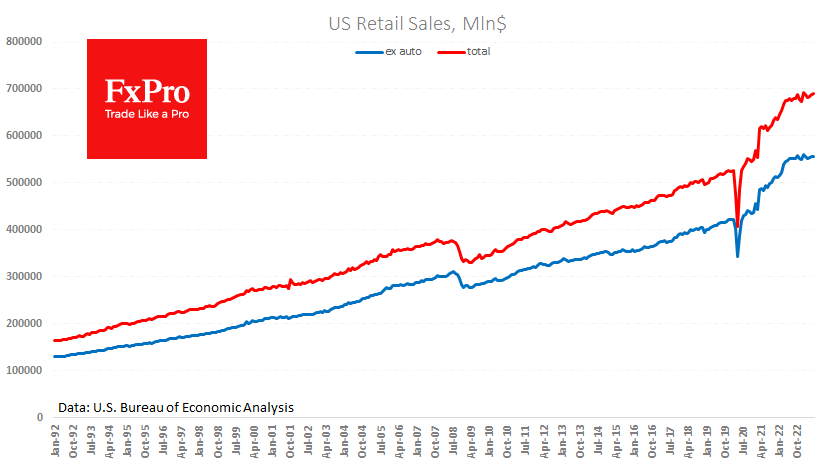

US retail sales underline stagnation in core demand

US retail sales rose 0.2% in June, weaker than the +0.5% expected. Year-to-date sales are up 1.5% versus 3% inflation over the same period, so it makes sense that consumer activity is slowing.

Sales excluding cars also rose by 0.2% (+0.4% expected). This indicator shows stagnation even without considering last June's price correction. This sales dynamic is an essential result of the Fed's tightening of monetary conditions and the depletion of the stock due to the exertion of stimulus accumulated thanks to the payments during the coronavirus.

Weak retail sales could excuse the Fed from easing monetary policy. But in recent weeks, FOMC members have bombarded the markets with forecasts of two hikes this year and an extended pause.

Simply put, for the market, this means a willingness to cool the economy despite the warning signs. And that's already a worrying sign for equity indices. It would not be surprising if the latest retail sales data caused equity markets to reassess their optimism about the strength of consumer demand.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)