Ethereum.

South Korea's largest cryptocurrency exchanges plan to review the status of more than 1,300 cryptocurrencies under updated, stricter self-regulatory standards that take effect on 19 July. Altcoins are far more popular in the country than the two flagship cryptocurrencies.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)