Edit Your Comment

Trading Journal

Nov 22, 2018 at 18:40

Mitglied seit Jan 24, 2018

207 Posts

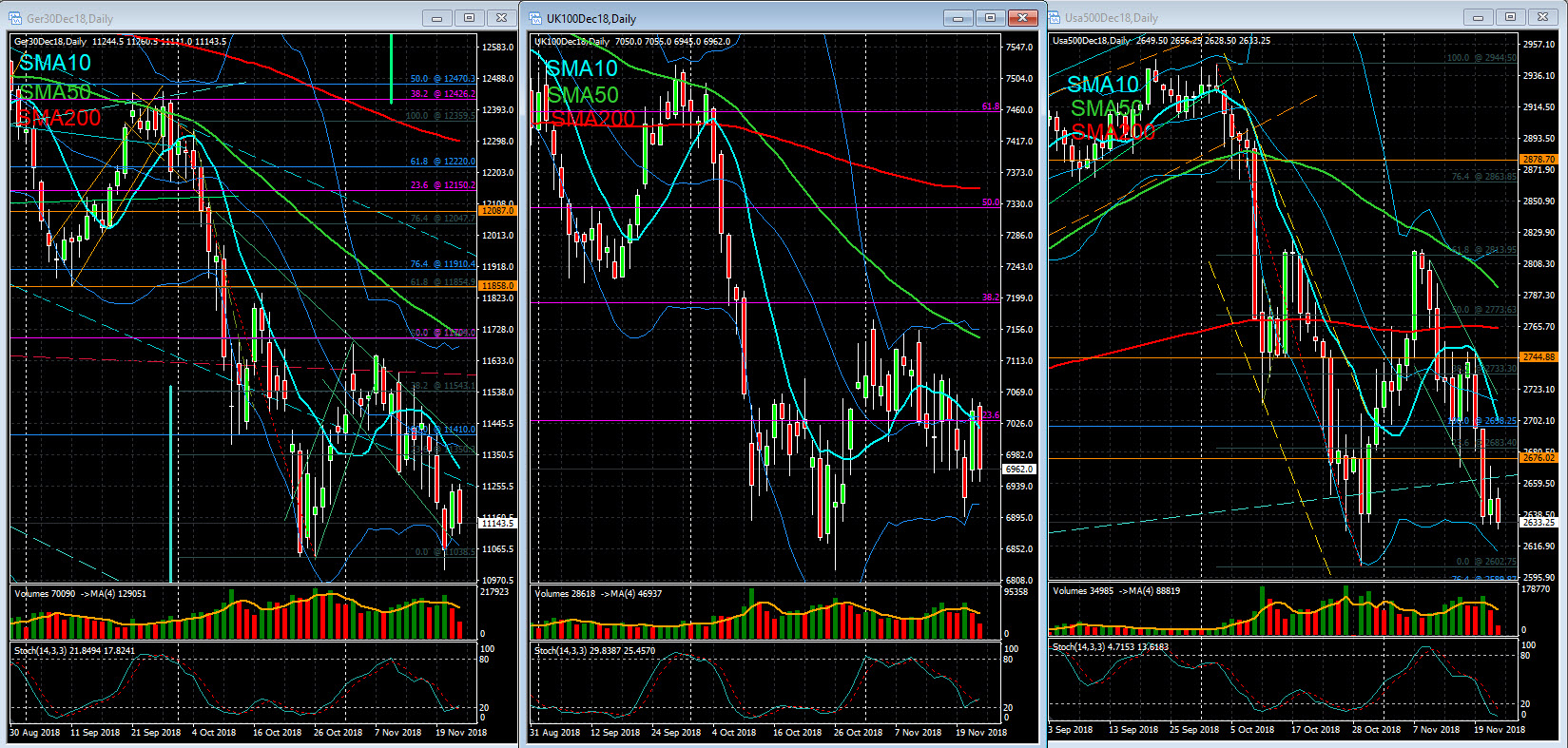

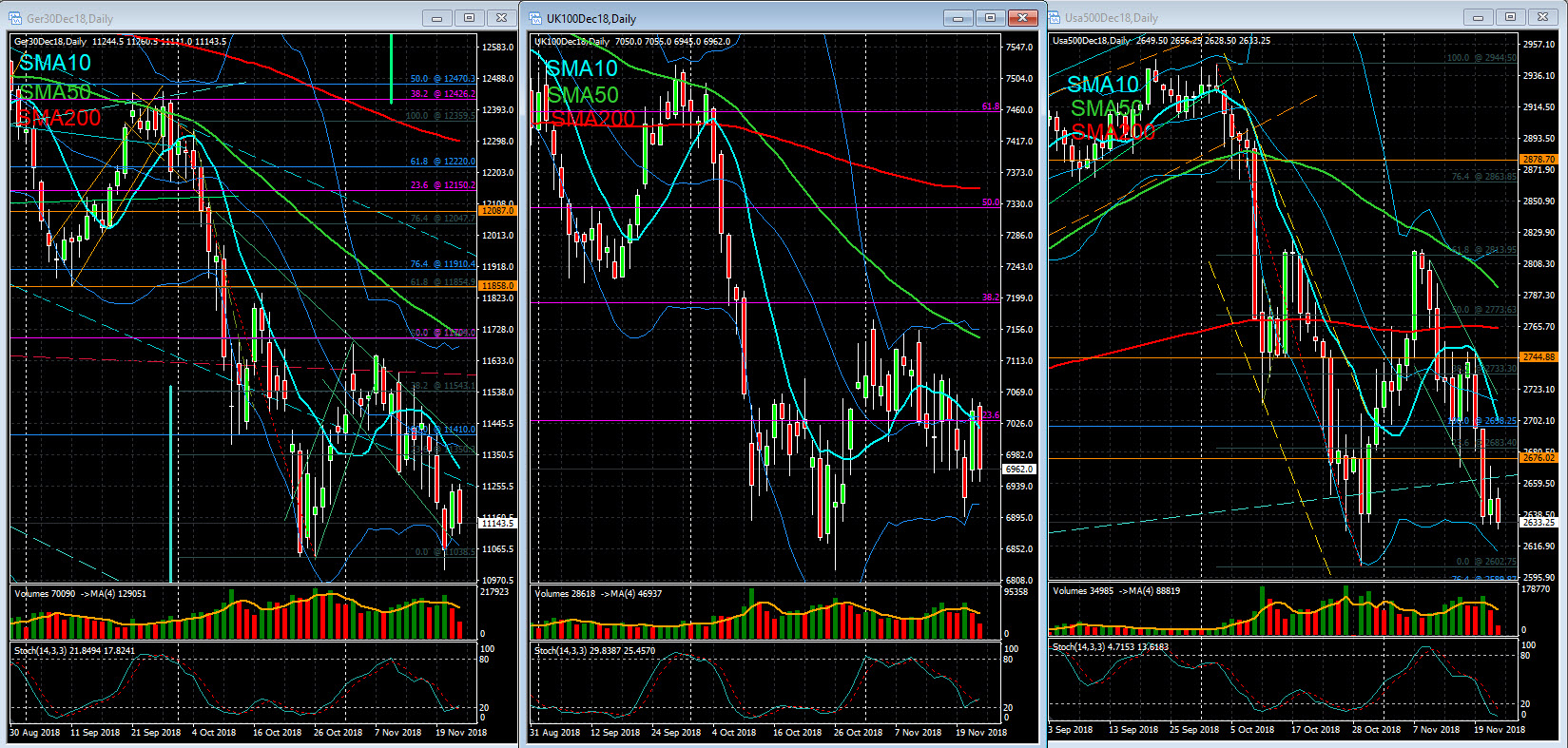

Stock Markets – Closing Note - 22 Nov

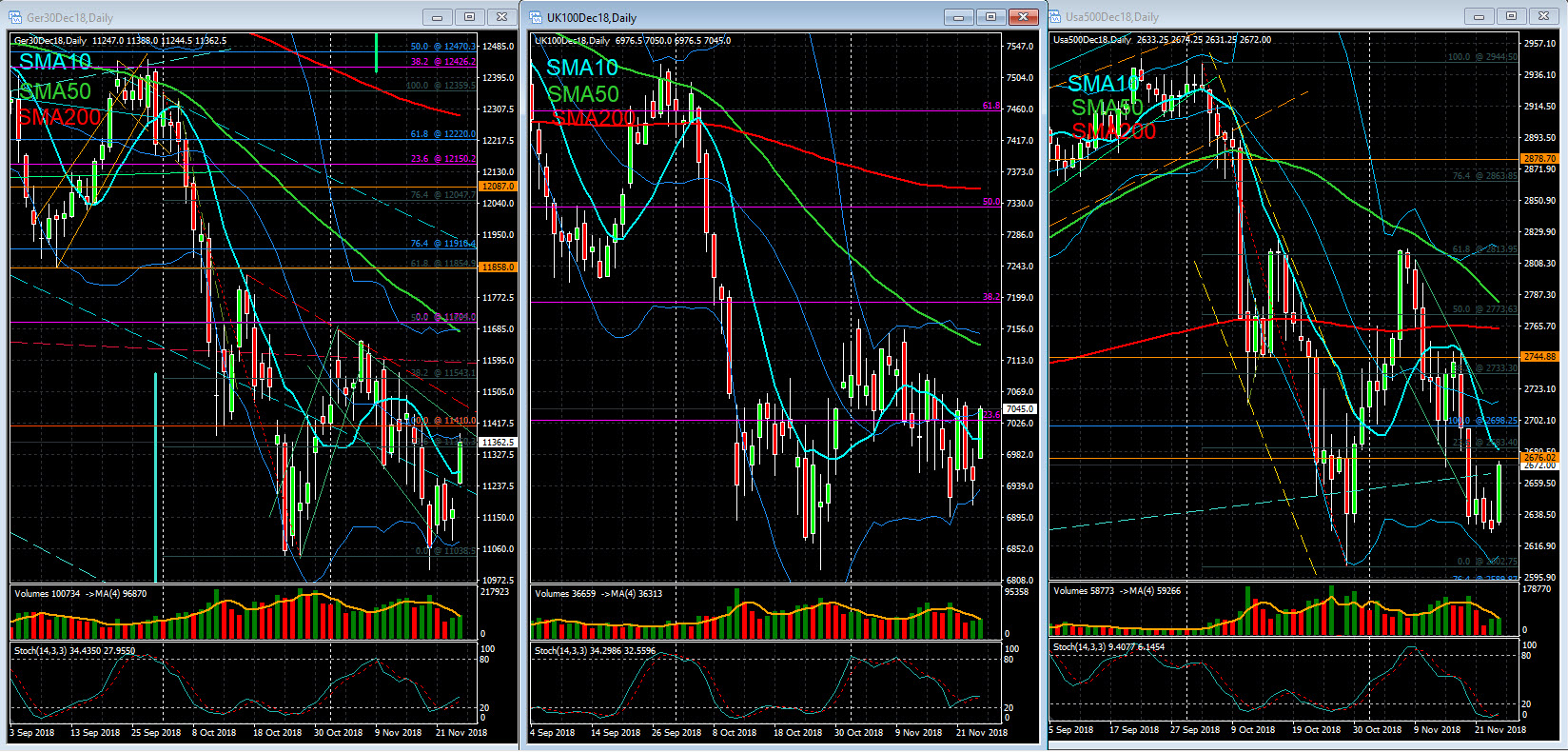

Ger30, UK100 and SP500 are CFD’s, written over the Dax30, Footsie100 and S&P500 Index futures:

European markets closed lower, losing part of the gains they conquered yesterday. The celebration of the Thanksgiving holiday in the US withdrew some liquidity to today's session, which showed below average volumes. The sectors that contributed the most to today's flexion were mining and telecommunications. The fall of the banking sector has been softened by the rise of transalpine banks. After the European Commission rejected the Italian State Budget, local investors seem to believe that the government of Rome is taking a more conciliatory stance, despite the statements of some of its members.

The US market is closed today to commemorate the Thanksgiving day.

Ger30, UK100 and SP500 are CFD’s, written over the Dax30, Footsie100 and S&P500 Index futures:

European markets closed lower, losing part of the gains they conquered yesterday. The celebration of the Thanksgiving holiday in the US withdrew some liquidity to today's session, which showed below average volumes. The sectors that contributed the most to today's flexion were mining and telecommunications. The fall of the banking sector has been softened by the rise of transalpine banks. After the European Commission rejected the Italian State Budget, local investors seem to believe that the government of Rome is taking a more conciliatory stance, despite the statements of some of its members.

The US market is closed today to commemorate the Thanksgiving day.

