Advertisement

Edit Your Comment

TWICE IN AS MANY WEEKS SMALL TRADERS ARE MOCKED BY THE BANKS

forex_trader_169700

Mitglied seit Dec 30, 2013

163 Posts

Oct 28, 2016 at 08:36

(bearbeitet Oct 28, 2016 at 00:34)

Mitglied seit Dec 30, 2013

163 Posts

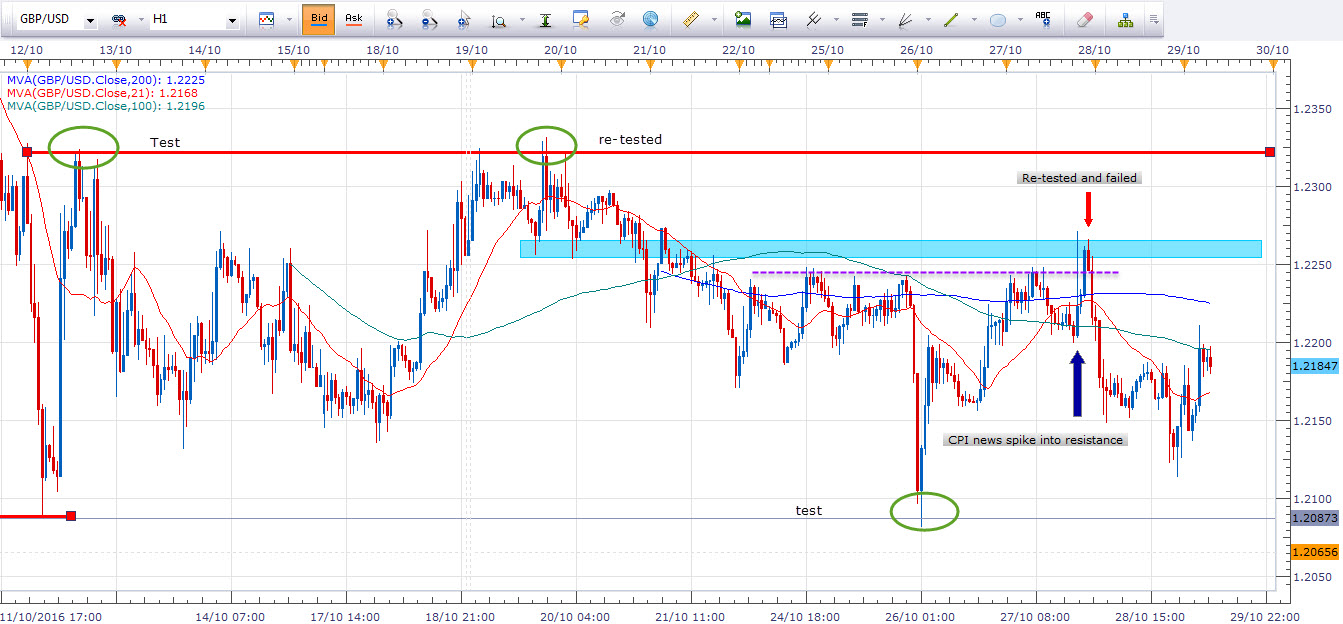

This morning some traders were eagerly awaiting news about UK GDP, consensus was that it would come in at 0.3%, the previous was 0.7% when the news was released it came in at 0.5% which was better than forcasted. This was a big news event following Brexit for obvious reasons. I think most small traders expected it to go up, but it didn't and at the end of the day had reached a low of 121.5. I don't know about you, but had I been trading real money I would have felt cheated when it didn't go up. I personally had GBPUSD going to 127 level on Fibonacci at least. This was positive news, not some statement by some politician but fact. Politicians and bankers can talk about the economy all they want, talk it down, talk it up, whatever, but all they are doing is saying what they think may or may not happen. The GDP figures released today were fact and positive facts about the UK economy. The fact that Sterling went lower today following this makes a mockery of the markets, not only that it makes a mockery of small hard working traders who are trying their hardest to make money. Following the release this morning I went onto the FXStreet Website and the headline read 'Sterling Rallies on GDP Figures'. What rally? Later I read on the same website that Sterling had fallen, following release of Durable Goods Orders in the US. It just turns out that those Durable Goods Orders had come in lower than expected. The banks, brokers or whoever is in control of this market are scamming the likes of you and me for their own greed. See charts above.

