EBC’s Million Dollar Trading Challenge II | Tariff Shock Sends Gold Soaring as Traders Adapt

EBC’s Million Dollar Trading Challenge II has entered day 33, and as of 12:00 PM, the Rising Stars category has shattered the long-standing "10x curse," with the top 3 traders all achieving returns exceeding 10x.

President Trump’s latest tariff announcement sent shockwaves through the markets, igniting a surge in safe-haven assets. Gold reached yet another record high, providing traders with significant opportunities to capitalise on the volatility.

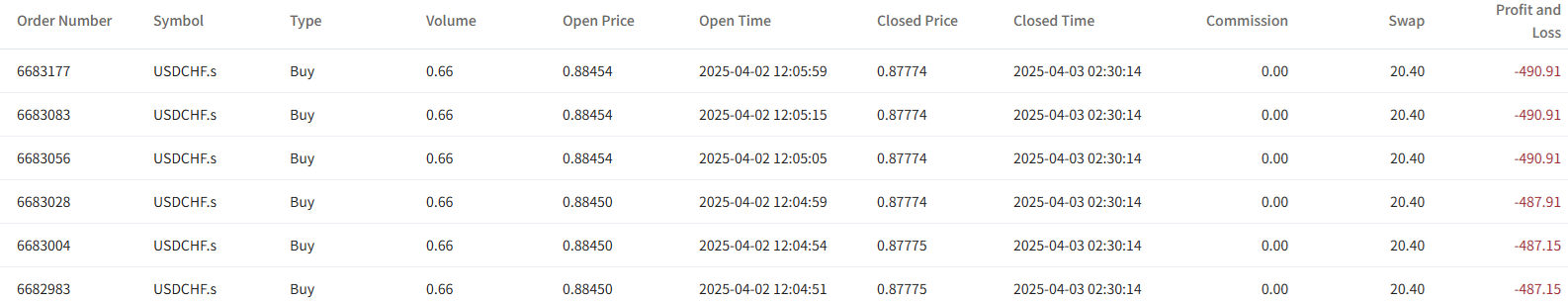

In the Rising Stars category, @18500131555VIP reclaimed the top spot but saw their lead narrow after an unsuccessful short position on the Swiss franc near a key support level. Despite this setback, their profit curve remains smooth, and their copy trading capital has climbed to over $50,000.

Meanwhile, in the Dream Squad category, @songqiantongzi continues to dominate with a staggering $90,000 in profits. Their strategy of consistently going long on gold has proven to be both simple and highly effective. They remain confident in their positions, holding trades initiated near $3,100 as gold maintains its upward momentum.

Second place @willsdad holds steady with $48,000 in profits. Notably, they have executed only 26 trades so far, demonstrating a patient and disciplined approach that aspiring traders can learn from.

The Rising Stars leaderboard also welcomed a new contender. @fulizhiyi climbed into the top 3 after just 3 days of trading by successfully shorting gold multiple times following its rally. This tactical approach highlights their sharp market instincts and adaptability.

EBC Financial Group and its community provide traders with unique, zero-fee copy trading opportunities. Signal providers receive generous rewards, and all trades are fully transparent and traceable. EBC's platform offers copying flexibility, rapid response times, a comprehensive five-dimensional signal rating system, and complete transparency to meet various copy-trading needs.

For active traders seeking simplicity and efficiency, EBC enables copy trading with a single click, potentially offering a streamlined path to profitability.