Nov 23, 2018 at 22:16

Mitglied seit Jan 24, 2018

207 Posts

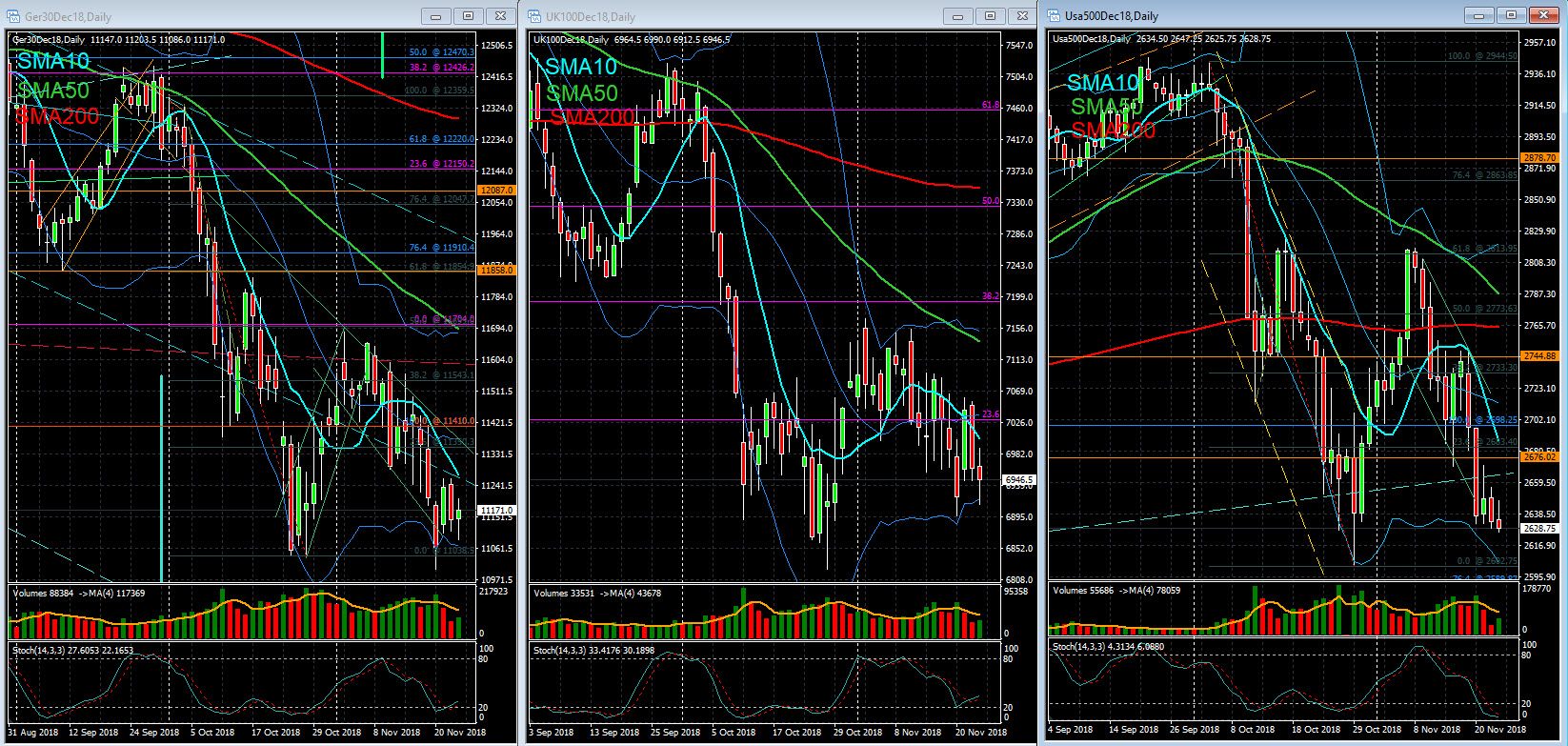

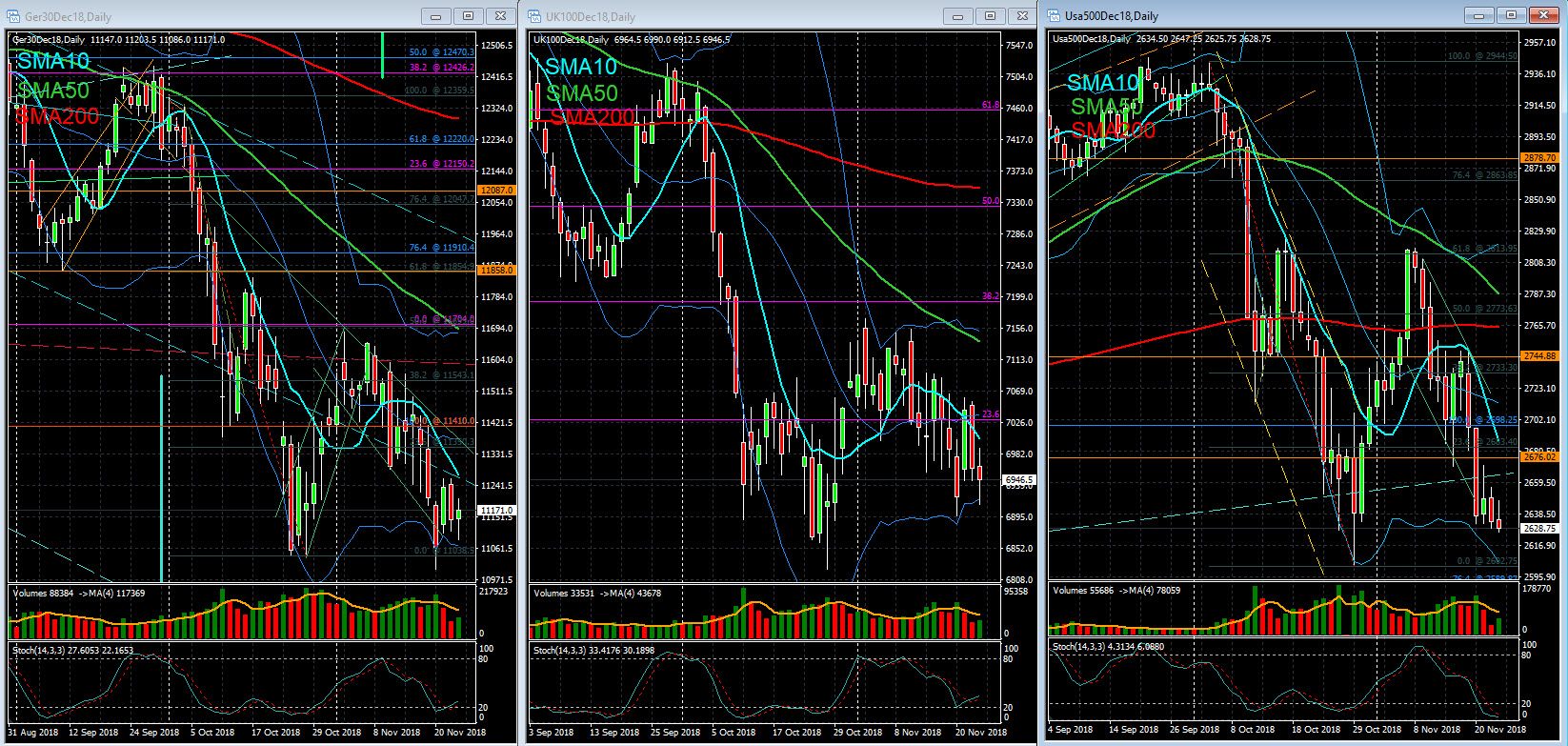

Stock Markets – Closing Note - 23 Nov

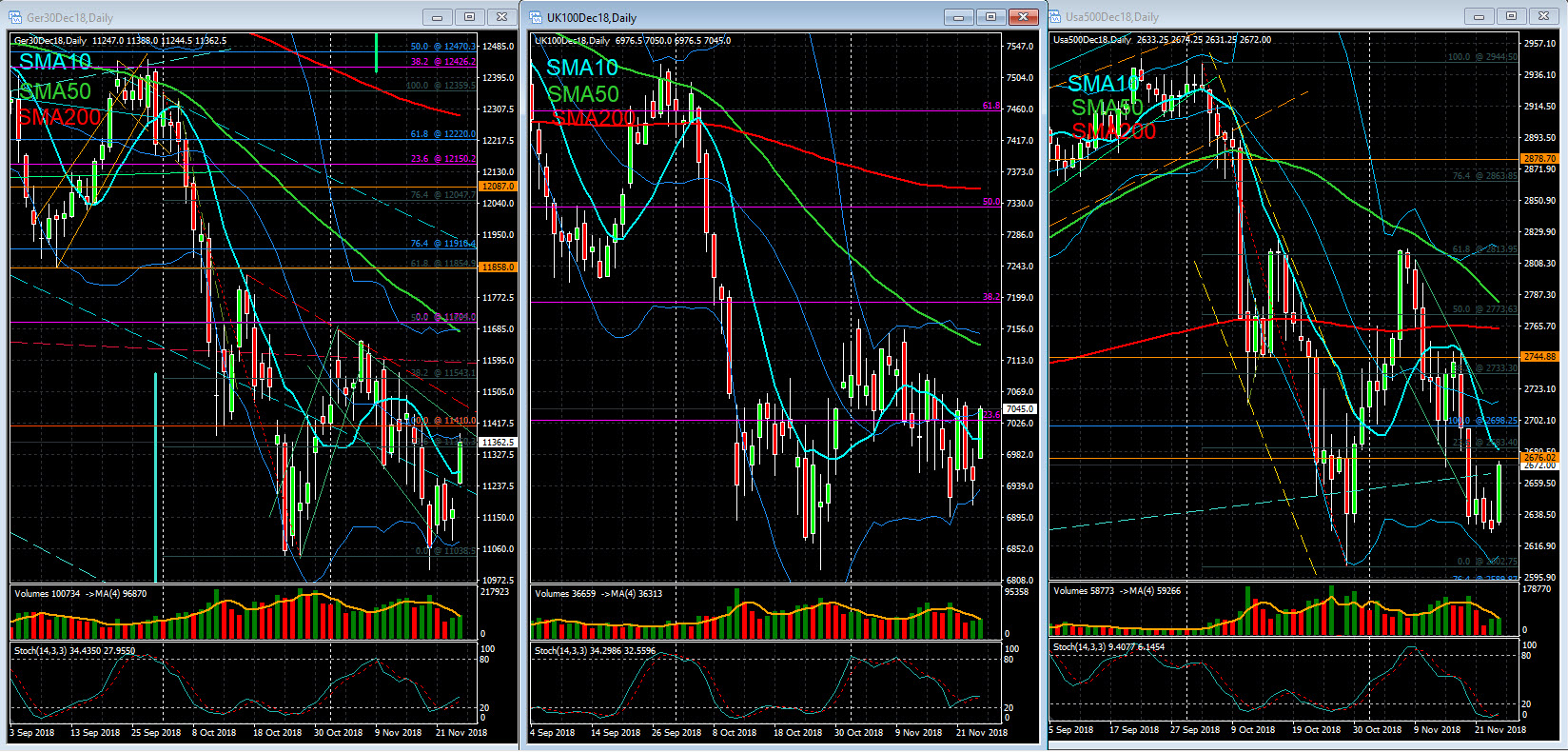

Ger30, UK100 and SP500 are CFD’s, written over the Dax30, Footsie100 and S&P500 Index futures:

The European indices closed with contained valuations. In its opening hours, the European session was characterized by a resilience to the significant drop in Chinese stock markets (which accumulated losses of more than 2%). The volume traded was below average due to the reduced session in New York. Perhaps the European markets would have been able to achieve more significant gains had it not been for the sharp falls in the mining and oil sectors. Oil traded at the lows last year, with Brent reaching 60USD/barrel. To reinforce the recent downward trend has now been the news that Saudi Arabia's production is at its maximum and that US oil reserves have been increasing. The decline in oil was spreading the trend of other industrial raw materials. On the positive side, the stocks associated with tourism and pharmaceuticals emerged. At the macroeconomic level, the PMI indices, related to economic activity and services, were bending relative to October. The November readings were also below expectations, confirming the decline in economic growth in the Euro Zone.

US stocks were trading at a loss. The session today is shorter, ending at 6 PM GMT. The main hallmark of the session, in addition to the drop in oil prices, was the overperformance of stocks more focused on the domestic economy (customized by the Russell2000 index), which contrasted with selling pressure on top technology stocks.