Two weeks ago, Sterling crashed and the Banks used the excuse of a 'Fat Finger', but which later turned out to be because of a Rogue Algo. Personally I think it was once again due to manipulation. They knew that small traders were waiting to jump in and go long Sterling at around 1.24, but in fact it went far lower. My broker recorded 1.10!!!

I don't know about you but I work really hard at trying to improve my technical analysis skills and I'm quickly learning that in this age of Algorithms these skills don't really count for much.

Two weeks ago, Sterling crashed and the Banks used the excuse of a 'Fat Finger', but which later turned out to be because of a Rogue Algo. Personally I think it was once again due to manipulation. They knew that small traders were waiting to jump in and go long Sterling at around 1.24, but in fact it went far lower. My broker recorded 1.10!!!

I don't know about you but I work really hard at trying to improve my technical analysis skills and I'm quickly learning that in this age of Algorithms these skills don't really count for much.

Mitglied seit May 17, 2013

33 Posts

forex_trader_169700

Mitglied seit Dec 30, 2013

163 Posts

Oct 28, 2016 at 13:11

Mitglied seit Dec 30, 2013

163 Posts

Bankers at it again, before someone tells me it's not the bankers, who are the ones who can trade millions of $? Certainly not Fred Bloggs up the road!!!

On another note you might find this interesting reading: https://www.bloomberg.com/news/articles/2016-10-28/pound-spurred-by-fear-of-the-future-shrugs-off-good-news Headline: The Pound is Trading on Politics not the Economy. Still does not justify the move seen yesterday and today looking at my analysis, but maybe I'm just a plonker!!!

On another note you might find this interesting reading: https://www.bloomberg.com/news/articles/2016-10-28/pound-spurred-by-fear-of-the-future-shrugs-off-good-news Headline: The Pound is Trading on Politics not the Economy. Still does not justify the move seen yesterday and today looking at my analysis, but maybe I'm just a plonker!!!

forex_trader_169700

Mitglied seit Dec 30, 2013

163 Posts

Oct 28, 2016 at 13:18

Mitglied seit Mar 14, 2016

40 Posts

You know what - I think you are quite right about the importance of technical analysis skills nowadays. everything is controlled on a massive scale by machine learning algorithms and at the end it is not your or my trades that will move the market. These days it seems more like betting rather than analysing and forecasting. I guess this is the new reality we need to adapt to.

Oct 28, 2016 at 14:16

(bearbeitet Oct 28, 2016 at 14:17)

Mitglied seit Nov 14, 2015

315 Posts

GDP is alright, but it doesn't matter The numbers behind the GDP matters as well, the big raise was in hotels and resturants at 5.1%, likely the UK is becoming a popular tourist destination now being 25% cheaper.

Industrial output expanded at a slower pace (1.2 percent compared to 1.6 percent in Q2), as manufacturing (0.4 percent compared to 1 percent) and electricity, gas, steam and air contracted (-0.7 percent compared to 4.4 percent), this industrial slowdown is worrysome.

Etc a news about a bank planning to leave the UK is far more impactful for the time being.

Industrial output expanded at a slower pace (1.2 percent compared to 1.6 percent in Q2), as manufacturing (0.4 percent compared to 1 percent) and electricity, gas, steam and air contracted (-0.7 percent compared to 4.4 percent), this industrial slowdown is worrysome.

Etc a news about a bank planning to leave the UK is far more impactful for the time being.

Oct 29, 2016 at 00:29

(bearbeitet Oct 29, 2016 at 00:34)

Mitglied seit Sep 20, 2014

342 Posts

Look, I have over 20 systems in the market. All of them with contradictory positions on 28 pairs. They all make money.

The only possible conclusion that you can come to from that is that direction and therefore technical analyses is irrelevant. If you don't believe me then go look at say the top 10 systems on fx book. They all will have contradictory positions at any given tine and they all make money as well.

