Stocks at new records ahead of Fed, tech earnings; yen off highs

Trade and AI euphoria boosts equities

Optimism that the US and China are close to resolving their trade differences and that Wall Street’s tech giants will report bumper earnings this week continue to drive equity markets higher on Wednesday. Negotiators from both sides have been working hard to mend the fractious trade relations between Washington and Beijing ahead of the scheduled meeting between the US and Chinese leaders on Thursday.

With a framework for a deal already agreed, hopes are high that Donald Trump and Xi Jinping will put pen to paper when they hold their first face-to-face talks since 2019 on the sidelines of the APEC summit in South Korea.

There are growing indications each day that all the contentious issues are being worked out ahead of the meeting. China has reportedly agreed to delay the introduction of new exports controls for its rare earths and has restarted the purchases of US soybeans. The moves seem to have pleased Trump as he’s hinted he’s willing to lower the 20% tariff imposed on all Chinese goods for Beijing’s inaction in stopping the illegal flow of fentanyl into the US.

Tech earnings eyed amid high expectations

Adding to the positive mood is a string of headlines from the tech and AI space that’s adding fresh fuel to the stock market rally.

Apple’s valuation briefly topped $4 trillion on Tuesday on signs that the new iPhone 17 series is enjoying strong sales. Microsoft’s stock closed at a new all-time high after it was revealed that the company will hold a 27% stake in the new OpenAI Group PBC, which is more than the 26% stake the restructured OpenAI Foundation will hold. It follows the ChatGPT maker’s transition to a for-profit business.

Meanwhile, Nvidia saw its shares surge to a new all-time high after CEO Jensen Huang said the company currently has $500 billion in chip orders.

Microsoft will remain in the spotlight today as it’s due to announce its latest earnings, along with Alphabet and Meta, after Wall Street’s closing bell.

US futures are mixed today following yesterday’s record closes for all three major indices. Elsewhere, London’s FTSE 100 is extending its record run for a fifth day, Chinese indices closed sharply higher, while the Nikkei 225 index in Tokyo closed above 51,000 for the first time.

Bessent calls for BoJ rate hikes

The signing of trade deals, including one for rare earths, in Japan this week during Trump’s visit to the country has significantly lowered the risk of any tariff escalation anytime soon, boosting local stocks. There’s also relief that the US is deepening rather than curtailing its security guarantees to Tokyo.

However, there is some friction when it comes to the new Japanese government’s stance on monetary policy and the exchange rate. US Treasury Secretary Scott Bessent appears to be pressuring the Takaichi government to give the Bank of Japan “policy space” to hike interest rates more aggressively in a bid to strengthen the yen.

The US dollar briefly fell below 152 yen yesterday before recovering slightly. Comments by Japan’s economic revitalisation minister about the need for fiscal discipline also helped the currency amid worries about unsustainable deficits.

How dovish will the Fed be?

But unless the Fed strikes a very dovish tone today and the Bank of Japan strongly signals a rate hike tomorrow, it will be difficult for the yen to stage a meaningful rally just yet.