Ger30, UK100 and SP500 are CFD’s, written over the Dax30, Footsie100 and S&P500 Index futures:

The European indices closed with contained valuations. In its opening hours, the European session was characterized by a resilience to the significant drop in Chinese stock markets (which accumulated losses of more than 2%). The volume traded was below average due to the reduced session in New York. Perhaps the European markets would have been able to achieve more significant gains had it not been for the sharp falls in the mining and oil sectors. Oil traded at the lows last year, with Brent reaching 60USD/barrel. To reinforce the recent downward trend has now been the news that Saudi Arabia's production is at its maximum and that US oil reserves have been increasing. The decline in oil was spreading the trend of other industrial raw materials. On the positive side, the stocks associated with tourism and pharmaceuticals emerged. At the macroeconomic level, the PMI indices, related to economic activity and services, were bending relative to October. The November readings were also below expectations, confirming the decline in economic growth in the Euro Zone.

US stocks were trading at a loss. The session today is shorter, ending at 6 PM GMT. The main hallmark of the session, in addition to the drop in oil prices, was the overperformance of stocks more focused on the domestic economy (customized by the Russell2000 index), which contrasted with selling pressure on top technology stocks.

Nov 26, 2018 at 20:57

Mitglied seit Jan 24, 2018

207 Posts

Stock Markets – Closing Note - 26 Nov

Ger30, UK100 and SP500 are CFD’s, written over the Dax30, Footsie100 and S&P500 Index futures:

European indexes closed with valuations above 1%. The deal reached over the weekend for Brexit, the latest news from Italy and the rise in crude oil were the main catalysts of this rise. The understanding reached between the European Union and the UK over the weekend softened the nervousness among investors. British stocks and pound sterling traded higher. However, on the horizon lies the challenge that Prime Minister Theresa May will face: to bring together an internal consensus capable of securing Parliament's approval of the agreement drawn up over the weekend. The Italian market was the best performer of the day. To galvanize the transalpine investors and to reflect their European peers was the news reported by the local press. According to this source, Deputy Prime Minister Matteo Salvini, who has led the tough wing of the Government in its relationship with Brussels, has opened the possibility of the 2019 Budget to undergo some tinkering in order to reassure international investors. The increase in crude oil led to the appreciation of its sector a

s well as that of the miner, with which it has a high correlation. At the macroeconomic level, the IFO index, which measures the sentiment of German entrepreneurs, fell from 102.6 in November to 102.0, a level also below the forecast of 102.3.

US markets were trading higher, with volumes recovering after the festive period late last week. The catalyst for the climb was the first numbers of the shopping season (or holiday season) and its positive effects in the technological sector as well as the recovery of crude. Although definitive figures are not yet available, on Black Friday, online purchases amounted to 6200 M.USD, which represents a 24% increase over the same day of 2017.

Ger30, UK100 and SP500 are CFD’s, written over the Dax30, Footsie100 and S&P500 Index futures:

European indexes closed with valuations above 1%. The deal reached over the weekend for Brexit, the latest news from Italy and the rise in crude oil were the main catalysts of this rise. The understanding reached between the European Union and the UK over the weekend softened the nervousness among investors. British stocks and pound sterling traded higher. However, on the horizon lies the challenge that Prime Minister Theresa May will face: to bring together an internal consensus capable of securing Parliament's approval of the agreement drawn up over the weekend. The Italian market was the best performer of the day. To galvanize the transalpine investors and to reflect their European peers was the news reported by the local press. According to this source, Deputy Prime Minister Matteo Salvini, who has led the tough wing of the Government in its relationship with Brussels, has opened the possibility of the 2019 Budget to undergo some tinkering in order to reassure international investors. The increase in crude oil led to the appreciation of its sector a

s well as that of the miner, with which it has a high correlation. At the macroeconomic level, the IFO index, which measures the sentiment of German entrepreneurs, fell from 102.6 in November to 102.0, a level also below the forecast of 102.3.

US markets were trading higher, with volumes recovering after the festive period late last week. The catalyst for the climb was the first numbers of the shopping season (or holiday season) and its positive effects in the technological sector as well as the recovery of crude. Although definitive figures are not yet available, on Black Friday, online purchases amounted to 6200 M.USD, which represents a 24% increase over the same day of 2017.

*Kommerzielle Nutzung und Spam werden nicht toleriert und können zur Kündigung des Kontos führen.

Tipp: Wenn Sie ein Bild/eine Youtube-Url posten, wird diese automatisch in Ihren Beitrag eingebettet!

Tipp: Tippen Sie das @-Zeichen ein, um einen an dieser Diskussion teilnehmenden Benutzernamen automatisch zu vervollständigen.