EBC Markets Briefing | European market of 2025 might be a one-hit wonder

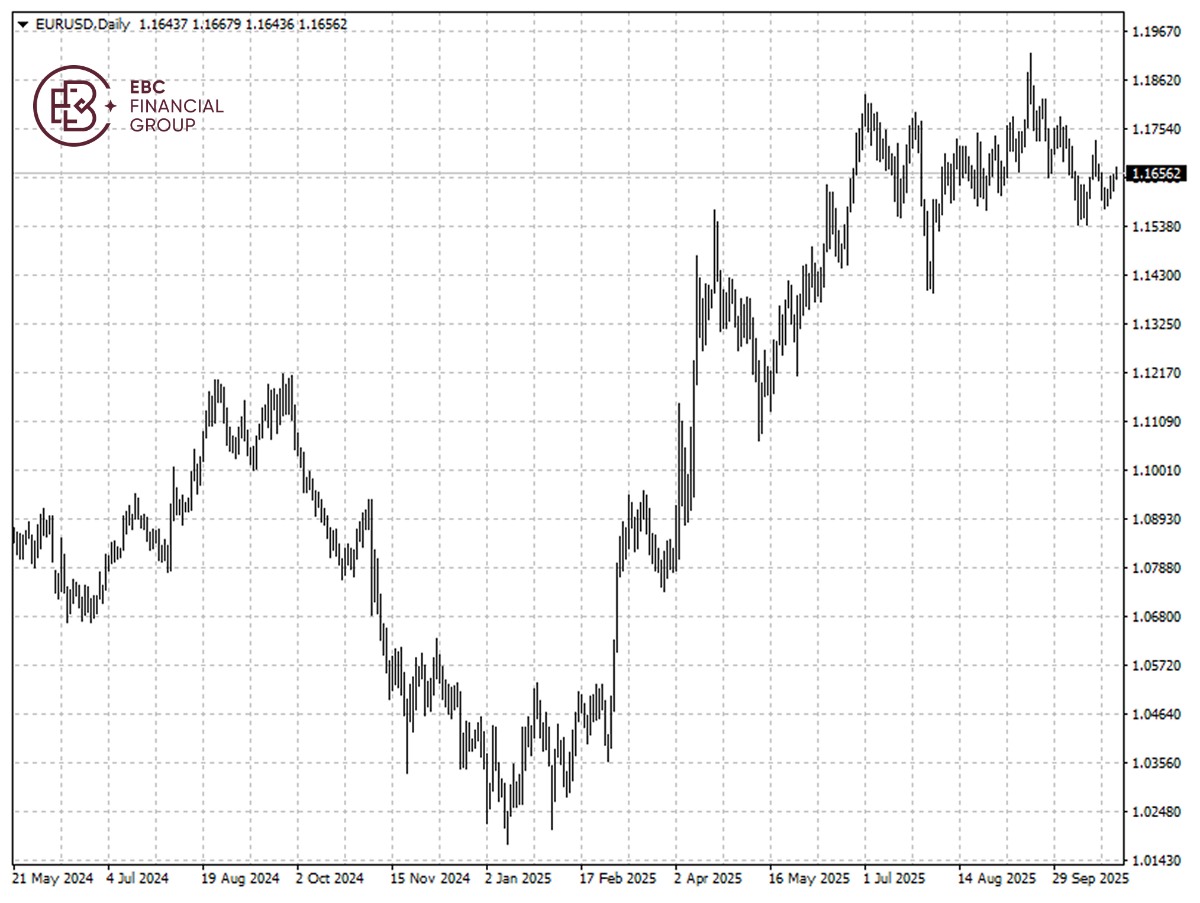

The euro's 14% gain in the first half of the year was the biggest since its creation, as traders dumped the greenback on the back of a once-in-a-generation shift in German fiscal spending amid rising trade tensions.

The uptrend may near its end though. Europe is yet feel the full pains of tariffs, with meagre GDP growth for Q2 reflecting chronic weak momentum after a bright start of 2025.

The EU swung from an €11.4 billion trade surplus in July to a €5.8 billion deficit in August, according to Eurostat data. The mainstays of the bloc are also already showing signs of disarray.

Germany's industrial sector faced a significant setback in August, with output plunging by 4.3% compared to the previous month, marking the steepest monthly decline since March 2022.

The French government fell in September, owing to disputes about how to close outsize budget deficit, prompting its benchmark bond yields to rise to the level of Italy's for the first time since the creation of the euro in 1999.

The IMF lifted its 2025 growth forecast for the eurozone to 1.2%, warning that policy uncertainty and general geopolitical tensions continue to pose major risks to the economic outlook.

The euro could rise gradually, but it is unlikely to break above the major resistance at 1.1680. In the longer run, it is likely to trade between 1.1585 and 1.1680, said UOB Group analysts.

