Edit Your Comment

EUR/USD

Mitglied seit Apr 08, 2014

1140 Posts

May 07, 2018 at 08:38

Mitglied seit Apr 08, 2014

1140 Posts

On the last Friday’s session, the EURUSD initially fell with a wide range but found enough buying pressure near 2018 low to trim some of its losses and managed to close in the middle of the daily range, although closed within Thursday’s range, which suggests being clearly neutral, neither side is showing control.

The currency pair trading below the 10, the 50 and the 200-day moving averages that should provide dynamic resistance.

The key levels to watch: a daily resistance at 1.2287, a swing low at 1.2200 (resistance), a key level at 1.2165 (resistance), the 200-day moving average at 1.2050 (resistance), a daily resistance at 1.2041, the 10-day moving average at 1.2022 (resistance), and 2018 low at 1.1915 (support).

The currency pair trading below the 10, the 50 and the 200-day moving averages that should provide dynamic resistance.

The key levels to watch: a daily resistance at 1.2287, a swing low at 1.2200 (resistance), a key level at 1.2165 (resistance), the 200-day moving average at 1.2050 (resistance), a daily resistance at 1.2041, the 10-day moving average at 1.2022 (resistance), and 2018 low at 1.1915 (support).

"I trade to make money not to be right."

May 08, 2018 at 06:39

Mitglied seit Apr 21, 2018

45 Posts

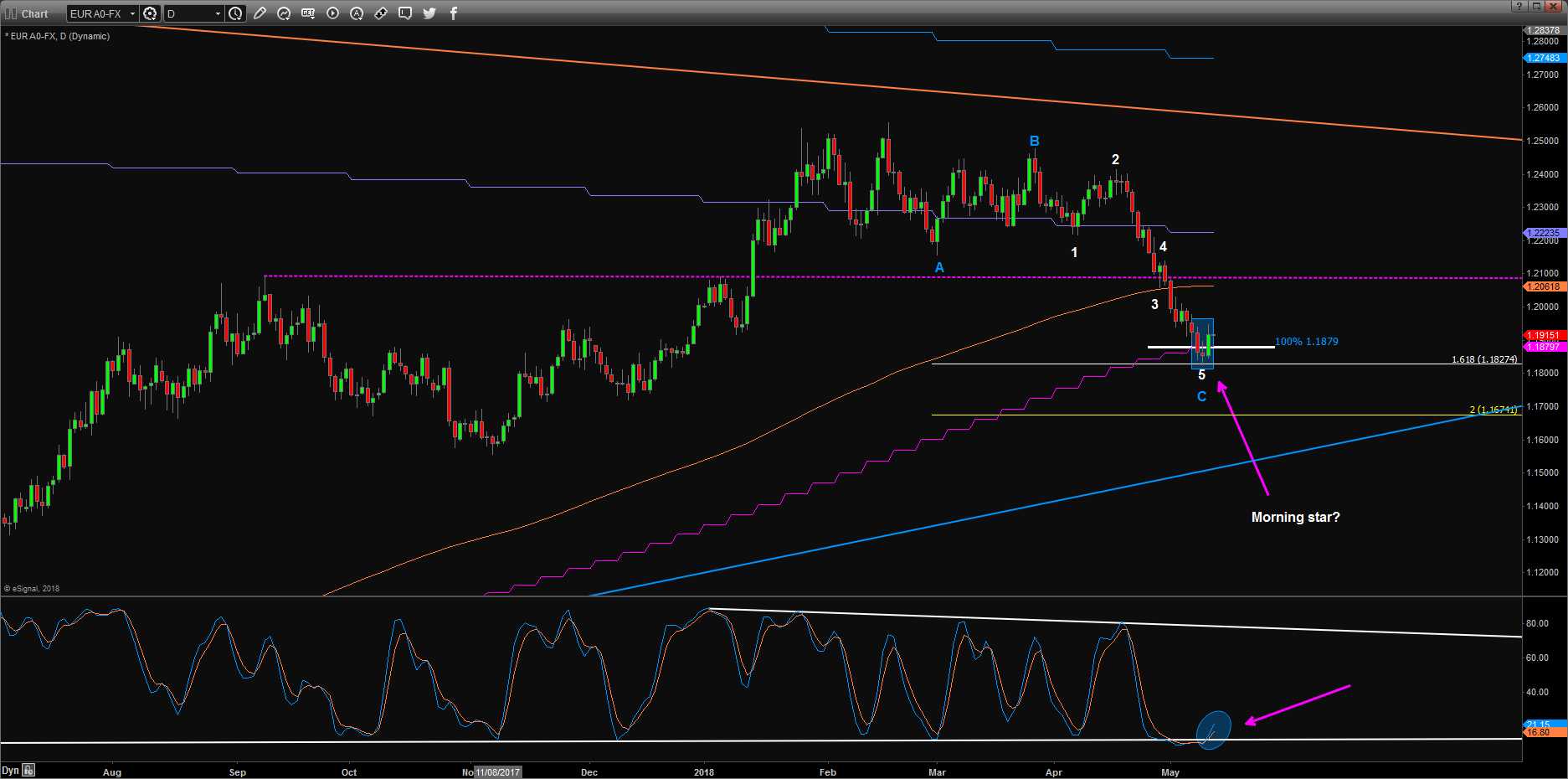

Elliott Wave Analysis: EURUSD,Sell at 1.2072

EURUSD traded below 200 day MA for the first time since May 2017.

The decline from 1.2476 is a 5 wave down pattern.

If 5=1, target should be 1.1879.

On intraday chart we see large divergence and a potential falling wedge formation.

Once upside resolved, price may consolidate for several days before next leg lower.

We'll try to re-build tactical short positions.

EURUSD Trade Idea:

Sell Limit @ 1.2072 SL @1.2169 Take Profit @ 1.1812

