Europe slows less than expected, PMIs show

Europe slows less than expected, PMIs show

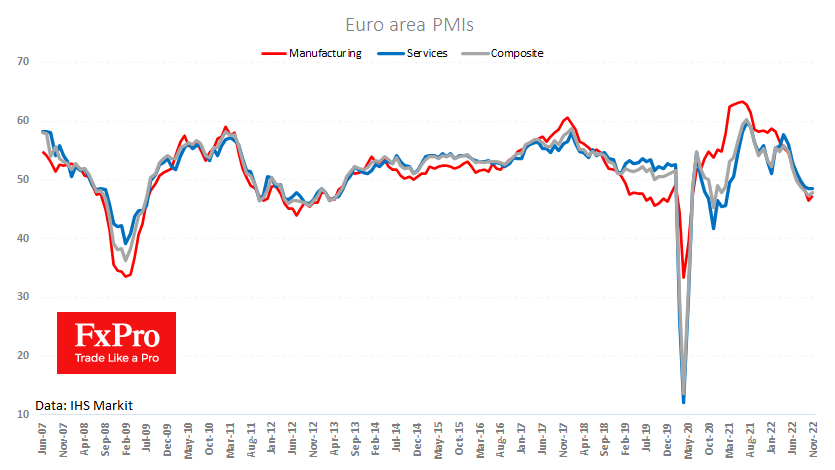

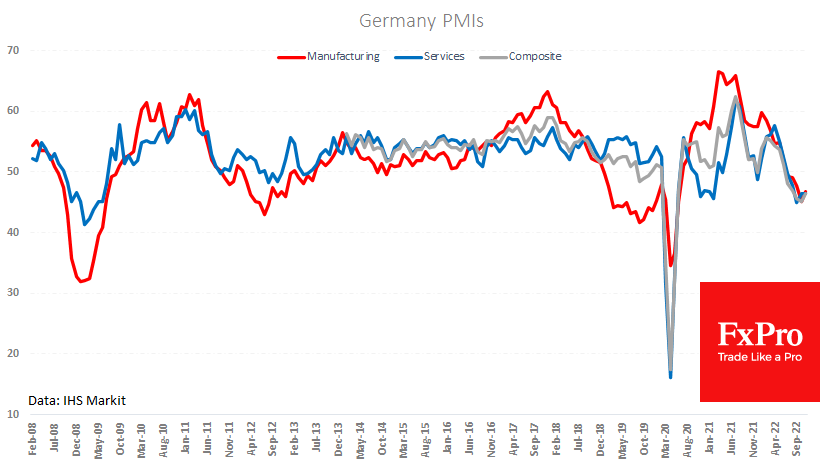

Preliminary eurozone PMI estimates are better than expected, although they point to an economic contraction. Germany's manufacturing PMI rose from 45.1 to 46.7 in November, contrary to forecasts of a decline to 44.9. Values below 50 indicate an activity decrease, while higher-than-expected figures indicate its lesser intensity.

The service sector PMI declined from 46.5 to 46.4, but above the expected 46.1. The composite PMI rose from 45.1 to 46.4 thanks to manufacturing.

Earlier, a positive reversal, albeit from low levels, was also marked by the ZEW indices. Tomorrow will be the turn of the Ifo to confirm or deny this trend.

Most likely, the Eurozone and the German economies will shrink in the current quarter and could also lose some money at the start of next year. However, so far, we only see signs of a relatively modest slowdown, and the labour market is displaying the highest employment rate in the history of the Euro-region.

The ECB is expected to raise its rate by at least 50 points in December but might take a more drastic step with relatively strong economic data, as we saw in New Zealand earlier today.

Until 2009, the eurozone economy grew strongly, even at higher rates than in the US, contributing to the euro's strength against the dollar. The economy and inflation in the Eurozone have been less rate-sensitive than expected and more so than in the USA.

The euro, however, has been relatively well worked out the difference between the ECB and Fed rates. If so, the ECB could take rates above US levels, which would gradually restore the position of the single currency lost since the start of 2021.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)