German Business Climate Report and Elections

German Business Climate Report and Elections

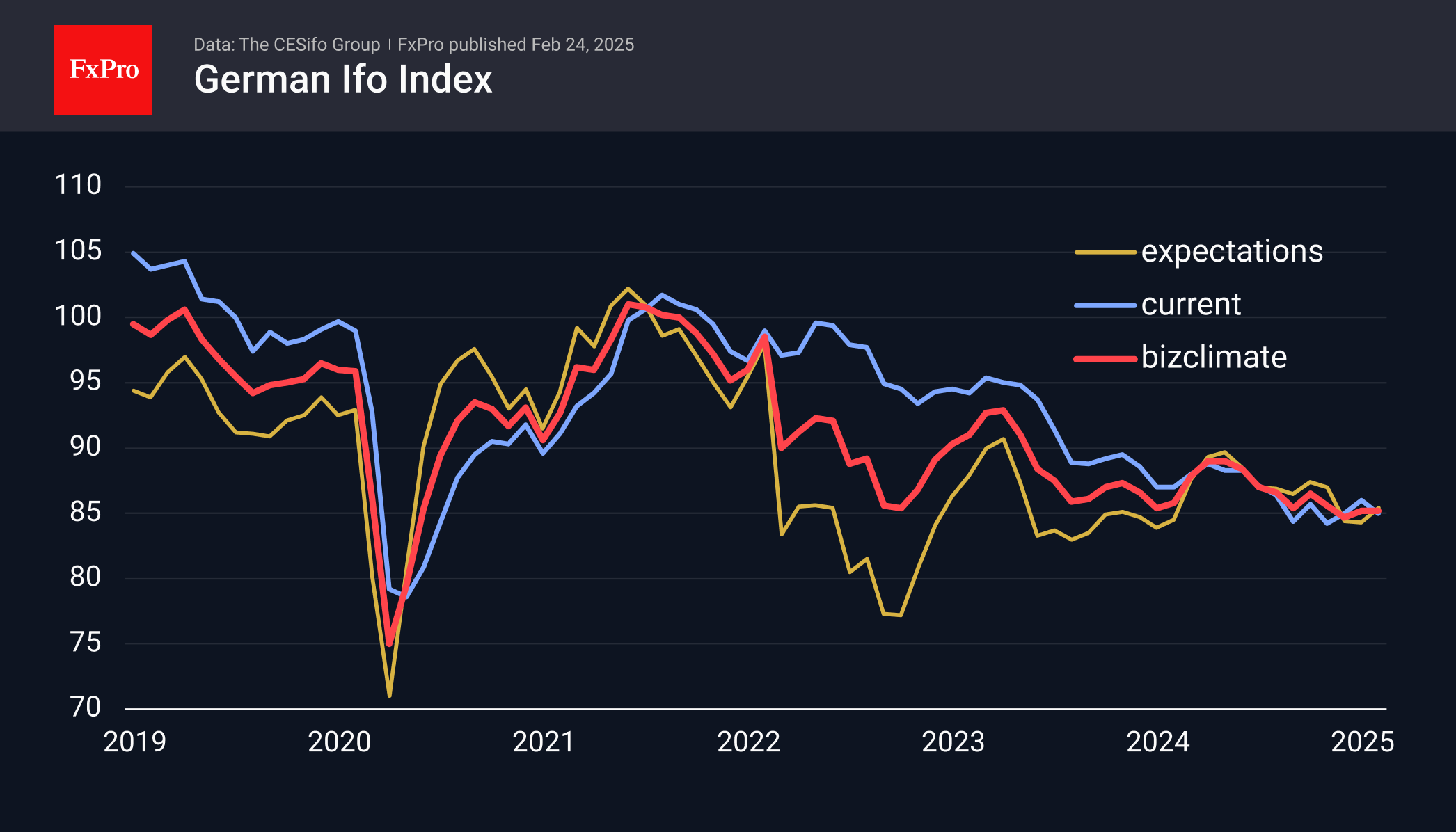

According to the latest Ifo report, the German business climate remained unchanged in February. The business climate index stayed at 85.2, with a deterioration in the assessment of the current situation offset by an increase in the expectations component. It is also noted that for almost a year, the index components have nearly converged into a single line, with all three slowly declining.

On average, market analysts anticipated positive development, so the outcome led to some pressure on the single currency, which fell below $1.05. Over the weekend, Germany's parliamentary elections largely aligned with expectations, confirming the transition of power from Scholz to Merz. The latter announced a course of "independence from the US."

The far-right AfD party came in second with 21% of the vote, but other parties declined to form a coalition with it, thus significantly reducing its influence. Markets reacted moderately positively to the election results, with EURUSD and the German DAX40 opening the day higher. However, a more cautious reading on business sentiment limited these gains.

From a technical perspective, the EURUSD continues to encounter significant resistance at 1.05. A break below this level at the end of last year indicated a market shift towards a possible decline below parity. In January and February, the euro attempted to rise above this level but has so far encountered resistance.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)