EURUSD traded below 200 day MA for the first time since May 2017.

The decline from 1.2476 is a 5 wave down pattern.

If 5=1, target should be 1.1879.

On intraday chart we see large divergence and a potential falling wedge formation.

Once upside resolved, price may consolidate for several days before next leg lower.

We'll try to re-build tactical short positions.

EURUSD Trade Idea:

Sell Limit @ 1.2072 SL @1.2169 Take Profit @ 1.1812

http://forexsignal.love/aggressive-trend-scalper-ea/ 5 days' trial period is available. Welcome to backtesting!

Mitglied seit Apr 08, 2014

1140 Posts

May 08, 2018 at 08:40

Mitglied seit Apr 08, 2014

1140 Posts

On yesterday session, the EURUSD tried to rise but quickly found enough selling pressure to turn south and closed near the low of the day, although managed to close within Friday’s range, which suggests being slightly on the bearish side of neutral.

The currency pair trading below the 10, the 50 and the 200-day moving averages that should provide dynamic resistance.

The key levels to watch: a key level at 1.2165 (resistance), the 200-day moving average at 1.2050 (resistance), a daily resistance at 1.2041, the 10-day moving average at 1.2000 (resistance), 2018 low at 1.1915 (support), a daily support at 1.1829.

The currency pair trading below the 10, the 50 and the 200-day moving averages that should provide dynamic resistance.

The key levels to watch: a key level at 1.2165 (resistance), the 200-day moving average at 1.2050 (resistance), a daily resistance at 1.2041, the 10-day moving average at 1.2000 (resistance), 2018 low at 1.1915 (support), a daily support at 1.1829.

"I trade to make money not to be right."

Mitglied seit Apr 08, 2014

1140 Posts

May 09, 2018 at 08:35

Mitglied seit Apr 08, 2014

1140 Posts

On yesterday session, the EURUSD fell with a wide range and closed near the low of the day, in addition closed below Mondays’ low, which suggests a strong bearish momentum.