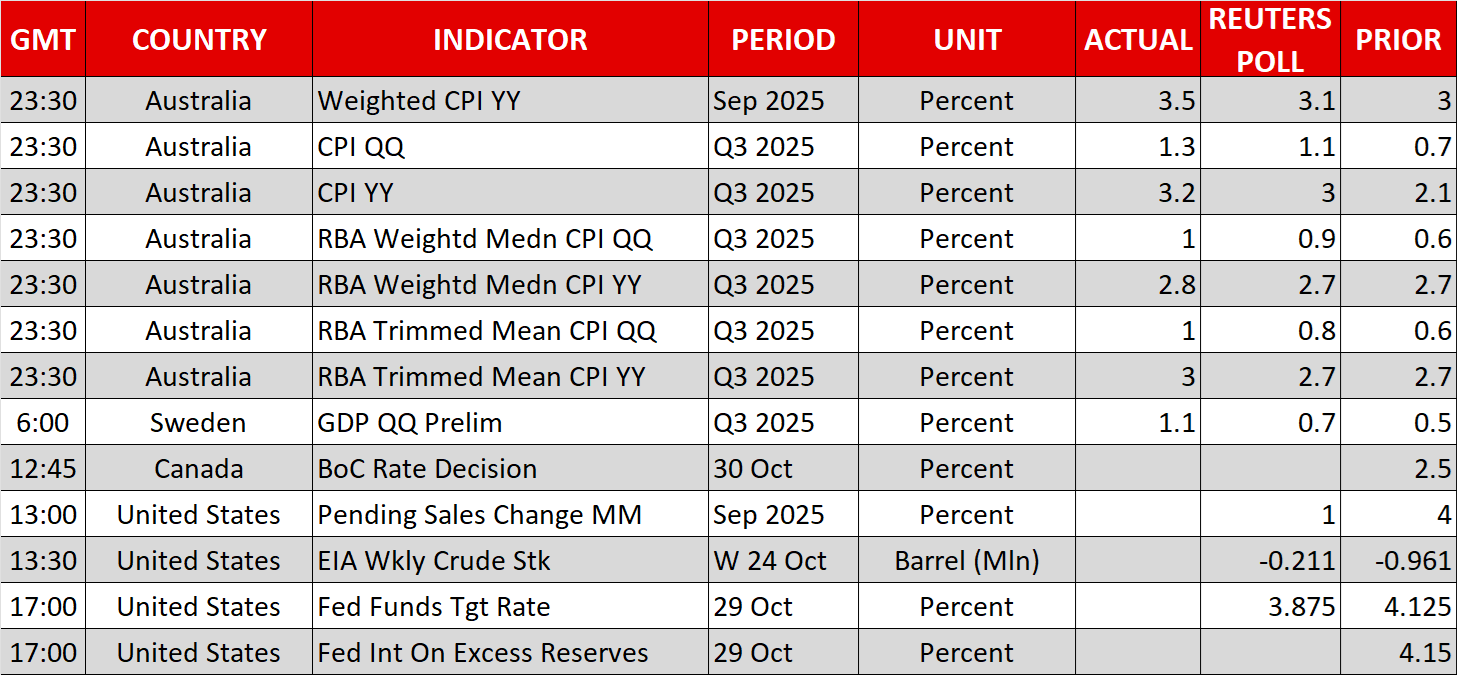

There’s a risk that the Fed may disappoint investors’ very dovish expectations when it announces its latest policy decision at 18:00 GMT. Although a second 25-bps rate cut is almost certain following the resumption of easing in September, Chair Powell may refrain from commenting much about where policymakers stand on a December cut amid growing divisions within the FOMC.

Still, should the Fed decide to end its quantitative tightening, that could be enough to buoy markets.

BoC to cut, investors price out RBA cut

The Bank of Canada is also expected to cut rates today and will probably signal that it’s not done easing, as trade negotiations between the US and Canada have suffered another setback, with Trump saying he’s not planning to resume talks “for a while”.

But despite the renewed trade tensions, the Canadian dollar has been edging higher over the past few days, likely lifted by the recent jump in oil prices.

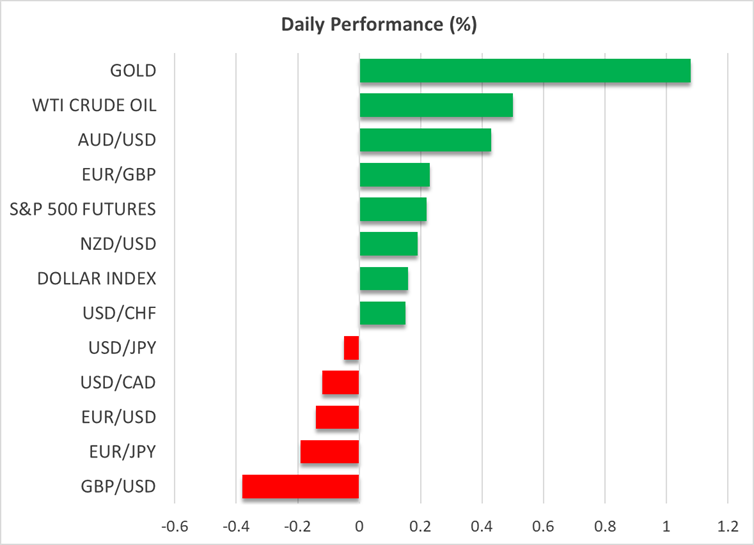

One central bank that is now looking less likely to cut rates at its next meeting is the RBA. Australia’s inflation rate spiked to 3.5% y/y in September, while underlying measures that the RBA watches very closely rose more than expected in the third quarter. The Australian dollar is today’s best performer against the greenback, as investors price out the possibility of a 25-bps reduction at next week’s meeting.

Pound struggles, gold attempts a recovery

The pound, on the other hand, remains on the backfoot and is struggling to hold above $1.32 after falling to the lowest since August 1.

Following the softer-than-expected UK CPI data last week and signs that next month’s budget will bring a fresh round of tax increases, investors are ramping up their bets of a year-end rate cut by the Bank of England.

Surprisingly, gold is recovering today, climbing by almost 2%. The precious metal slumped by more than 10% from last week’s record highs on the back of the trade optimism, but today’s rebound suggests a prolonged correction isn’t on the cards.

.jpg)