Advertisement

Edit Your Comment

Newbie Question : USD/JPY Pair more volatile?

Jan 20, 2017 at 08:18

Mitglied seit Jan 14, 2017

3 Posts

Hello,

I am new to forex and I am trying to understand things well before I trade with lvie accounts. I understand how profits/losses are calculated but I don't seem to get why profit/losses with USD/JPY pair differ from other pairs such as EUR/USD.

For example, when testing strategies in Demo Account. A buy of 2500 Size (.25 lots) gives me a a higher profit/loss ~between $50-$500 for USD/JPY pair. But, when I test the strategy against EUR/USD with same position size -2500, I get a lower profit loss range ($5-$50). Two Questions:

Q1.If profit/loss depends on pips then why so much difference in $ amount ? Is it that USD/JPY pair is much more volatile and there is a greater opportunity for profits or risk for loss?

Q2. Does entering a Position(long) of 2500 USD/JPY mean I need to have greater than $2500 in my account? Conversely, does entering a Short position with a size 2500 means selling $2500 USD to buy JPY? The math would say-

To put it in mathematical terms , here is how I am calculating profit when buying

Buying- 0.25 lots @114.50

Enter Long Calculation : 2500 X 114.50 = 286250 YEN

Selling -.25 Lots @114.70

Exit Long Calculation : 2500 X 114.70 = 286750 YEN

Difference =500 YEN . Applying current conversion rate results in 500/114.70 = $1 Profit @ 20 Pips

In the demo account however, I get a much higher profit amount ~$1000. What am I not getting???

Thank you for your help!!

I am new to forex and I am trying to understand things well before I trade with lvie accounts. I understand how profits/losses are calculated but I don't seem to get why profit/losses with USD/JPY pair differ from other pairs such as EUR/USD.

For example, when testing strategies in Demo Account. A buy of 2500 Size (.25 lots) gives me a a higher profit/loss ~between $50-$500 for USD/JPY pair. But, when I test the strategy against EUR/USD with same position size -2500, I get a lower profit loss range ($5-$50). Two Questions:

Q1.If profit/loss depends on pips then why so much difference in $ amount ? Is it that USD/JPY pair is much more volatile and there is a greater opportunity for profits or risk for loss?

Q2. Does entering a Position(long) of 2500 USD/JPY mean I need to have greater than $2500 in my account? Conversely, does entering a Short position with a size 2500 means selling $2500 USD to buy JPY? The math would say-

To put it in mathematical terms , here is how I am calculating profit when buying

Buying- 0.25 lots @114.50

Enter Long Calculation : 2500 X 114.50 = 286250 YEN

Selling -.25 Lots @114.70

Exit Long Calculation : 2500 X 114.70 = 286750 YEN

Difference =500 YEN . Applying current conversion rate results in 500/114.70 = $1 Profit @ 20 Pips

In the demo account however, I get a much higher profit amount ~$1000. What am I not getting???

Thank you for your help!!

Jan 20, 2017 at 13:44

Mitglied seit Dec 17, 2015

28 Posts

Robsingh posted:

Q2. Does entering a Position(long) of 2500 USD/JPY mean I need to have greater than $2500 in my account?

Not necessary, it depends on the required margin / leverage you are using for your account as well as the margin call and stop out levels set by your broker. If you trade at 1:100, to open a position of 2500 USD you need to have more than 25 USD in your account, for example. 2500 is actually .025 lots.

Jan 20, 2017 at 13:48

Mitglied seit Dec 17, 2015

28 Posts

Robsingh posted:

For example, when testing strategies in Demo Account. A buy of 2500 Size (.25 lots) gives me a a higher profit/loss ~between $50-$500 for USD/JPY pair. But, when I test the strategy against EUR/USD with same position size -2500, I get a lower profit loss range ($5-$50).

These are 2 separate instruments, 2 separate markets, so the same position (long/short) will certainly result in different outcome, so I am not sure what is not clear in this case. Maybe I couldn't get you point correctly.

Jan 22, 2017 at 07:49

Mitglied seit Jan 14, 2017

3 Posts

janettte posted:Robsingh posted:

For example, when testing strategies in Demo Account. A buy of 2500 Size (.25 lots) gives me a a higher profit/loss ~between $50-$500 for USD/JPY pair. But, when I test the strategy against EUR/USD with same position size -2500, I get a lower profit loss range ($5-$50).