The currency pair trading below the 10, the 50 and the 200-day moving averages that should provide dynamic resistance.

The key levels to watch: a key level at 1.2165 (resistance), the 200-day moving average at 1.2049 (resistance), a daily resistance at 1.2041, the 10-day moving average at 1.1968 (resistance), 2018 low at 1.1915 (support), a daily support at 1.1829 and other daily support at 1.1753.

The currency pair trading below the 10, the 50 and the 200-day moving averages that should provide dynamic resistance.

The key levels to watch: a key level at 1.2165 (resistance), the 200-day moving average at 1.2049 (resistance), a daily resistance at 1.2041, the 10-day moving average at 1.1968 (resistance), 2018 low at 1.1915 (support), a daily support at 1.1829 and other daily support at 1.1753.

"I trade to make money not to be right."

Mitglied seit Dec 10, 2017

210 Posts

May 09, 2018 at 18:38

Mitglied seit Dec 10, 2017

210 Posts

The euro/dollar dropped to a new low for 2018 at 1.1837 yesterday. The price is under the support line of the downward channel, which implies a further drop down. Short-term expectations remain bearish to test support 1.1750 (weekly EMA 200). Resistance for the day is 1.1895. A clear break above this level could take the price to a neutral trading area with testing 1.1935/50, but I stay in bears' camp so far and any upward pressure should be considered a good opportunity for short positions.

Mitglied seit Apr 08, 2014

1140 Posts

May 10, 2018 at 08:32

Mitglied seit Apr 08, 2014

1140 Posts

On yesterday session, the EURUSD went back and forward without any clear direction but closed in the red, in the middle of the daily range, in addition, managed to close within Tuesdays’ range, which suggests being clearly neutral, neither side is showing control.

The currency pair trading below the 10, the 50 and the 200-day moving averages that should provide dynamic resistance.

The key levels to watch: a key level at 1.2165 (resistance), the 200-day moving average at 1.2049 (resistance), a daily resistance at 1.2041, the 10-day moving average at 1.1942 (resistance), January low at 1.1915 (resistance), a daily support at 1.1829 and other daily support at 1.1753.

The currency pair trading below the 10, the 50 and the 200-day moving averages that should provide dynamic resistance.

The key levels to watch: a key level at 1.2165 (resistance), the 200-day moving average at 1.2049 (resistance), a daily resistance at 1.2041, the 10-day moving average at 1.1942 (resistance), January low at 1.1915 (resistance), a daily support at 1.1829 and other daily support at 1.1753.

"I trade to make money not to be right."