You don't need to guess what the pound is going to do to make money in fx. You make or lose your money by how you manage your positions. So stop waisting time trying to figure out direction, take your best guess, choose one direction, put down your trade leave it for 24 hours and then come back and decide what you're going to do with it.

Then all of this goes away....

The only possible conclusion that you can come to from that is that direction and therefore technical analyses is irrelevant. If you don't believe me then go look at say the top 10 systems on fx book. They all will have contradictory positions at any given tine and they all make money as well.

You don't need to guess what the pound is going to do to make money in fx. You make or lose your money by how you manage your positions. So stop waisting time trying to figure out direction, take your best guess, choose one direction, put down your trade leave it for 24 hours and then come back and decide what you're going to do with it.

Then all of this goes away....

Mitglied seit May 04, 2012

1534 Posts

Oct 29, 2016 at 00:48

(bearbeitet Oct 29, 2016 at 00:49)

Mitglied seit May 04, 2012

1534 Posts

theHand posted:

Look, I have over 20 systems in the market. All of them with contradictory positions on 28 pairs. They all make money.

The only possible conclusion you can make from that is that direction and therefore technical analyses is irrelevant. If you don't believe me then go look at say the top 10 systems on fx book. They all will have contradictory positions at any given tine and they all make money as well.

You don't need to guess what the pound is going to do to make money in fx. You make or lose your money by how you manage your positions. So stop waisting time trying to figure it out direction, choose one, put down your trade leave it for 24 hours and then come back and decide what you're going to do with it.

Then all of this goes away....

Interesting approach, resembling to an experiment published in Forbes Magazine, which kind of validates the above:

https://www.forbes.com/sites/rickferri/2012/12/20/any-monkey-can-beat-the-market/#4fc6ed7d6e8b

Please click "Vouch" if you liked my post. If not, just put me on your Blocked list. :o)

Oct 29, 2016 at 12:44

(bearbeitet Oct 29, 2016 at 12:50)

Mitglied seit Sep 20, 2014

342 Posts

Well there we go, explicit evidence. Thanks SaltyWaters.

Obviously you want to get your entries as good as possible, but they are maybe 1% of the process. Eye it out, trade the way you think it's going to go, but then start the management. Don't lose sleep over being right. Even top fund managers are right about 30% of the time.

I once counted how many times we go through a price level on a pair, 11 on average.

Any trade you open likely will go at least 11 times into profit before you move away from the price range. That's more than enough time to manage the thing.

Once you do this, you start thinking about the things that make fx work. When to go big, when to reduce, what is margin use like, how good is this profit ? What's the trend speed like ? Does the thing pose a risk to my portfolio ? And so on, there's a thousand questions after which way is it going to go...

Obviously you want to get your entries as good as possible, but they are maybe 1% of the process. Eye it out, trade the way you think it's going to go, but then start the management. Don't lose sleep over being right. Even top fund managers are right about 30% of the time.

I once counted how many times we go through a price level on a pair, 11 on average.

Any trade you open likely will go at least 11 times into profit before you move away from the price range. That's more than enough time to manage the thing.

Once you do this, you start thinking about the things that make fx work. When to go big, when to reduce, what is margin use like, how good is this profit ? What's the trend speed like ? Does the thing pose a risk to my portfolio ? And so on, there's a thousand questions after which way is it going to go...

Mitglied seit May 04, 2012

1534 Posts

Oct 29, 2016 at 12:57

(bearbeitet Oct 29, 2016 at 12:59)

Mitglied seit May 04, 2012

1534 Posts

I am sure that SaltyWaters' 47% is not totally random. Also, potential DD - before going big - is another issue.

Please click "Vouch" if you liked my post. If not, just put me on your Blocked list. :o)

Oct 29, 2016 at 13:06

(bearbeitet Oct 29, 2016 at 13:10)

Mitglied seit Sep 20, 2014

342 Posts

Don't take my word for it, someone do the leg work. Download the data set to a CV file, get it into excell and see how often you get a high and low straddling the initial price point + 1 your count, it will clearly demonstrate that almost any position you open will go into profit several times.

I've done this so I know this. So I know it doesn't matter what I do it will go into profit, you can throw darts blind folded at fx and make money. As long as you manage your positions properly.

