Weak German Producer Prices Send the Euro Back Down

Market picture

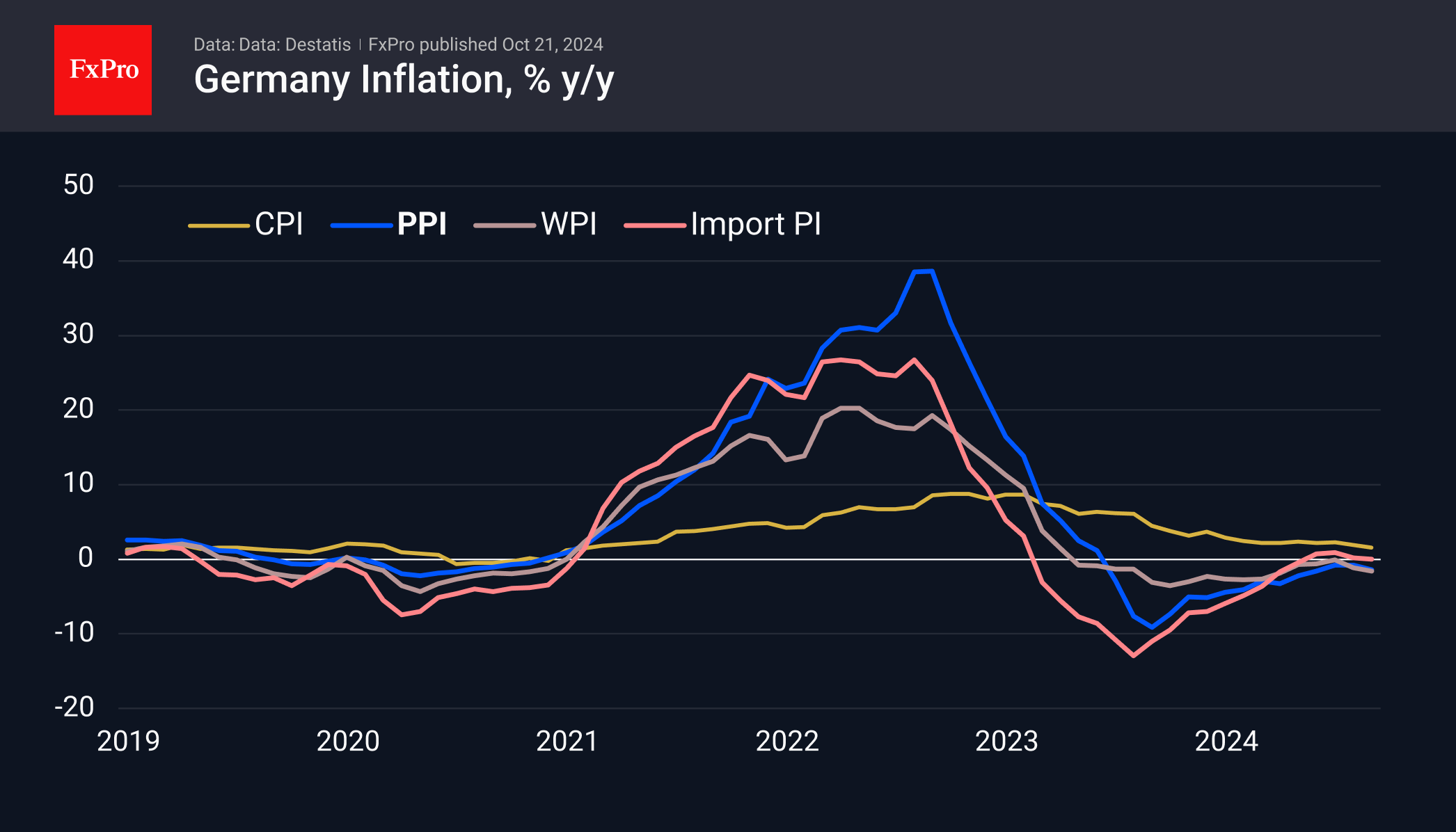

The German Producer Price Index fell more than expected, preventing the EURUSD from extending the rebound seen at the end of last week.

Producer prices in Europe’s largest economy fell 0.5% in September (-0.2% expected), accelerating the annual decline to 1.4% (-0.8% expected) from 0.8% in the previous month. The negative annual growth rate has persisted for the past 15 months, pulling the nominal index back to levels last seen in May 2022.

The weakness in German producer prices puts further active monetary easing in the eurozone back on the agenda. Last week, the ECB cut its key interest rate for the third time this cycle. Soft comments from the bank’s president, Christine Lagarde, sent EURUSD towards 1.08, but a corrective dollar pullback brought the pair back to 1.0870 by early Monday afternoon.

Technical picture

The rally at the end of last week looks like a corrective bounce after the pair had fallen 3.5% from its late September highs. This bounce lost momentum as it ran into the 200-day moving average and unwound what appeared to be overheated selling. The decline at the start of the new week suggests that bearish sentiment is clearly prevailing.

A break below the 1.0770-1.0810 support area would open a direct path to 1.0600-1.0670. If the fundamental background does not change by then, a break to the more fundamental support area—the 1.05 area—is possible.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)