EBC Markets Briefing | Gold extends gains as slump deepened in Asia

Bullion climbed towards its July high on Tuesday on growing bets the Fed will act to prop up the world's largest economy. Trump called the sharp revisions to payroll growth "rigged" and "concocted."

Asia's factory activity deteriorated in July as soft global demand and lingering uncertainty over sweeping tariffs weighed on business morale, clouding the outlook for the region's recovery.

An outlier was India, which saw manufacturing activity expand at the fastest pace in 16 months in July on robust demand. But the survey was conducted before Trump announced a 25% tariff on the country.

The tariffs imposed last week on scores of countries are likely to stay in place rather than be cut as part of continuing negotiations, Trade Representative Jamieson Greer said on CBS show on Sunday.

Citi raised its gold price forecast over next three months to $3,500 per ounce on Monday from $3,300 on the belief that near-term US growth and inflation outlook has deteriorated.

Global gold demand including OTC trading rose by 3% year-on-year to 1,248.8 metric tons in the second quarter of 2025 as investment jumped 78%, the WGC said.

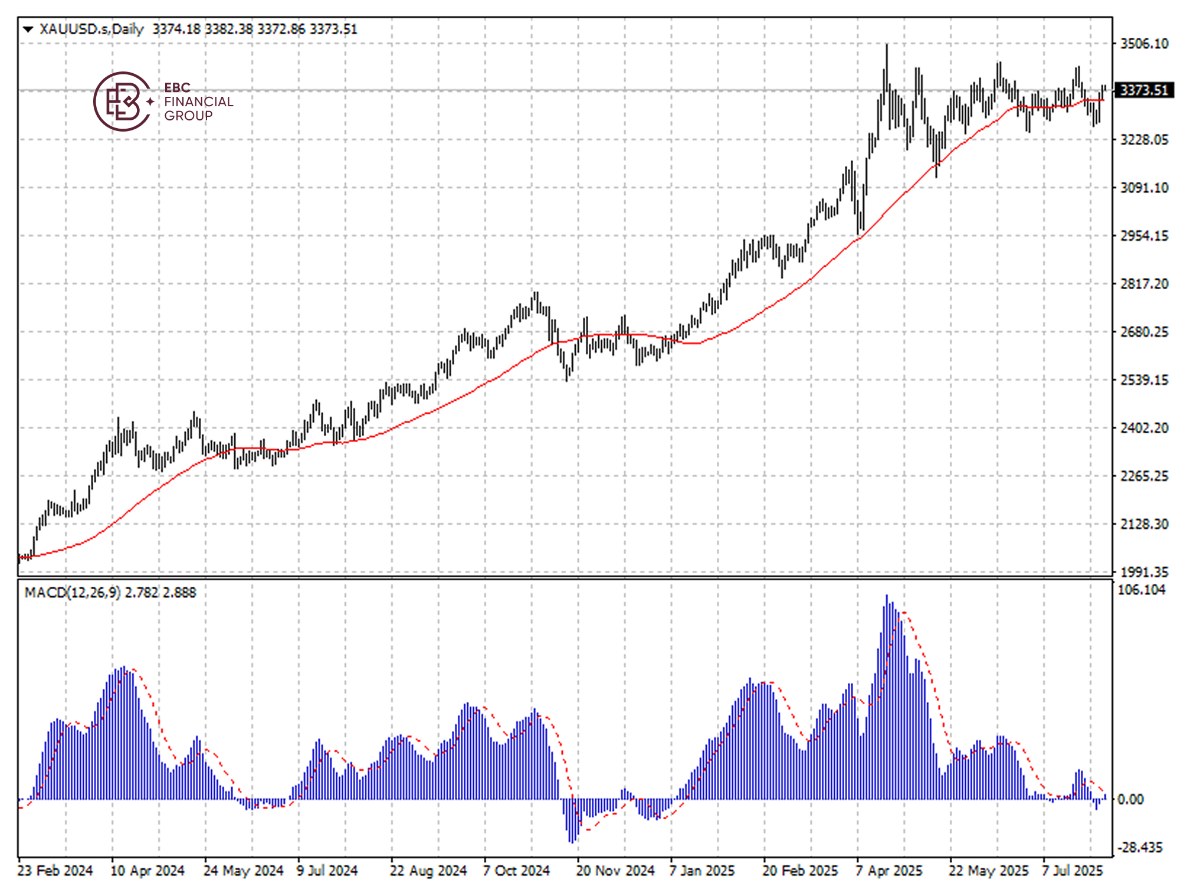

Gold has been fluctuating in a band since mid-May, so we expect it to fall back towards 50 SMA next. However, the long-term trend remains bullish.

EBC Financial Group Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Global Financial Collaboration or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.