Dollar Index: Slowly Forming a Bottom

Dollar Index: Slowly Forming a Bottom

The US Dollar has been trading in a tight range against its major rivals for the past two weeks, and the Dollar Index is gently forming a bottom after an impressive oversold condition. However, traders are advised to be patient. Last August, the dollar was similarly oversold, which coincided with weakness in US equities. However, it took more than a month for the Dollar Index to rally strongly. In other words, a low Relative Strength Index is not in itself a buy signal. One should not succumb to FOMO and look for a low to buy. It makes much more sense to join the uptrend when it is already in place.

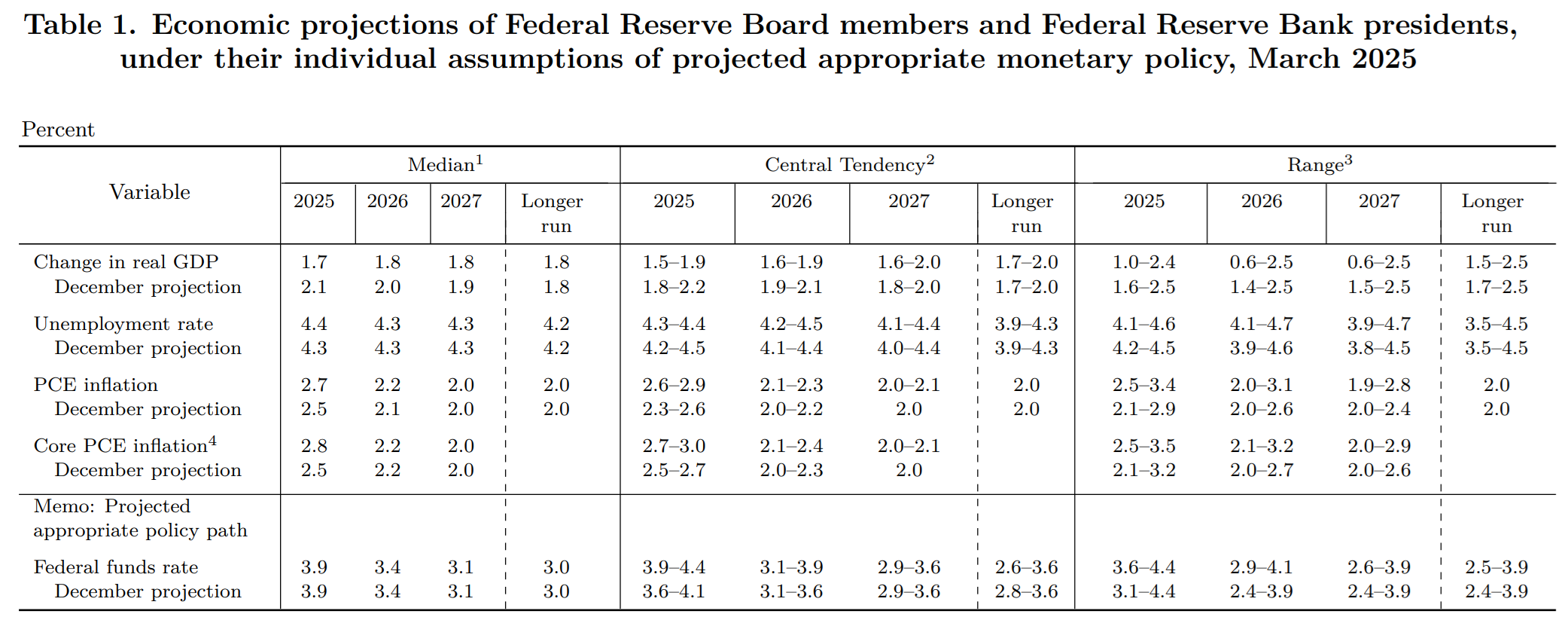

Earlier this week, the Fed sent a mixed signal to the markets. On the one hand, it lowered its GDP growth forecasts for the current year but also raised inflation expectations. The former brings us closer to a rate cut, while the latter makes us wary of a spike in inflation as we saw three years ago.

We would guess that Powell is hardly a hawk. He is quite reactive to the stimulus to cut rates but has more than once delayed action when it is necessary to raise rates. This time, too, he will likely be tolerant of some increase in inflation if he sees weakness in the labour market or consumer demand.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)