May 10, 2018 at 11:59

Mitglied seit Apr 21, 2018

45 Posts

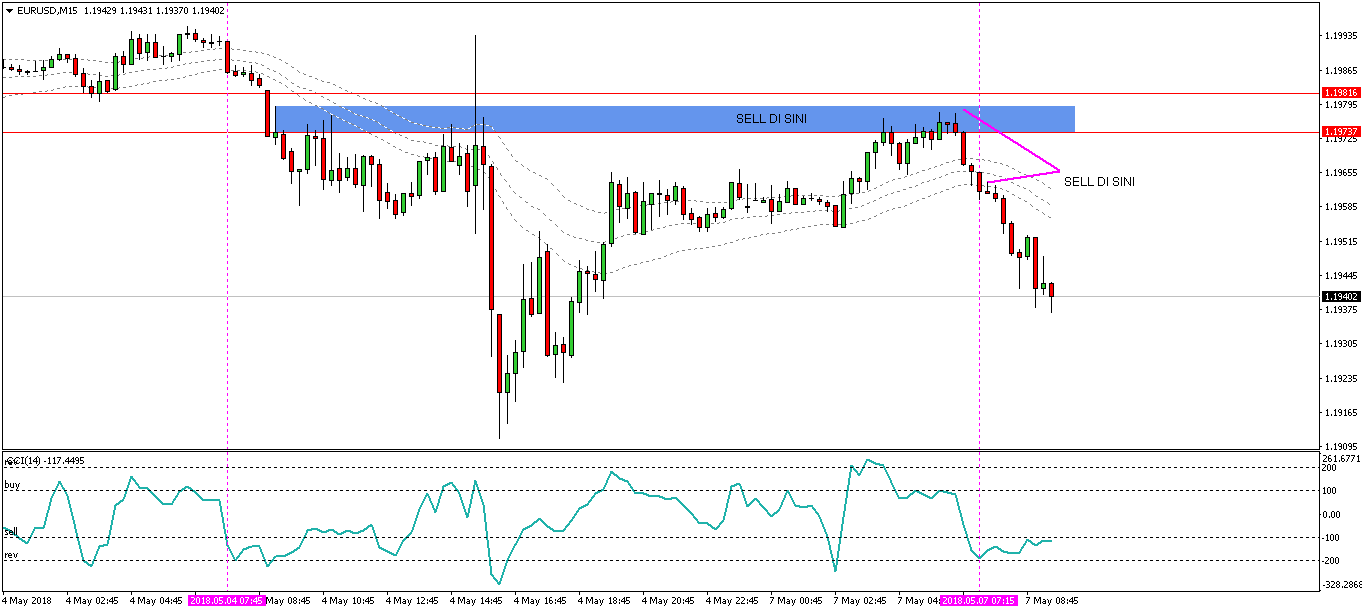

Intraday Elliottwave Analysis: EURUSD, 1.1964 is key level to watch

EURUSD was just rejected by 161.8% extension from 1.2556.

Almost the same divergence and wedge like formation as DXY.

Close above 1.1964 will be the first recovery sign.

To the downside, I still expect 1.1790 could hold the price at least for the first time.

Support Levels: 1.1843 1.1836 1.1831 1.1824 1.1805 1.1795

Resistance Levels: 1.1868 1.1878 1.1885 1.1895 1.1898 1.1903

Intraday Trade Idea:

Sell Latentinterest Order: 1.1921

Buy Latentinterest Order: 1.1806

EURUSD was just rejected by 161.8% extension from 1.2556.

Almost the same divergence and wedge like formation as DXY.

Close above 1.1964 will be the first recovery sign.

To the downside, I still expect 1.1790 could hold the price at least for the first time.

Support Levels: 1.1843 1.1836 1.1831 1.1824 1.1805 1.1795

Resistance Levels: 1.1868 1.1878 1.1885 1.1895 1.1898 1.1903

Intraday Trade Idea:

Sell Latentinterest Order: 1.1921

Buy Latentinterest Order: 1.1806

http://forexsignal.love/aggressive-trend-scalper-ea/ 5 days' trial period is available. Welcome to backtesting!

May 10, 2018 at 12:42

Mitglied seit Nov 16, 2015

708 Posts

The single currency continued to decline against the US dollar on Wednesday. The currency pair opened at 1.1864 and ended at 1.1850. The single currency in the early hours reached the support level at 1.1825, after which the price recovered positions and reached a peak of 1.1896. If the euro turns the resistance break at 1.1911, we can expect a 1.2055 test.

Mitglied seit Dec 10, 2017

210 Posts

May 10, 2018 at 14:05

Mitglied seit Dec 10, 2017

210 Posts

The euro/dollar was indecisive yesterday. The signals are neutral for now. The price is in a range of 75 pips between 1.1895 and 1.820, suggesting a consolidation phase. A clear break above 1.1895 could lead to future test bulls testing at 1.1935/50, but I stay in the bear camp at this stage and any upward pressure should be seen as a good sales opportunity. On the downside, a clear break below 1.1820 will clear the way to 1.1750.

Mitglied seit Apr 08, 2014

1140 Posts

May 11, 2018 at 08:06

Mitglied seit Apr 08, 2014

1140 Posts

On yesterday session, the EURUSD rallied with a wide range and closed near the high of the day, in addition, managed to close above Wednesday’s high, which suggests a strong bullish momentum.

