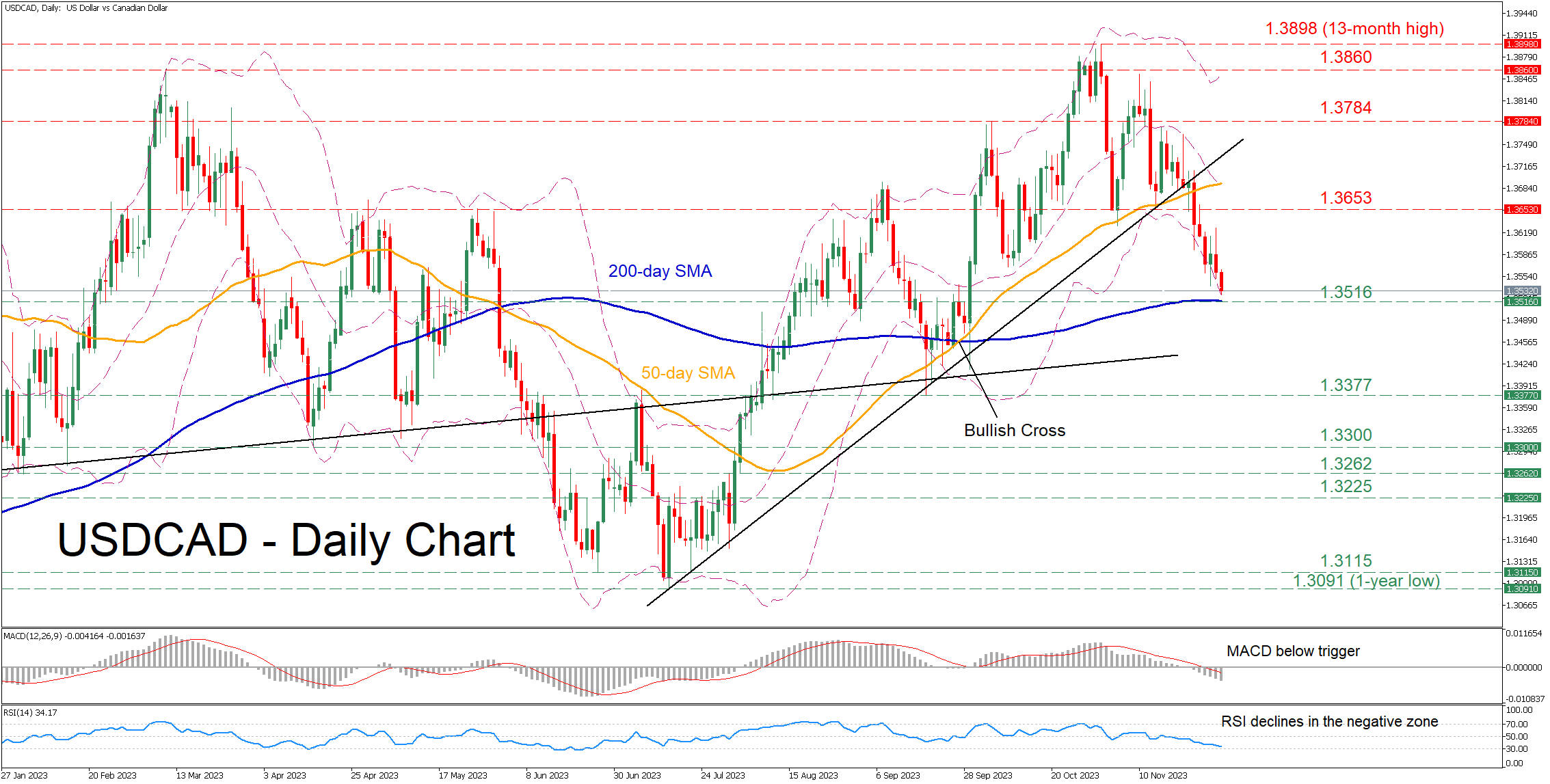

USD/CAD extends decline towards the 200-day SMA

USDCAD has been constantly losing ground following its 13-month high of 1.3898 on November 11. Moreover, the pair dropped to its lowest levels in two months on Friday, with the bears setting the stage for a test of the 200-day simple moving average (SMA).

Given that the momentum indicators are heavily tilted to the downside, the pair could soon face the 200-day SMA at around 1.3516. Should that barricade fail, there is no prominent support until the September low of 1.3377. A violation of that territory could open the door for the April bottom of 1.3300. On the flipside, if the price reverses higher, the bulls might attack the April-May resistance of 1.3653. Surpassing that zone, the pair could face the October resistance of 1.3784. Further advances may then cease at the March peak of 1.3860.

On the flipside, if the price reverses higher, the bulls might attack the April-May resistance of 1.3653. Surpassing that zone, the pair could face the October resistance of 1.3784. Further advances may then cease at the March peak of 1.3860.

In brief, USDCAD has been under increasing downside pressures lately, generating a structure of lower lows. Moving forward, a test of the 200-day SMA could decide whether the decline has been overstretched.

.jpg)