Markets in cautious mode as Fed meeting is in sight

Fed meeting in 2 days

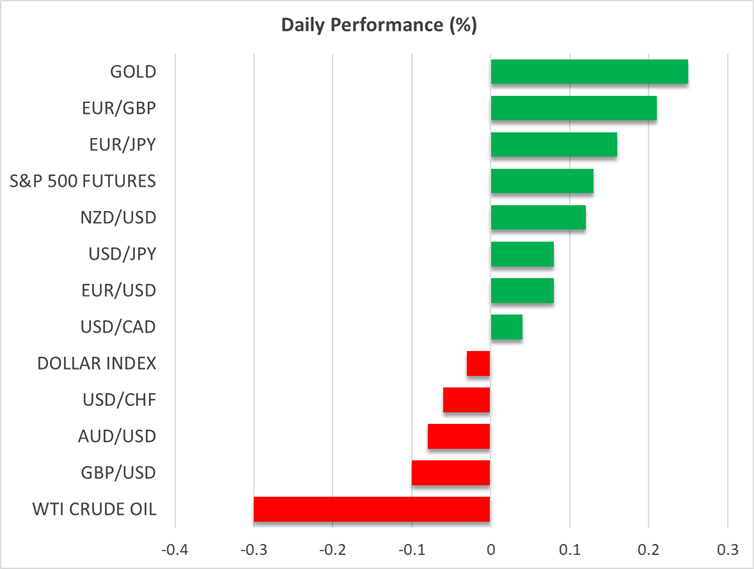

Risk markets have started the new week on a mixed note after decent gains recorded last week. The US 100 index led the rally, with both the technology and consumer discretionary sectors running ahead of the pack in the US 500 index. Interestingly, cryptos experienced strong selling pressure again on Sunday, but have since recovered, with bitcoin climbing again above $90k and Ether reclaiming the $3,100 level.

It is evident that investors are just numbing, unwilling to position aggressively ahead of Wednesday’s Fed meeting, which is expected to produce another rate cut. The countdown to one of the biggest events of 2025 is almost over, but not the pressure from the Trump administration, with NEC Director Hassett – the favorite for the Fed Chair – supporting this week's probable rate cut.

RBA meeting in focus

Until Wednesday, the RBA meeting and further US labour market data, both on Tuesday, should keep investors entertained. Chances of a rate change are almost zero, as the RBA members remain concerned about the elevated inflationary pressures and the tightness in the labour market, raising the risk of a hawkish tilt on Tuesday. Notably, the aussie continues to outperform the US dollar, climbing to a three-month high, reflecting the ongoing divergence in monetary policy between the RBA and the Fed.

Interestingly, the RBA is zoned in on China’s outlook. Overnight, the November Chinese trade balance figures showed a solid jump, confirming the improved trade sentiment after the late-October Trump-Xi meeting that, up to now, has led to a quieter trade environment.

That said, Europeans are not happy with China’s trade dominance. Following his visit to China, French President Macron pointed out that strong measures would be taken, such as tariffs on Chinese products in the coming months, an unusual reaction from Europe. However, with China having survived the Trump tariff Armageddon, European threats might prove less effective.

A US-Canada trade agreement in sight?

Staying on the topic of tariffs, there might be light at the end of the tunnel regarding US-Canada trade relations following President Trump’s comments about finding a solution to break the current deadlock. This change of sentiment was evident last week, with dollar/loonie posting its strongest daily drop since May 23, 2025. Notably, the BoC also meets this week, and positive developments in US-Canada relations could make Wednesday’s decision to stand pat much easier.

Gold and oil react to Ukraine-Russia newsflow

While commodity markets are also preparing for the Fed meeting, investors are also focusing on the developments in the Ukraine-Russia conflict. Specific sticky points, such as the frozen Russian assets and the future of the occupied eastern Ukraine regions, have been identified, making the next step in the negotiations a crucial one.

Notably, Trump’s side continues to express disappointment in Ukrainian President Zelenskyy’s stance, potentially endangering America’s future involvement in the conflict if the current US-led truce attempt fails. Oil is up 3% this month, following four months of negative performance, while gold continues to hover around $4,200.

Dollar/yen stabilizes

Finally, with verbal interventions from Japanese government officials continuing – Finance Minister Katayama was the latest to warn about taking appropriate action if necessary – dollar/yen is trading above the 154.52-154.80 area. Mixed data overnight – a weaker Q3 GDP report but firmer labour cash earnings in November – maintains the current beefed-up rate hike expectations, but is Governor Ueda really ready to make such a key decision?