After honeymoon

EU-China relations have reached an "inflection point", European Commission President Ursula von der Leyen told her Chinese counterpart Xi Jinping at a one-day summit in Beijing in July.

The EU recorded a €305.8 billion trade deficit with China in 2024, a number that has doubled in the past nine years. The bloc has accused China of subsidy-induced overcapacity and imposed tariffs on Chinese EVs.

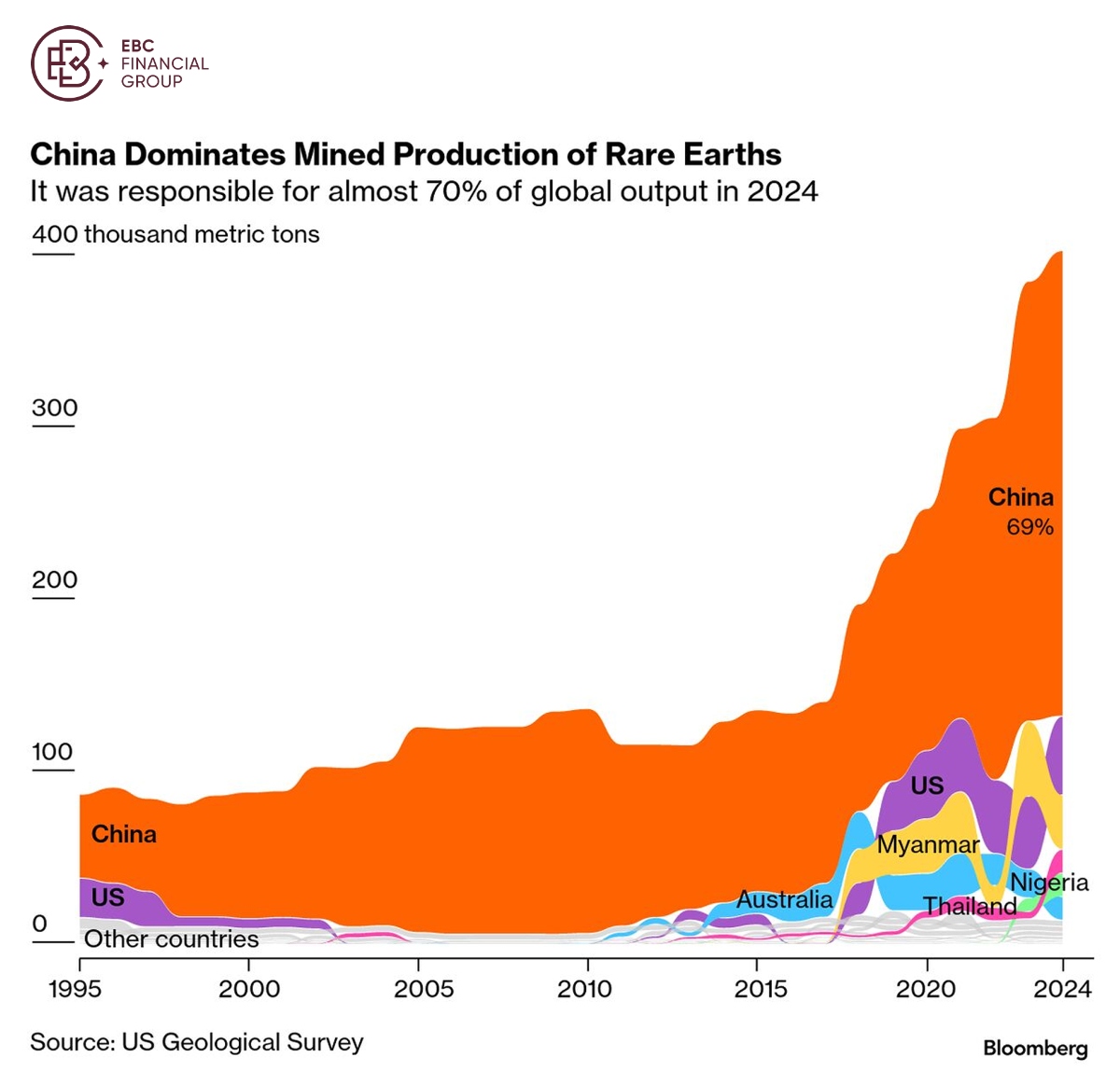

Last week French President Macron told EU leaders to consider using the anti-coercion instrument against China if they are unable to find a resolution to Beijing's planned export controls on critical raw materials.

German Chancellor Friedrich Merz confirmed that the plan was discussed but that no decision had been reached on using it. The measures generally include higher tariffs or targeted cubs on investments.

The EU is even considering forcing Chinese firms to hand over technology to European companies if they want to operate locally, in an aggressive new push to make the bloc's industry more competitive.

Whereas aggressive response is unlikely at this stage, the relationship between the great powers has taken a drastic turn since Russia invaded Ukraine – China blames it on NATO's eastward expansion.