The currency pair trading below the 10, the 50 and the 200-day moving averages that should provide dynamic resistance.

The key levels to watch: a key level at 1.2165 (resistance), the 200-day moving average at 1.2049 (resistance), a daily resistance at 1.2041, the 10-day moving average at 1.1931 (resistance), January low at 1.1915 (resistance), a daily support at 1.1829 and other daily support at 1.1753.

The currency pair trading below the 10, the 50 and the 200-day moving averages that should provide dynamic resistance.

The key levels to watch: a key level at 1.2165 (resistance), the 200-day moving average at 1.2049 (resistance), a daily resistance at 1.2041, the 10-day moving average at 1.1931 (resistance), January low at 1.1915 (resistance), a daily support at 1.1829 and other daily support at 1.1753.

"I trade to make money not to be right."

May 11, 2018 at 08:58

Mitglied seit Apr 21, 2018

45 Posts

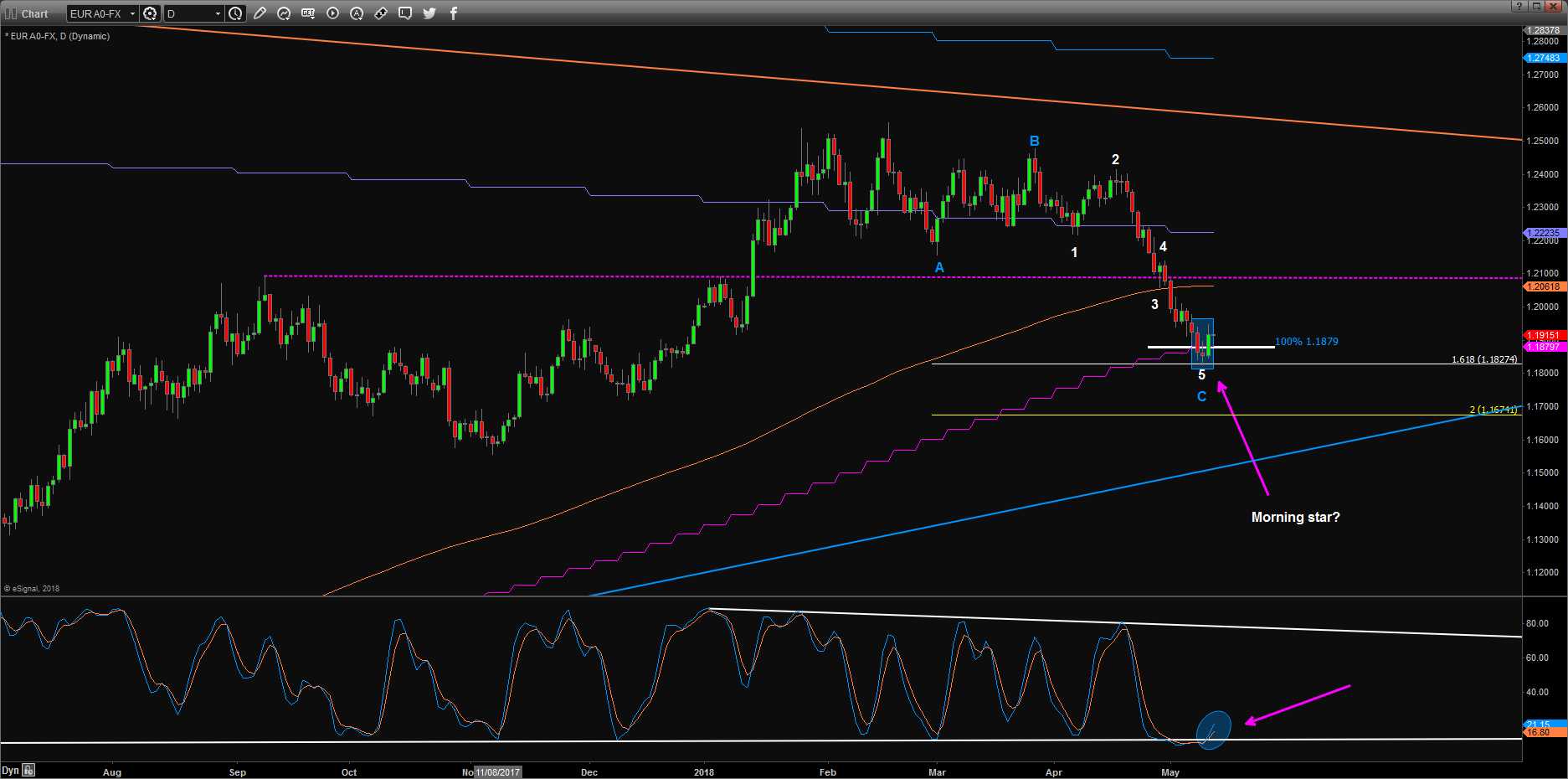

Elliott Wave Analysis: EURUSD, Long at spot

EURUSD finally break out from the falling wedge.

Daily osicillators are cross-over from their range low.

According to my system, we have a fresh daily buy signal, but still in weekly sell mode.

I suspect a near term low already in place.

Directly close below 1.1822 will negative this view.

EURUSD Trade Idea:

①Buy Limit @ 1.1897 SL @ 1.1820 Take Profit @ 1.1993/1.2072

②Buy Limit @ 1.1881 SL @ 1.1820 Take Profit @ 1.1993/1.2072

EURUSD finally break out from the falling wedge.

Daily osicillators are cross-over from their range low.

According to my system, we have a fresh daily buy signal, but still in weekly sell mode.

