EBC Markets Briefing | Euro plunges with EU gripped by fear of tariffs

The dollar hovered off a four-month high on Thursday as the market continued to digest Trump's win in the presidential election. Now focus will shift to central bank meetings that will be wrapped up by the Fed.

October NFP report came in weaker than expected, raising questions over the degree of softness in the labour market, though this data was clouded by the impact of recent hurricanes and Boeing strikes.

Other major currencies took a hit as the former president is determined to improve trade balance by protectionism. Further economic pain in Europe that could deepen euro losses and hurt its stocks.

The stakes are high for a region haunted by war in Ukraine and conflict in the Middle East. Goldman Sachs expects more limited tariffs on Europe, foreseeing a 0.5% hit to eurozone output.

Chancellor Olaf Scholz sacked Finance Minister Christian Lindner late on Wednesday, bringing an end to Germany’s ruling coalition after months of political wrangling and raising the possibility of snap elections in March.

Lindner said that Scholz had demanded a pause to Germany’s debt brake, which he could not accept. The rules limit government spending and budget deficit and hence a potential dent in growth.

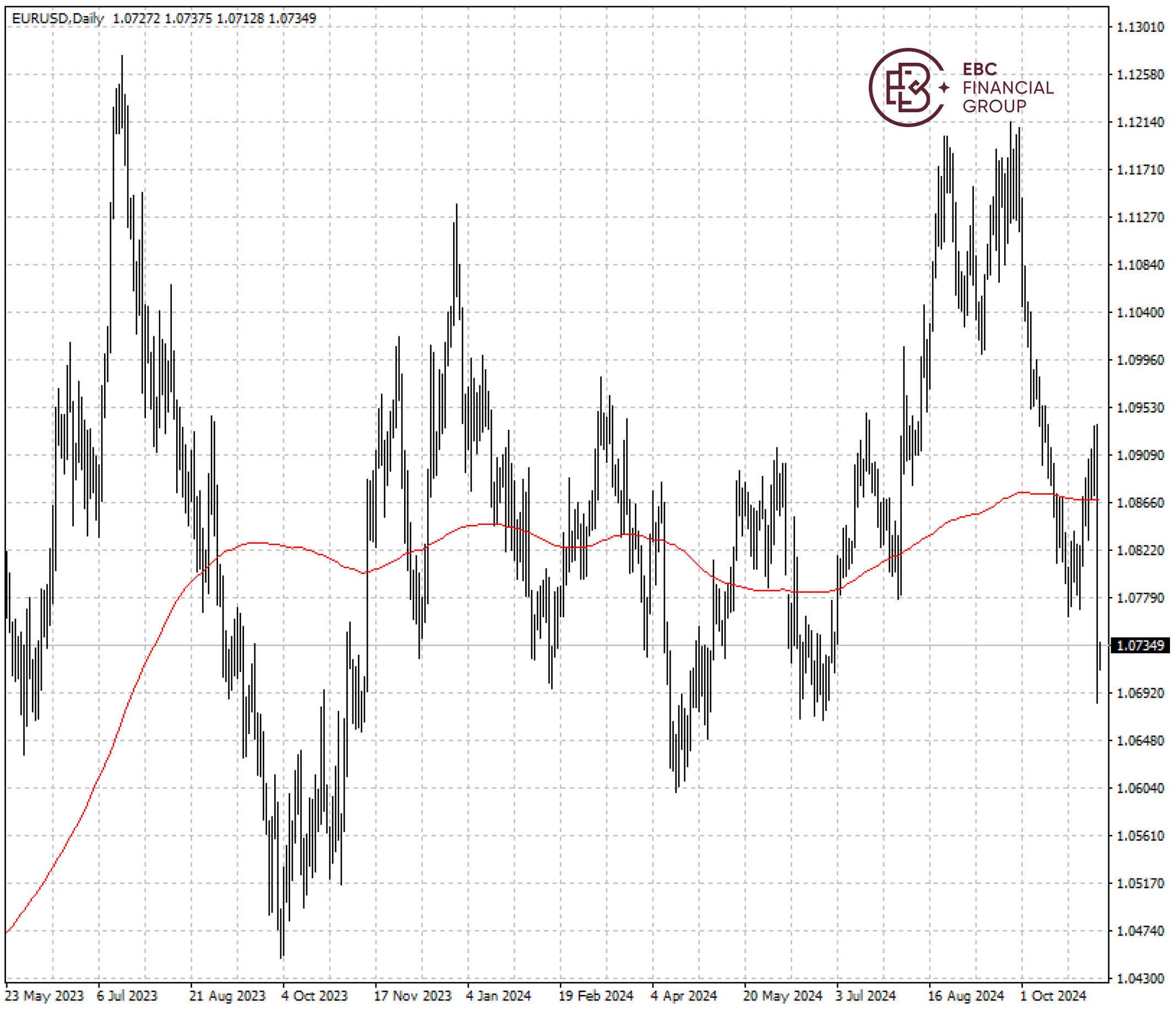

The euro plummeted below 200 SMA – a sign of trend reversal. We see more weaknesses as likely around the corner with support at 1.0670.

EBC Capital Market Consulting Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Trading Platform Security or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.