I've done this so I know this. So I know it doesn't matter what I do it will go into profit, you can throw darts blind folded at fx and make money. As long as you manage your positions properly.

Mitglied seit May 17, 2013

33 Posts

Oct 30, 2016 at 07:46

Mitglied seit May 17, 2013

33 Posts

Greggy posted:

I think most small traders expected it to go up, but it didn't and at the end of the day had reached a low of 121.5. I don't know about you, but had I been trading real money I would have felt cheated when it didn't go up. I personally had GBPUSD going to 127 level on Fibonacci at least.

I don't know about you but I work really hard at trying to improve my technical analysis skills and I'm quickly learning that in this age of Algorithms these skills don't really count for much.

I don't understand the nature of your gripe. We as retail traders don't move the market. Our job is to understand the flow and position our trades that go with the flow. What we think the market should do is irrelevant. We trade what we see. This is the most basic principle in trading that I can offer you.

I actually traded that CPI news event. I was bearish but prices spiked up on the news and stalled at major resistance. That price spike most likely took out all the protective stops of those that were short on the cable. Such price spike into major resistance can often be a trap especially if the spike cannot be subsequently taken out. This is standard signature play of those market movers. You have to learn to read their moves. I made some pips on that reversal but it was difficult to trade as the spread alone at one point was as much as 42 pips.

At a TA level, it is simply about support and resistance and price behaviour around this levels. As a general principle, prices will test and re-test resistance and if it is unsuccessful it will then do the same at support.

Oct 30, 2016 at 13:34

Mitglied seit Sep 20, 2014

342 Posts

@Greggy

Fxbook does a fairly shit job at tracking anything. I stopped using it some time ago as accurate stats are just impossible to get. So don't knock someone if they don't publish stats.

Here's an example of a 600% a year system apparently in loss when it clearly isn't, this is one of the best systems running on fxbook, but it looks like shit.

https://www.myfxbook.com/members/robotfxea/robotfx-30-bonus/1512778

And don't be so defensive, people are trying to help you here.

Fxbook does a fairly shit job at tracking anything. I stopped using it some time ago as accurate stats are just impossible to get. So don't knock someone if they don't publish stats.

Here's an example of a 600% a year system apparently in loss when it clearly isn't, this is one of the best systems running on fxbook, but it looks like shit.

https://www.myfxbook.com/members/robotfxea/robotfx-30-bonus/1512778

And don't be so defensive, people are trying to help you here.

Mitglied seit May 04, 2012

1534 Posts

Oct 30, 2016 at 13:56

Mitglied seit May 04, 2012

1534 Posts

The above link shows a -99.99% DD...

So it is either:

1. A really shitty strategy (-99.99% drawdown will qualify for that) with a lucky streak since March of 2016

or

2. If a different strategy had been used since that major DD in March, then the trader should have switched to a clean, new account.

So the problem is NOT with MyFxBook's reporting accuracy. Just my 2 cents...

So it is either:

1. A really shitty strategy (-99.99% drawdown will qualify for that) with a lucky streak since March of 2016

or

2. If a different strategy had been used since that major DD in March, then the trader should have switched to a clean, new account.

So the problem is NOT with MyFxBook's reporting accuracy. Just my 2 cents...

Please click "Vouch" if you liked my post. If not, just put me on your Blocked list. :o)

Oct 31, 2016 at 00:06

Mitglied seit Sep 20, 2014

342 Posts

@FxMasterGuru

Some can't easy switch accounts, myself included and you can't set the date, so those stats are wrong, the growth and Balance doesn't even appear to have anything to do with each other, That account is up 600% not down 90%.

Some can't easy switch accounts, myself included and you can't set the date, so those stats are wrong, the growth and Balance doesn't even appear to have anything to do with each other, That account is up 600% not down 90%.

*Kommerzielle Nutzung und Spam werden nicht toleriert und können zur Kündigung des Kontos führen.

Tipp: Wenn Sie ein Bild/eine Youtube-Url posten, wird diese automatisch in Ihren Beitrag eingebettet!

Tipp: Tippen Sie das @-Zeichen ein, um einen an dieser Diskussion teilnehmenden Benutzernamen automatisch zu vervollständigen.