Will EURUSD take its bullish chances?

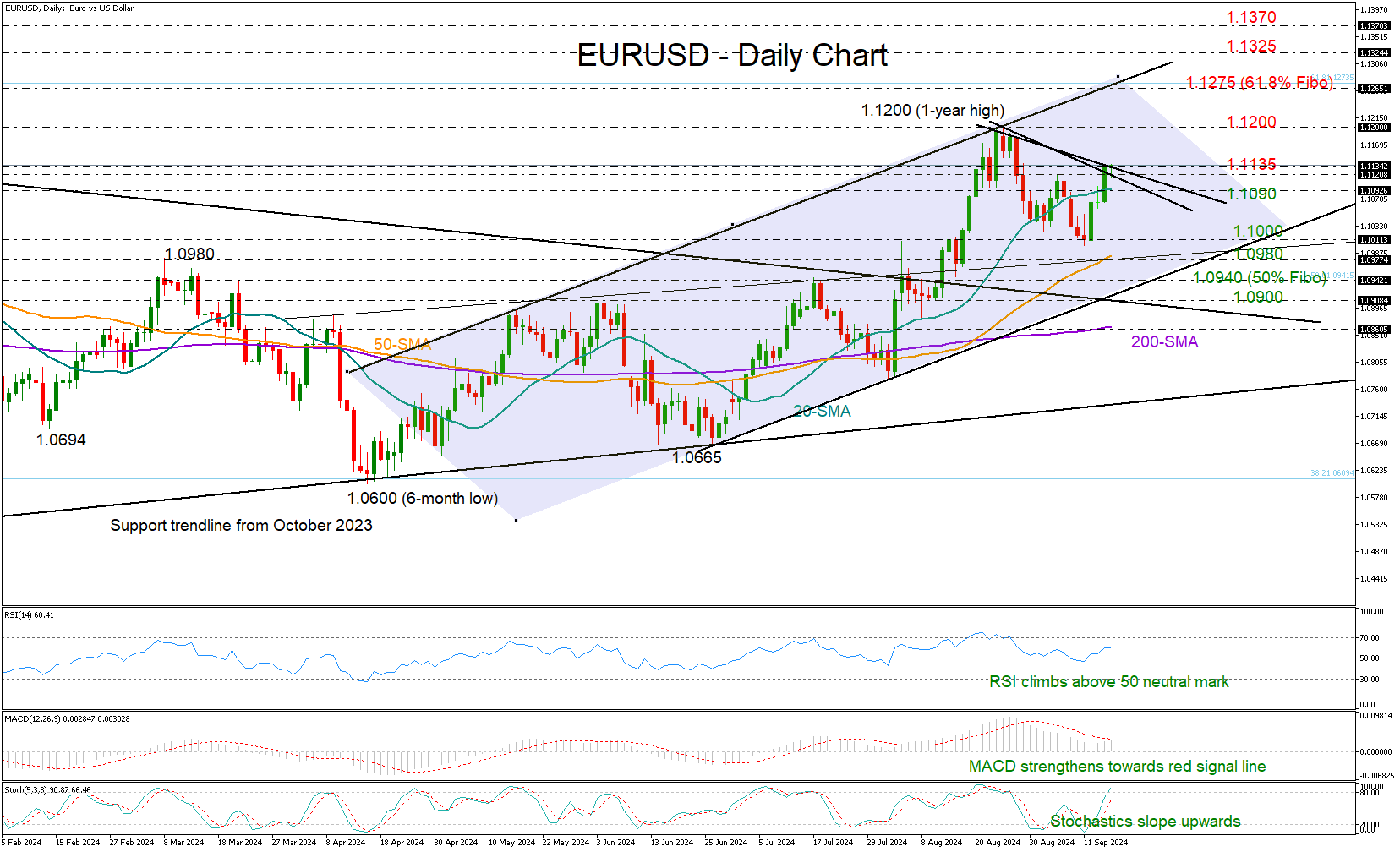

EURUSD started the week on the right foot, finishing Monday’s session comfortably higher, though around the short-term resistance trendline at 1.1135, which poses a risk.

The pair is currently lacking momentum, but the bulls are still in town according to the technical indicators. Hence, a close above 1.1135 could stage a new bull run towards the August peak of 1.1200, while a more exciting rally could target the upper band of the upward-sloping channel at 1.1275. Strikingly, the latter overlaps with the 61.8% Fibonacci retracement of the 2021-2022 downtrend, a break of which could see a continuation towards the 161.8% Fibonacci extension of the latest bearish wave at 1.1325.

In the event the price slips below its 20-day simple moving average (SMA) at 1.1090, it could once again find support near the 1.1000 round-level. The 50-day SMA could come next into view near 1.0980, while the 1.0900-1.0940 zone might attract greater attention as the channel’s lower boundary, a long -term descending trendline, and the 50% Fibonacci mark are within the neighborhood.

To summarize, although EURUSD is encountering a fresh barrier around the 1.1135 region following a swift bounce back, bullish sentiment remains intact.

.jpg)