WTI Crude is on track towards $50

WTI Crude is on track towards $50

Oil is losing over 3% on Monday due to concerns around demand in China caused by strengthening lockdowns. Also, demand for risky assets, including oil, declined due to massive protests in China against the zero-covid policy. In addition, the news that the US has granted Chevron a license to produce oil in Venezuela should not be missed either.

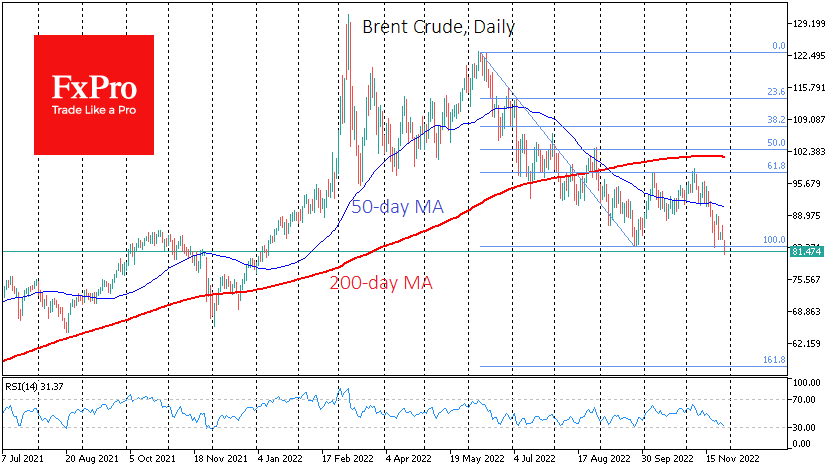

The price of WTI dipped below $74 on Monday, while Brent was temporarily trading below $81, hitting its lowest level in 11 months. Oil is very sensitive to fluctuations in global supply and demand, so even news of a potential supply and demand shift was enough to intensify the sell-off.

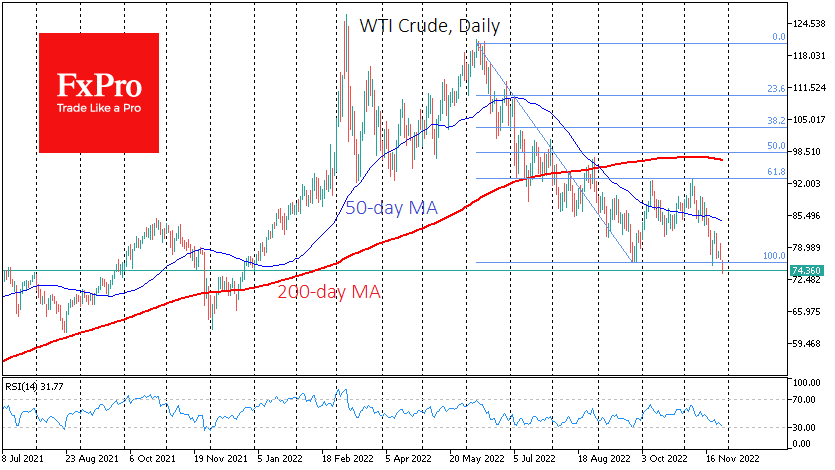

Today's move down confirmed the severity of the downward momentum of the last three weeks, as prices broke the support that stood two months ago. On the technical analysis side, the two upside impulses above $93 for WTI were nothing more than a corrective pullback as part of the downside trend from June this year.

Looking solely at the chart, the price could pull back quite quickly by another $10 to 64, where it last received support from buyers in August and December 2021. The realisation of the Fibonacci pattern suggests a drop to $49 (161.8% of the initial decline).

However, in oil, such long-term patterns are permanently disrupted by geopolitics. And now traders should also keep in mind that oil bounces in recent months have been directed by OPEC+, which first hinted at and then announced production quota cuts.

It is also worth realising that the energy situation in Europe looks better than expected only because of warmer weather. This factor remains outside the influence of the authorities, and in case of colder weather, energy prices could go up sharply, despite economic weakness.

Geopolitics and weather are the most significant risks to an overall bearish scenario in oil, which sees the price falling another $10 before year-end to $64 and $25 to $49 before the end of the second quarter next year. Translated into Brent, the scenario assumes a drop to $71 and $57, respectively.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)