These are 2 separate instruments, 2 separate markets, so the same position (long/short) will certainly result in different outcome, so I am not sure what is not clear in this case. Maybe I couldn't get you point correctly.

Thank you for the reply.

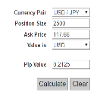

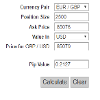

I understand that the results will be different. What I don't understand is - when look at Pip value for JPY and another pair , the value is approx the same (image attached)

But JPY has a greater profit/loss potential/risk for the same lot size (backtest image attached)

May 08, 2017 at 11:05

Mitglied seit Apr 18, 2017

659 Posts

You can use GBP/JPY, this is the most volatile trading pair in Forex! By the way, USD/JPY is my favorite trading pair! For the reason that, I get more than 90% accuracy on USD/JPY from my personal trading tool! Actually, in my live trading I am always interested on major Forex pairs, these all are reliable to use!

May 08, 2017 at 14:57

Mitglied seit Nov 21, 2015

5 Posts

Robsingh posted:

For example, when testing strategies in Demo Account. A buy of 2500 Size (.25 lots) gives me a a higher profit/loss ~between $50-$500 for USD/JPY pair. But, when I test the strategy against EUR/USD with same position size -2500, I get a lower profit loss range ($5-$50).

The ting that one particular strategy "works well" in one pair DOESN'T mean that it will also work on another one...the reasons depends on the strategies you are using everytime ;)

May 09, 2017 at 11:26

Mitglied seit Feb 12, 2016

507 Posts

Robsingh posted:

Hello,

I am new to forex and I am trying to understand things well before I trade with lvie accounts. I understand how profits/losses are calculated but I don't seem to get why profit/losses with USD/JPY pair differ from other pairs such as EUR/USD.

The reason for this is because when you trade (for example 1.0 standard MT4 lot):

* USD/JPY - You are buying or selling 100,000 USD vs JPY (PnL result is in JPY); Point here is the 3rd digit

* EUR/USD - You are buying or selling 100,000 EUR vs USD (PnL result is in USD); Point here is 5th digit

You have different currencies and different exchange rates with different place of decimal point and you will have also different pip value.

Jun 13, 2017 at 12:46

Mitglied seit Apr 18, 2017

659 Posts

Robsingh posted:

Hello,

I am new to forex and I am trying to understand things well before I trade with lvie accounts. I understand how profits/losses are calculated but I don't seem to get why profit/losses with USD/JPY pair differ from other pairs such as EUR/USD.

For example, when testing strategies in Demo Account. A buy of 2500 Size (.25 lots) gives me a a higher profit/loss ~between $50-$500 for USD/JPY pair. But, when I test the strategy against EUR/USD with same position size -2500, I get a lower profit loss range ($5-$50). Two Questions:

Q1.If profit/loss depends on pips then why so much difference in $ amount ? Is it that USD/JPY pair is much more volatile and there is a greater opportunity for profits or risk for loss?

Q2. Does entering a Position(long) of 2500 USD/JPY mean I need to have greater than $2500 in my account? Conversely, does entering a Short position with a size 2500 means selling $2500 USD to buy JPY? The math would say-

To put it in mathematical terms , here is how I am calculating profit when buying

Buying- 0.25 lots @114.50

Enter Long Calculation : 2500 X 114.50 = 286250 YEN

Selling -.25 Lots @114.70

Exit Long Calculation : 2500 X 114.70 = 286750 YEN

Difference =500 YEN . Applying current conversion rate results in 500/114.70 = $1 Profit @ 20 Pips

In the demo account however, I get a much higher profit amount ~$1000. What am I not getting???

Thank you for your help!!

Among JPY pairs, GBP/JPY is the most volatile one! It’s known as dragon pair because of it’s nature! I actually always use volatile currency pair since it produces my daily trading target so quickly! On the other hand, USD/JPY is average volatile as like others major currency pairs!

*Kommerzielle Nutzung und Spam werden nicht toleriert und können zur Kündigung des Kontos führen.

Tipp: Wenn Sie ein Bild/eine Youtube-Url posten, wird diese automatisch in Ihren Beitrag eingebettet!

Tipp: Tippen Sie das @-Zeichen ein, um einen an dieser Diskussion teilnehmenden Benutzernamen automatisch zu vervollständigen.