Bitcoin sticks to bull trend on banks’ woes

Market picture

Over the past 24 hours, the crypto market capitalisation rose 1.4% to $1.18 trillion.

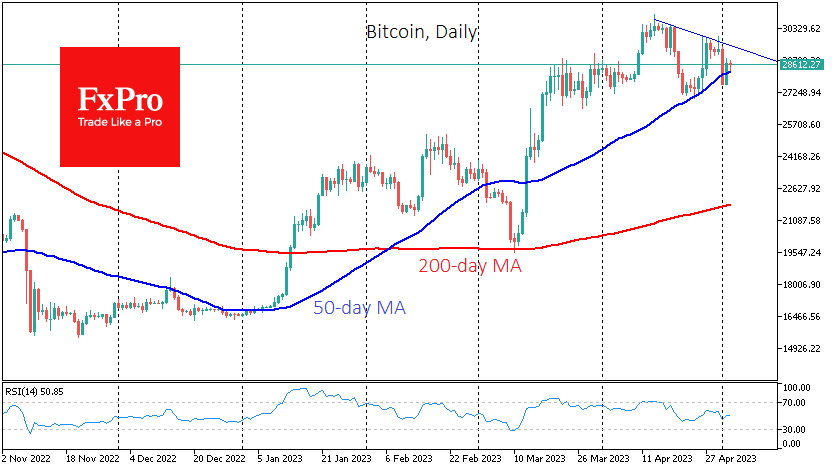

On Tuesday, Bitcoin recovered to $28.6K, over half of the previous day’s decline. Cryptocurrencies and gold gained momentum on the re-emerging woes of regional banks. This time it was PacWest Bancorp, Western Alliance and Metropolitan. However, we also note that the price stabilised before this news, suggesting that the selling momentum has subsided.

Bitcoin has steadily moved back above its 50-day moving average, proving that the break below was false. The upcoming Fed rate decision promises to increase volatility later in the day. A consolidation above $29.3K (the start of the sell-off) or a break below $28.2K (the 50-day moving average) could signal that the market has decided on a direction for the next few days or weeks.

News Background

According to CoinShares, investments in crypto funds fell by $72 million last week, continuing outflows for the second week. Bitcoin investments decreased by $46 million and Ethereum by $19 million (the largest outflow since September 2022).

Bitcoin transaction volume reached an all-time high established in December 2017 amid a surge in activity related to the Ordinals project, enabling the NFTs issuance on the BTC blockchain.

The main factor behind the suspension of the Bitcoin rally was the sell orders of “new investors” near $30K, Glassnode noted. Unconfirmed rumours of sales by Mt. Gox customers, the US government, and the revival of “old” BTC only added to the volatility.

MicroStrategy posted a net profit of $461.2 million for the first quarter. The company increased its position in digital gold from 7,500 BTC to 140,000 BTC. “The conviction in our bitcoin strategy remains strong,” the press release said.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)