EBC Markets Briefing | Crude prices up amid optimism on EU trade deal

Oil prices climbed on Thursday, buoyed by optimism over US trade negotiations that helped ease pressure on the global growth outlook and a sharper-than-expected decline in crude inventories.

The EU and the US are moving toward a trade deal that could include a 15% baseline tariff on EU goods and possible exemptions, two European diplomats said. Trump had struck a deal with Japan earlier.

They added EU member states were set to vote on 93 billion euros of counter-tariffs on US goods on Thursday. A broad majority support using anti-coercion instruments if there is no deal.

On the supply side, EIA data showed US crude inventories fell last week by 3.2 million barrels to 419 million barrels, exceeding analysts' expectations for a 1.6 million-barrel draw, as production and imports fell.

Russia and Ukraine held peace talks in Istanbul on Wednesday, discussing further prisoner swaps, though the two sides remain far apart on ceasefire terms and a possible meeting of their leaders.

The US considers sanctioning Russian oil to end the war in Ukraine. Meanwhile, the EU on Friday agreed its 18th sanctions package against Russia, lowering the price cap for Russian crude.

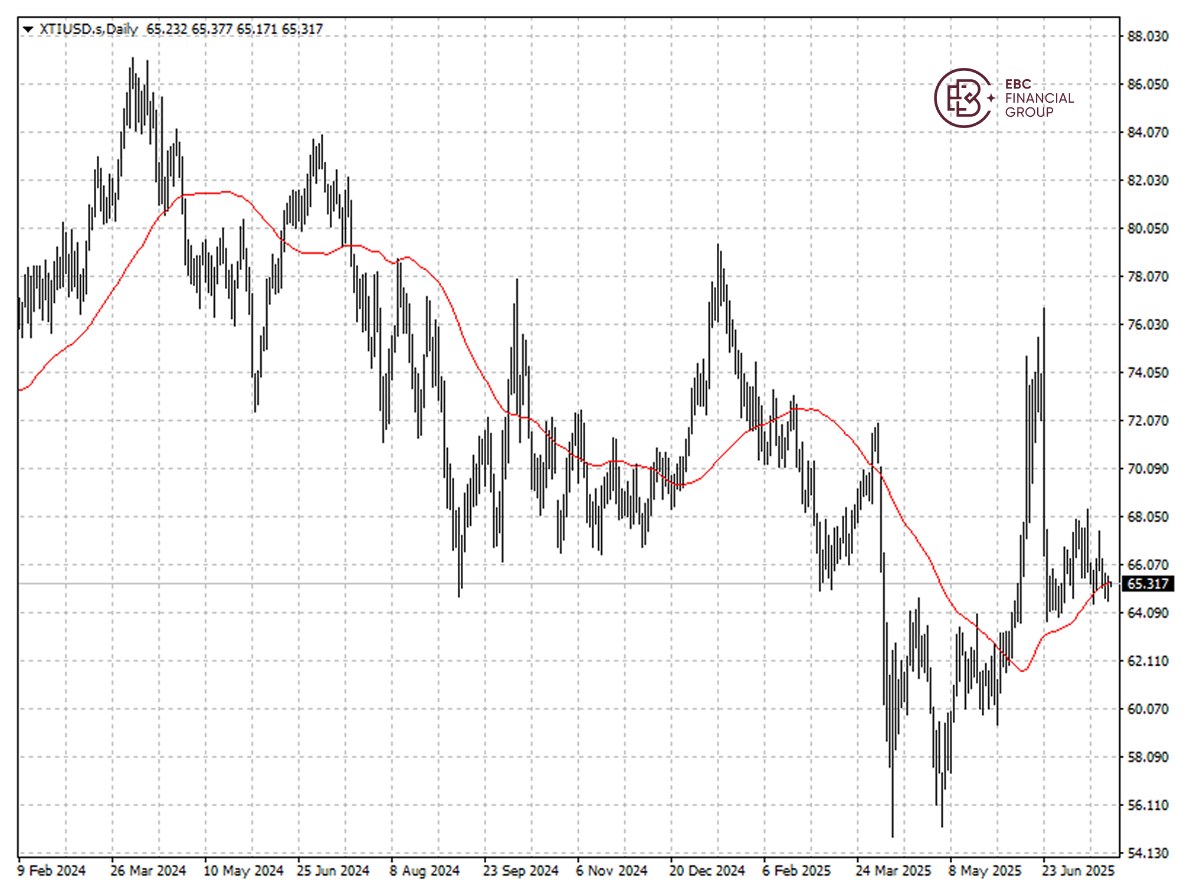

WTI crude has hovered around its 50 SMA lately with easing trade tensions largely priced in. WE expect it to go lower slightly towards $64.7 in the upcoming sessions.

EBC Financial Group Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Global Financial Collaboration or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.