Powell's speech deepens bitcoin correction

Market picture

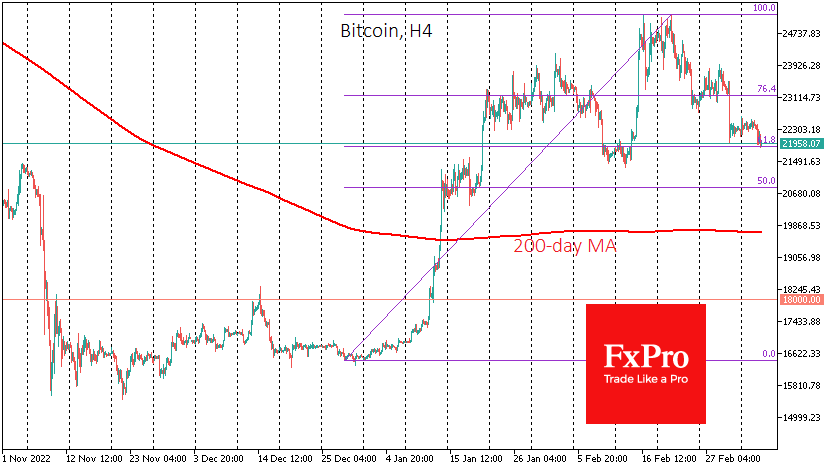

Bitcoin fell on Tuesday amid falling equity indices and a rising US dollar. BTC updated three-week lows below $22K, losing 2% in the past 24 hours. Risky assets fell sharply amid a hawkish speech from Fed chief Jerome Powell, after which markets began to price in the chances of a 50-basis point rate hike later this month.

BTCUSD re-entered the area of the February lows. However, the dynamics in the FX market were much more capitulatory than in cryptocurrencies, where intraday moves continue to mark buying on dips. Touching levels just below $22K took the price back to the 61.8% Fibonacci retracement of the December-February rally. Consolidation below $21.5K would be a strong signal to move lower.

However, more buying is likely at the end of the medium-term correction in such situations, and the bulls will only celebrate victory once the price returns above $22.5K.

News Background

According to CoinGecko, Tether's (USDT) share of the stackable coin market has surpassed 54% for the first time since November 2021, when the cryptocurrency market hit all-time highs.

El Salvador's president, Nayib Buquele, said the legalisation of bitcoin had boosted the country's tourism sector by 95%, improving the economy as a whole.

Ethereum co-founder Vitalik Buterin began selling his meme crypto assets MOPS, CULT and SHIK. The sale of tokens severely affected their value, and investors suffered losses.

WeChat, China's largest social network, integrated digital yuan into its payment platform WeChat Pay.

By the FxPro analyst team

-11122024742.png)

-11122024742.png)