I suspect a near term low already in place.

Directly close below 1.1822 will negative this view.

EURUSD Trade Idea:

①Buy Limit @ 1.1897 SL @ 1.1820 Take Profit @ 1.1993/1.2072

②Buy Limit @ 1.1881 SL @ 1.1820 Take Profit @ 1.1993/1.2072

http://forexsignal.love/aggressive-trend-scalper-ea/ 5 days' trial period is available. Welcome to backtesting!

Mitglied seit Oct 02, 2014

905 Posts

May 14, 2018 at 06:45

Mitglied seit Apr 21, 2018

45 Posts

Intraday Elliottwave Analysis: EURUSD, expect 1.1863--1.2004 weekly range

EURUSD closed above the large falling wedge.

Price was just satisfied 161.8% extension from 1.2555.

Above 1.1827, Near term some consolidation is likely.

To the downside, 1.1790 is key level to watch.

I expect the price consolidate in 1.1863--1.2004 range this week.

Daily support Levels: 1.1928 1.1916 1.1896 1.1885 1.1872

Daily resistance Levels: 1.1965 1.1988 1.2010 1.2023

Intraday Trade Idea:

Sell Latentinterest Order: 1.1993

Buy Latentinterest Order: 1.1895

EURUSD closed above the large falling wedge.

Price was just satisfied 161.8% extension from 1.2555.

Above 1.1827, Near term some consolidation is likely.

To the downside, 1.1790 is key level to watch.

I expect the price consolidate in 1.1863--1.2004 range this week.

Daily support Levels: 1.1928 1.1916 1.1896 1.1885 1.1872

Daily resistance Levels: 1.1965 1.1988 1.2010 1.2023

Intraday Trade Idea:

Sell Latentinterest Order: 1.1993

Buy Latentinterest Order: 1.1895

http://forexsignal.love/aggressive-trend-scalper-ea/ 5 days' trial period is available. Welcome to backtesting!

