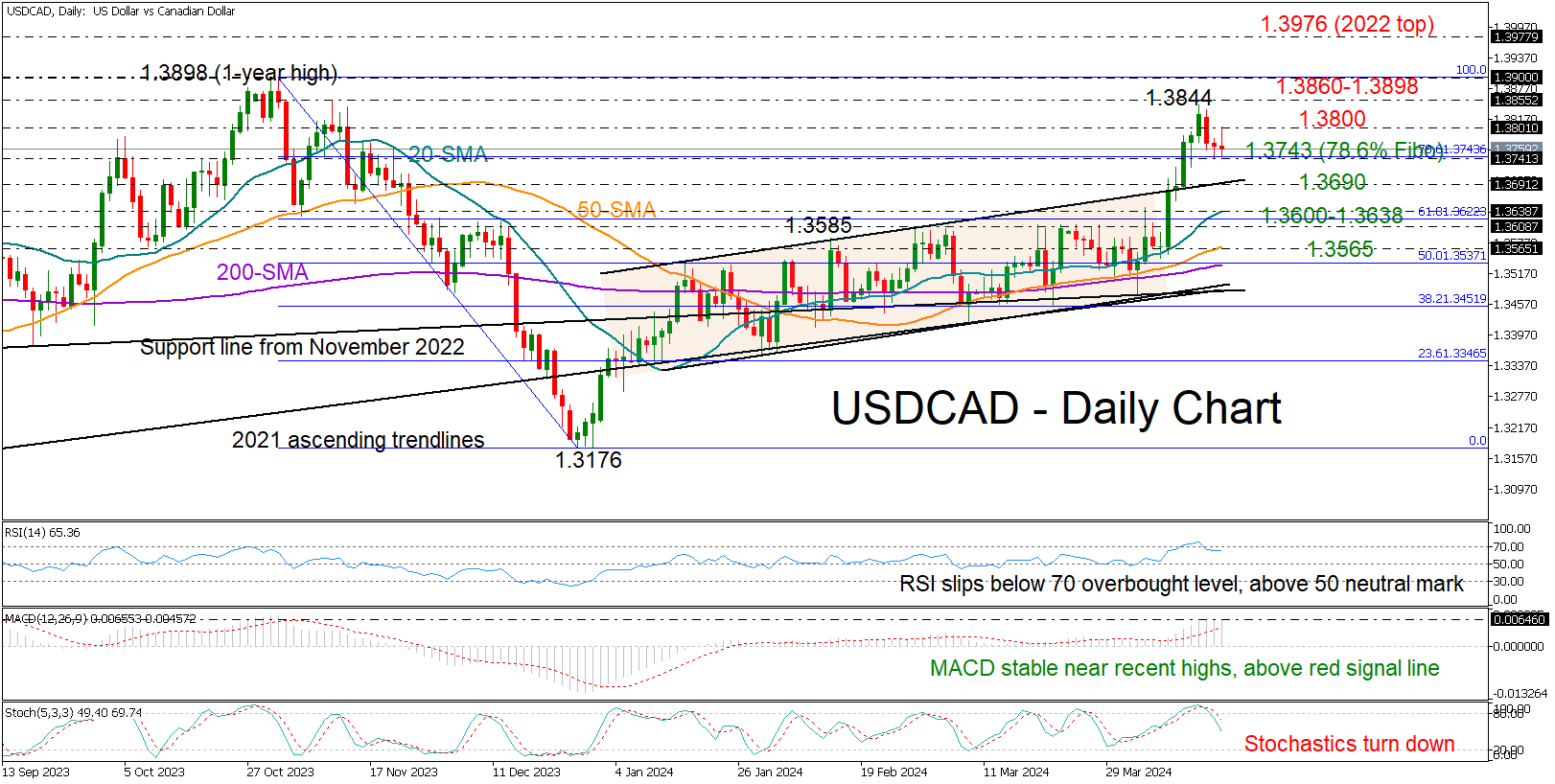

USDCAD puts rally on hold near 1.3800 caution zone

USDCAD attempted to re-enter the 1.3800 territory earlier today after its pullback from a five-month high of 1.3844 on Wednesday. But upside forces faded soon, forcing the price to pull back to Thursday’s closing price of 1.3765.

The RSI and the stochastic oscillator have exited the overbought territory, justifying the latest negative turn in the price. That said, the RSI is still comfortably elevated above its 50 neutral mark and the MACD is well above its red signal line, providing a ray of hope that the bulls could still show up.

Should the bears break below the 78.6% Fibonacci retracement of the November-December downleg at 1.3743, there is a possibility of another decline to retest the upper band of the broken bullish channel at 1.3690. An extension lower could stabilize somewhere between the 20-day simple moving average (SMA) and the 1.3600 round level. If not, the sell-off could continue towards the 50-day SMA at 1.3565.

In the positive scenario, where the pair closes back above 1.3800, it may face another tough battle within the 2023 peak area of 1.3860-1.3898. Once the border is successfully penetrated, the next target will be the 2022 top of 1.3976, while higher, the bulls might encounter resistance somewhere between the 1.4040 barrier seen in May 2020 and the psychological level of 1.4100.

To summarize, USDCAD has switched to a neutral mode and is awaiting a decisive move above 1.3800 or below 1.3690 to determine its next direction.