Edit Your Comment

EUR/USD

Aug 05, 2015 at 06:06

Mitglied seit May 01, 2015

675 Posts

The euro recorded a sharp decline against the dollar on Tuesday. The negative trend of the previous session was extended and as a result, the pair broke the support at 1.0891, finishing below these levels. So the euro gave indications for the continuation of the bearish trend until the second key level at 1.0807. Tuesday session started at a price of 1.0949 and the finished at 1.0880. Bottom of the day was hit just two pips below.

Mitglied seit Jun 08, 2014

454 Posts

Aug 05, 2015 at 11:00

Mitglied seit Jun 08, 2014

454 Posts

EUR/USD fell below Fibo level 38.2% .the next support level is 1.0815. other option a rebound above 1.0880 will lead to a further incline to the next resistance level 1.0980. for now it is too risky for a position as the price is near the turn around point 1.0888.

Mitglied seit Nov 19, 2014

157 Posts

Aug 05, 2015 at 11:50

Mitglied seit Nov 19, 2014

157 Posts

Hey guys,

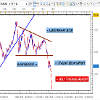

Based on my analysis, this pair could head higher by a few hundred Pips if we get a break above the Downtrend Line on the Daily Chart. This would mean the formation of the Pennant Consolidation Setup.

/AUG_1_2015_EURO_USD_PENNANT.png" target="_blank" rel="noopener noreferrer nofollow"> /AUG_1_2015_EURO_USD_PENNANT.png"/>

/AUG_1_2015_EURO_USD_PENNANT.png"/>

This Rally could come either with an ABC or 123 Setup or a pair of Double Bottoms. If neither scenario plays out, then we could simply see the pair break lower to continue the overall breakout from the Large Consolidation in favour of the USD.

Duane

DRFXTRADING

Based on my analysis, this pair could head higher by a few hundred Pips if we get a break above the Downtrend Line on the Daily Chart. This would mean the formation of the Pennant Consolidation Setup.

/AUG_1_2015_EURO_USD_PENNANT.png" target="_blank" rel="noopener noreferrer nofollow">

This Rally could come either with an ABC or 123 Setup or a pair of Double Bottoms. If neither scenario plays out, then we could simply see the pair break lower to continue the overall breakout from the Large Consolidation in favour of the USD.

Duane

DRFXTRADING

Trade Less, Earn More

Mitglied seit Jul 10, 2014

1114 Posts

Aug 05, 2015 at 19:52

Mitglied seit Jul 10, 2014

1114 Posts

EUR/USD formed a doji candlestick right under the resistance at 1.1000 visible on the weekly filter chart and moved to the downside again. The pair will likely test the support at 1.0790 again soon.

Aug 06, 2015 at 06:04

Mitglied seit May 01, 2015

675 Posts

The euro recorded a minor increase against the dollar on Wednesday. The session was dynamic as the single currency failed to offset losses from the previous two days. If bullish sentiment strengthen its influence it is very likely soon to be made a test of resistance at 1.1004. Trading on Wednesday was open at a price of 1.0880 as early trend was negative. Around noon direction changed and currencies peaked for the day at 1.0923. The day ended with 18 pips below.

Aug 06, 2015 at 06:40

Mitglied seit Aug 04, 2015

124 Posts

Abdul2012 posted:

The EUR/USD price rose from the 1.0850 resistance level today. and i think it is risky to open a position case the bearish is not clear yet.

I think below 1.08900 this will fall hard...

To achieve 3-5% portfolio growth a month

Mitglied seit Jul 10, 2014

1114 Posts

Aug 06, 2015 at 18:28

(bearbeitet Aug 06, 2015 at 18:29)

Mitglied seit Jul 10, 2014

1114 Posts

AliKhan1 posted:Abdul2012 posted:

The EUR/USD price rose from the 1.0850 resistance level today. and i think it is risky to open a position case the bearish is not clear yet.

I think below 1.08900 this will fall hard...

We won't know until the NFP tomorrow.

Mitglied seit Jun 08, 2014

454 Posts

Aug 07, 2015 at 14:48

Mitglied seit May 01, 2015

675 Posts

EUR/USD recorded a weak growth record on Thursday. The positive session on Wednesday was extended, but the pair still remains below the resistance at 1.1004. It is expected that this level soon to be overcome, having in mind that short-term indicators are in favor of the single currency. The dynamic trade on Thursday launched at a price of 1.0905, as the peak of the day was recorded early in the morning at level 1.0942. The day ended at 19 pips higher.

Mitglied seit Jul 10, 2014

1114 Posts

Aug 07, 2015 at 17:34

Mitglied seit Jul 10, 2014

1114 Posts

Unfortunately not even the US Non-farm payrolls could end the EUR/USD consolidation. There was a lot of volatility but ultimately range continues. Right now the pair is testing the resistance at 1.0970, but today is Friday, so even if it breaks above it I doubt it'll reach the next resistance around 1.1070 before next week.

*Kommerzielle Nutzung und Spam werden nicht toleriert und können zur Kündigung des Kontos führen.

Tipp: Wenn Sie ein Bild/eine Youtube-Url posten, wird diese automatisch in Ihren Beitrag eingebettet!

Tipp: Tippen Sie das @-Zeichen ein, um einen an dieser Diskussion teilnehmenden Benutzernamen automatisch zu vervollständigen.