China is taking advantage of cheaper oil from Russia to build strategic reserves. Moreover, Moscow recently announced progress in talks about a new pipeline to boost natural gas exports to the world's second largest economy.

Back to earth

European companies are expected to report low growth in Q3 earnings, on average, according to LSEG I/B/E/S data. It would be the worst quarterly performance since the first quarter of 2024.

Barclays said that "room for beats" exists as expectations have been sharply cut in recent months. Several heavyweights reported robust results, cementing that sanguine view.

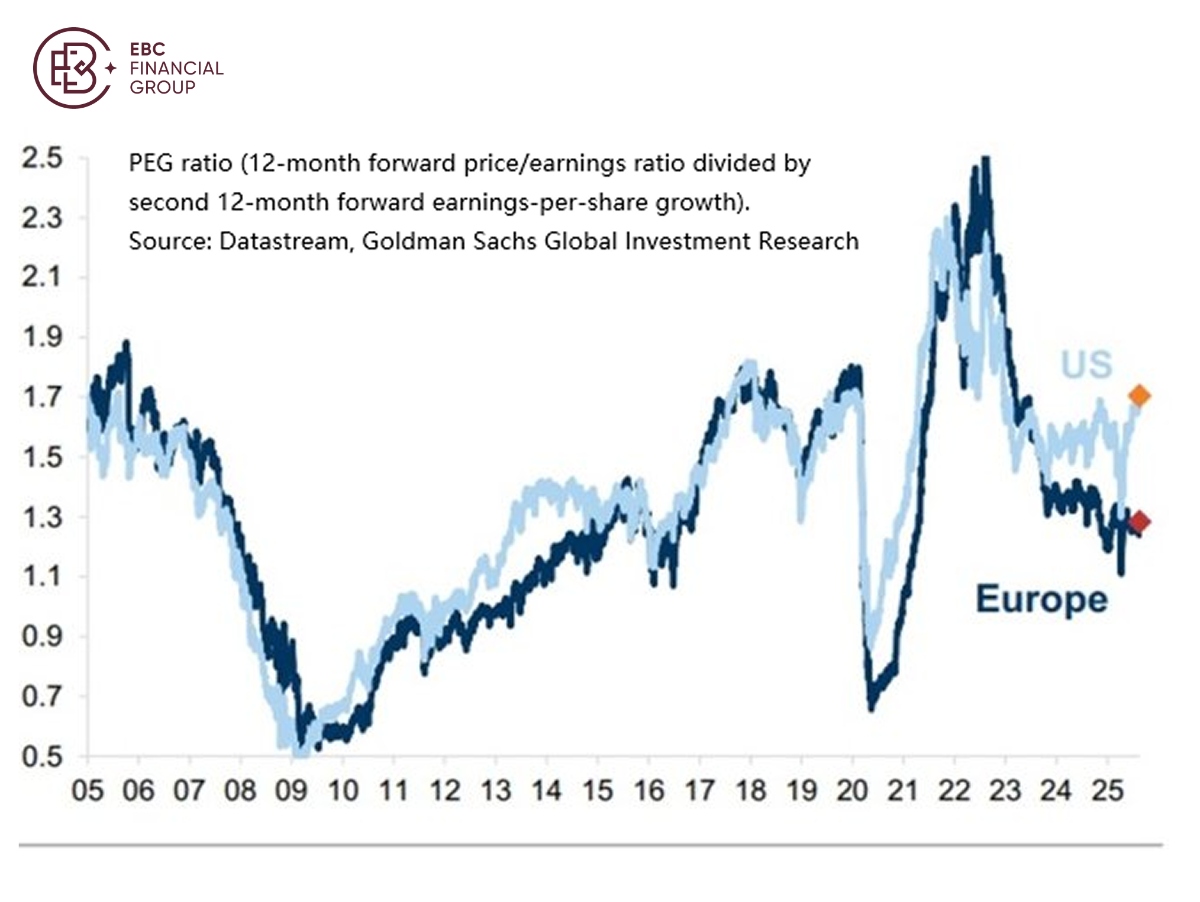

The bank highlighted that forex effects remain a key factor, with a strong euro "continuing to hurt" European earnings. So far this year, the markets have been driven more by multiple expansion.

Since Trump announced his tariffs plans in February, around 72% of companies in Europe, the Middle East and Africa tracked by Reuters have flagged price hikes, as global import taxes have surged.

The Stoxx 50 has significantly outperformed the Dow in 2025, partly due to the largest component AMSL. The chip-making equipment giant gained more than 33% amid AI investment boom.

AXA IM said in its note that while the valuation gap between European and US stocks has narrowed from its more extreme levels, the asset class can continue to offer value relative to the US peer.

While currency stability benefits foreign orders, tepid consumption in China and Europe's scaremongering against the socialist state will likely scuttle earnings growth, especially after when AI rush wanes.

EBC Financial Group Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Global Financial Collaboration or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.