Mitglied seit Apr 08, 2014

1140 Posts

May 14, 2018 at 07:35

Mitglied seit Apr 08, 2014

1140 Posts

On the last Friday’s session, the EURUSD went back and forward without any clear direction but and managed to close in the green, in the middle of the daily range, in addition, closed within Thursday’s range, which suggests being clearly neutral, neither side is showing control.

The currency pair managed to close above the 10-day moving average that should provide dynamic support, however, is still trading below the 50 and the 200-day moving averages that should provide dynamic resistance.

The key levels to watch: a key level at 1.2165 (resistance), the 200-day moving average at 1.2049 (resistance), a daily resistance at 1.2041, the 10-day moving average at 1.1931 (support), January low at 1.1915 (support), a daily support at 1.1829 and other daily support at 1.1753.

The currency pair managed to close above the 10-day moving average that should provide dynamic support, however, is still trading below the 50 and the 200-day moving averages that should provide dynamic resistance.

The key levels to watch: a key level at 1.2165 (resistance), the 200-day moving average at 1.2049 (resistance), a daily resistance at 1.2041, the 10-day moving average at 1.1931 (support), January low at 1.1915 (support), a daily support at 1.1829 and other daily support at 1.1753.

"I trade to make money not to be right."

May 15, 2018 at 06:41

Mitglied seit Apr 21, 2018

45 Posts

Intraday Elliottwave Analysis: EURUSD, 1st target met

EURUSD reached profit target of 1.1993 yesterday.

There's various possible wave count results from here.

Enough patience is needed for now.

Daily support Levels: 1.1917 1.1910 1.1904 1.1897 1.1875 1.1869

Daily resistance Levels: 1.1948 1.1957 1.1970 1.1981 1.1993 1.2023

Intraday Trade Idea:

Sell Latentinterest Order: 1.1981

Buy Latentinterest Order: 1.1877

EURUSD reached profit target of 1.1993 yesterday.

There's various possible wave count results from here.

Enough patience is needed for now.

Daily support Levels: 1.1917 1.1910 1.1904 1.1897 1.1875 1.1869

Daily resistance Levels: 1.1948 1.1957 1.1970 1.1981 1.1993 1.2023

Intraday Trade Idea:

Sell Latentinterest Order: 1.1981

Buy Latentinterest Order: 1.1877

http://forexsignal.love/aggressive-trend-scalper-ea/ 5 days' trial period is available. Welcome to backtesting!

Mitglied seit Apr 08, 2014

1140 Posts

May 15, 2018 at 08:35

Mitglied seit Apr 08, 2014

1140 Posts

On yesterday session, the EURUSD tried to rise but quickly found enough selling pressure to turn south and closed near the low of the day, although managed to close within Friday’s range, which suggests being slightly on the bearish side of neutral.

The currency pair is trading above the 10-day moving average that should provide dynamic support, however, is still trading below the 50 and the 200-day moving averages that should provide dynamic resistance.

The key levels to watch: a key level at 1.2165 (resistance), the 200-day moving average at 1.2049 (resistance), a daily resistance at 1.2041, the 10-day moving average at 1.1920 (support), January low at 1.1915 (support), a daily support at 1.1829 and other daily support at 1.1753.

The currency pair is trading above the 10-day moving average that should provide dynamic support, however, is still trading below the 50 and the 200-day moving averages that should provide dynamic resistance.

The key levels to watch: a key level at 1.2165 (resistance), the 200-day moving average at 1.2049 (resistance), a daily resistance at 1.2041, the 10-day moving average at 1.1920 (support), January low at 1.1915 (support), a daily support at 1.1829 and other daily support at 1.1753.

"I trade to make money not to be right."

*Kommerzielle Nutzung und Spam werden nicht toleriert und können zur Kündigung des Kontos führen.

Tipp: Wenn Sie ein Bild/eine Youtube-Url posten, wird diese automatisch in Ihren Beitrag eingebettet!

Tipp: Tippen Sie das @-Zeichen ein, um einen an dieser Diskussion teilnehmenden Benutzernamen automatisch zu vervollständigen.