Daily Global Market Update

Bitcoin's Significant Drop

Bitcoin fell sharply by 2.5% against the dollar in the last session. The Stochastic indicator suggests that the market is currently overbought.

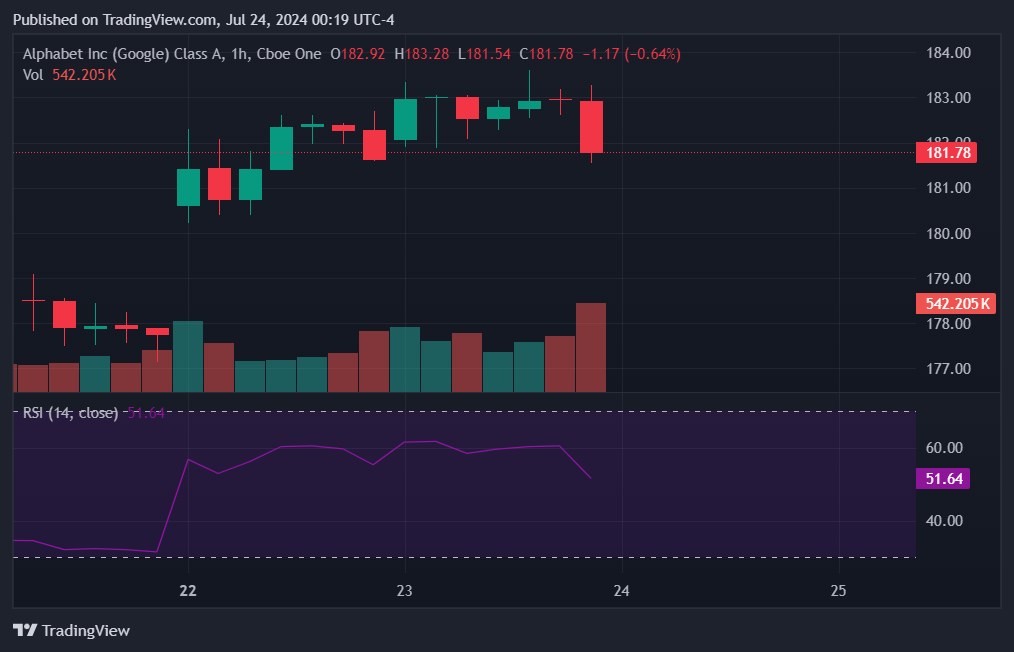

Google's Stock Minor Decline

Google's stock experienced a minor decline of 0.1% in the last session. The RSI indicates a negative signal.

AUD/USD Pair's Decline

The AUD/USD pair decreased by 0.3% in the last session. The Stochastic indicator is showing a negative signal.

Gold's Increment Against Dollar

Gold increased by 0.5% against the dollar in the last session. The RSI is giving a negative signal, indicating potential downward movement.

Global Financial Headlines

Oil prices dropped significantly by about 2% to a six-week low, influenced by ceasefire expectations in Gaza and ongoing demand concerns in China. The yen strengthened against the dollar after remarks from a senior Japanese politician suggested policy normalization. Ether ETFs have begun trading, with Bitwise recording significant early inflows.

Upcoming Economic Highlights

Here's a brief rundown of today's anticipated economic releases:

• Japan's Jibun Bank Manufacturing PMI - 0300 GMT

• US New Home Sales - 1400 GMT

• Eurozone's Eurogroup Meeting - 0700 GMT

• UK's 30-Year Bond Auction - 0930 GMT

• Finland's Producer Price Index - 0500 GMT

• Japan's Jibun Bank Services PMI - 0300 GMT